- 30년대 스무트 홀리 관세법 소환한 트럼프, K-바이오에겐 '양날의 검'

- 1930년 미국은 대공황의 충격에서 벗어나기 위해 스무트-홀리 관세법(Smoot-Hawley Tariff Act)을 시행했다. 전 세계 수천 개 품목에 고율의 관세를 부과하며 자국 산업 보호에 나섰다. 그러나 결과는 참혹했다. 주요 교역국들이 보복 관세로 맞서며 글로벌 무역이 급격히 위축됐다. 이는 세계 경제를 더욱 깊은 불황으로 몰아넣었다. 거의 100년이 지난 지금 도널드 트럼프 전 대통령의 관세 폭탄이 K-바이오 산업에 비슷한 충격을 안길지 우려가 커지고 있다. 글로벌 시장에서 빠르게 성장하던 한국의 제약·바이오 기업들은 예상

.

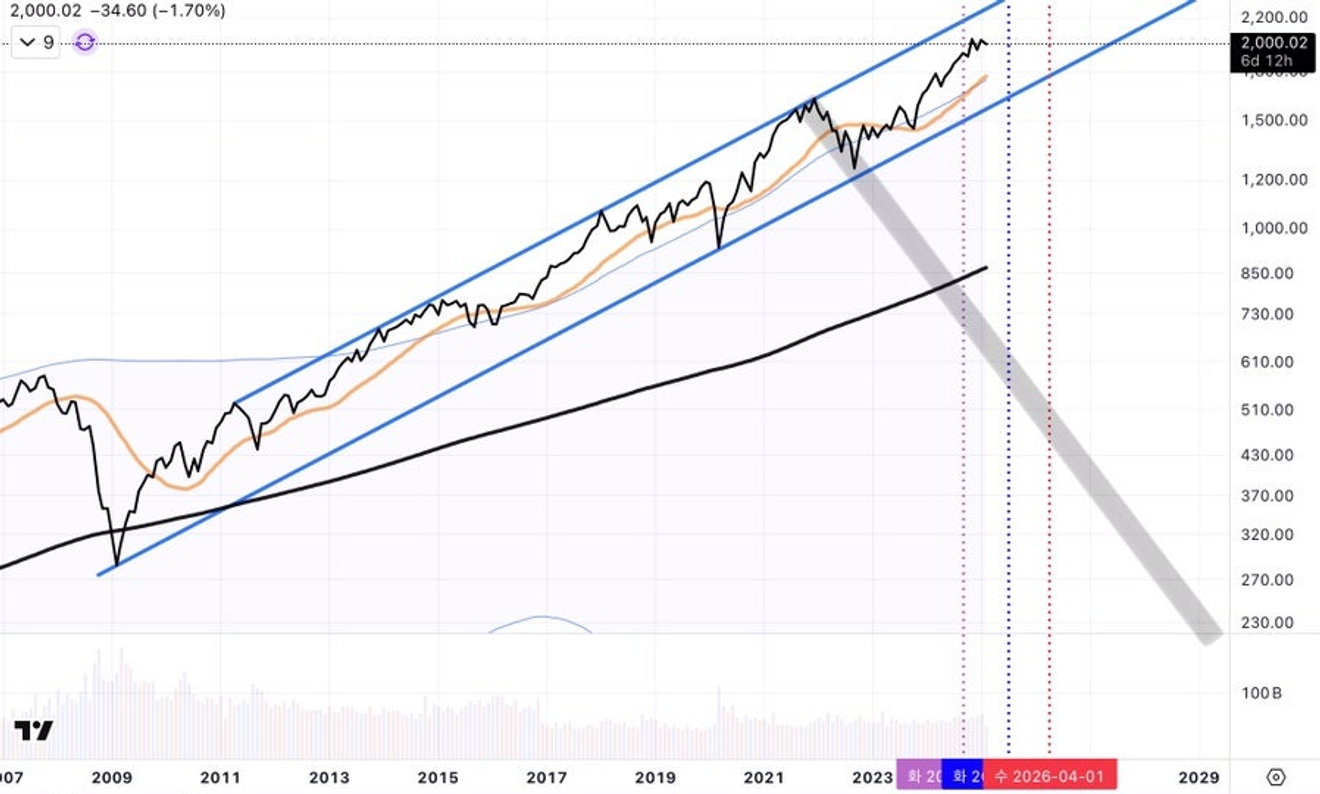

The charts below depict various scenarios I previously envisioned based on the US stock market. This is also content I wrote on the Nafcon channel in 2022 (or early 2023?).

Excluding the reasons behind my thinking... these are the main anticipated points and assumptions regarding this resulting scenario.

1) The high point of the US stock market recorded at the end of 2021~beginning of 2022 will act as a major technical pivot point on the long-term chart.

2) Once a long-term bear market (marked with a black highlighter below) begins, regardless of when it starts, it will only end when the next US president's term ends—if Donald Trump returns, that would be at the end of 2028~beginning of 2029.

3) If a repeat of the Great Depression materializes in the late 2020s, while there's currently no visible basis for this prediction beyond the long-term technical trends of market indicators, as time passes, circumstances that could cause it will begin to appear.

My point number 2 above stemmed from the belief that, based on the long-term trend of the US stock market, if Trump's second term were to occur, Trump would occupy a position similar to that of President Hoover historically.

Assuming that the US stock index at the end of 2021 becomes a significant pivot point, several scenarios can be considered from the perspective of before the latter half of 2022, as follows:

[A] A case where, from the end of 2021 onwards, it may flow along an unknown path, but gradually flows down to the end point.

- While 1929 saw this, the style of immediately hitting a high point with a long-term upward trend followed by a single large candlestick is not very likely based on examples of technical patterns.

.

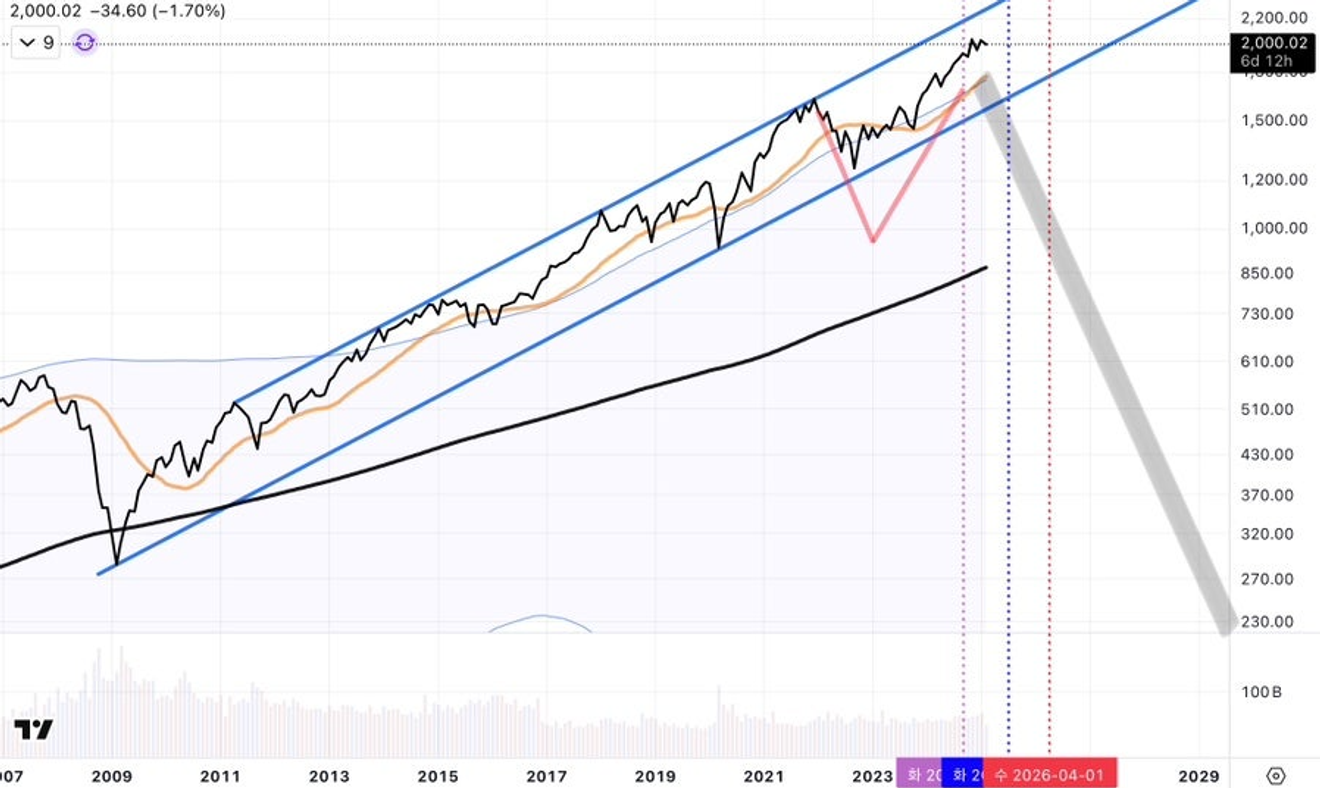

[B] A case where a 50% major drop, which is considered a correction from a long-term chart perspective, occurs once, forming a double top on a large weekly or monthly candlestick chart, followed by a long-term bear market.

.

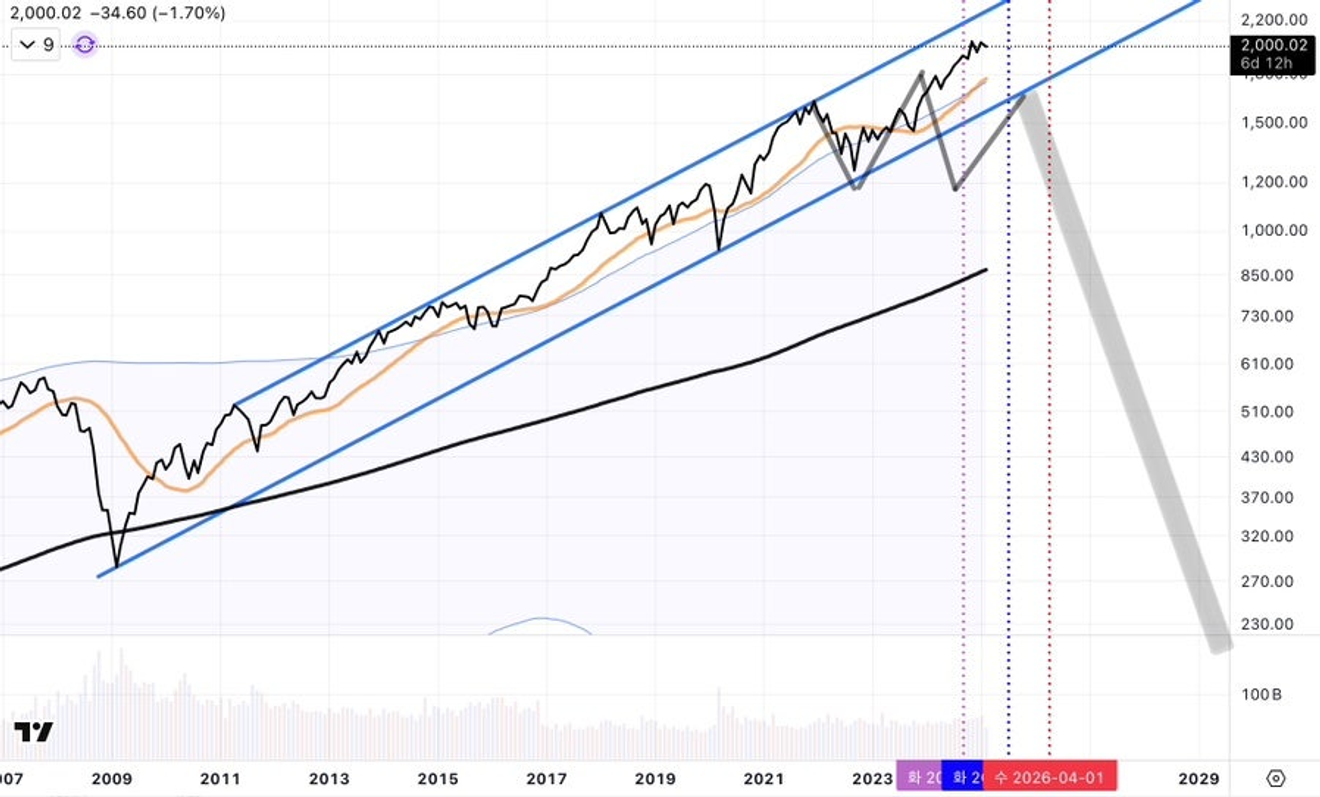

[C] A case where a large three-candle pattern is formed with a 20% correction as a large neckline, followed by a long-term bear market.

.

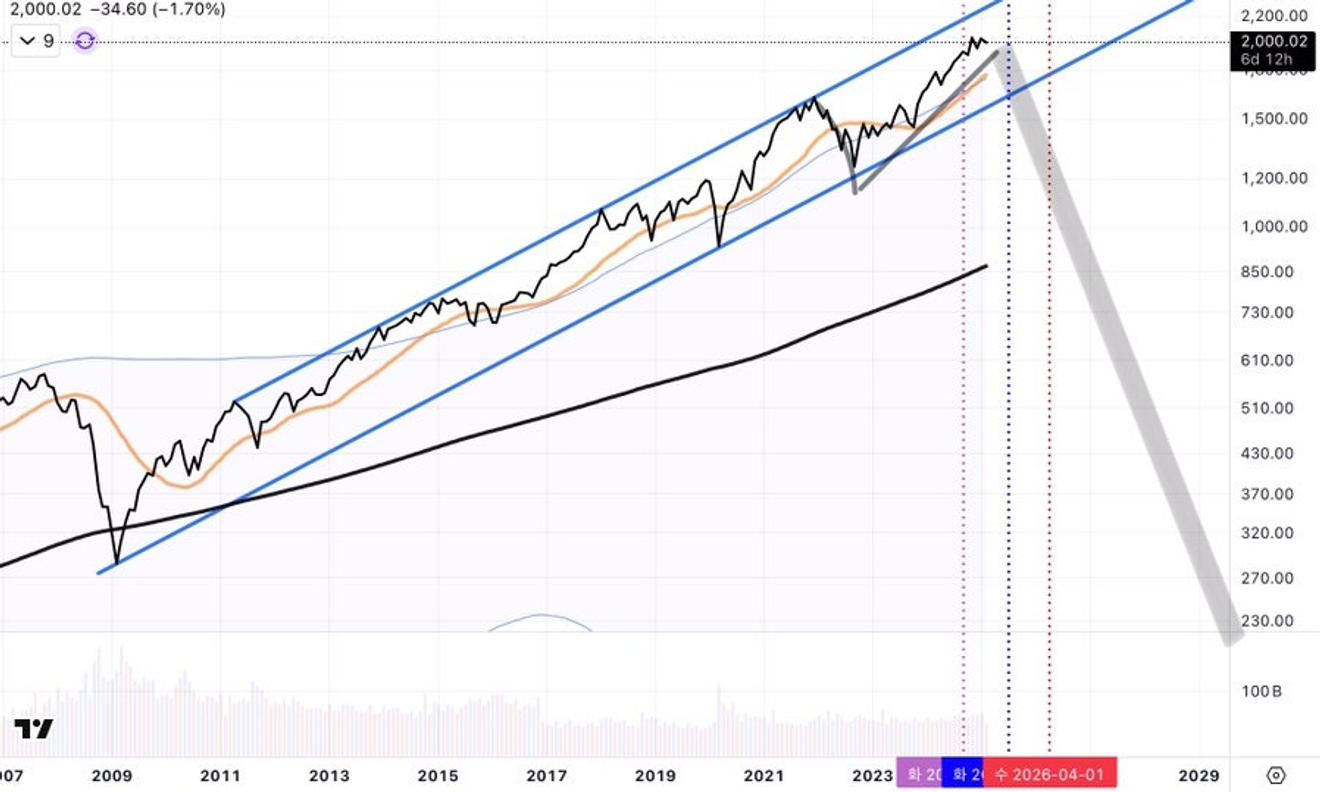

[D] A case where a large double-top pattern is formed with a 20% correction as a large neckline, followed by a long-term bear market.

.

These are the kinds of scenarios...

As you can see from the three vertical lines drawn above, it can be inferred that the case where the entry into the long-term bear market is maximally prolonged is viewed as around April 2026, with case [C] or [D].

(Conversely, the meaning of these lines could also suggest that it has now entered a range where it's acceptable to start regardless of when it begins.)

The reason I said that "my thinking has changed" after seeing the market reaction immediately following the US presidential election last November was because my previously considered maximum timeline had been brought forward. I had mentioned that the possibility of this shift happening within this year (2025) instead of the first half of 2026 had increased.

In short, the view changed from a long-term high theory to the beginning of a long-term bear market theory from a previously held perspective of "this year or next year?" to "likely starting at a specific point in 2025."

Now, Donald Trump has returned as president after Biden. With a more intense style of threats, perhaps?

And over time, various other conditions have arisen compared to before.

- An unprecedentedly long period of high interest rates from the Federal Reserve

- The resulting record-long period of inversion between long-term and short-term interest rates

- Trade war risks stemming from Trump

- The ratio of US government debt and expenditure to revenue, reaching almost 1/4 of tax revenue

- Concerns about deflation in China due to real estate and the US-China power struggle

- Concerns about the full-scale unwinding of yen carry trades, etc...

Most of these situations were created by the actions of the previous Biden administration. The Biden administration accomplished these things rapidly in a short period... an amazing(?) feat. It seems that the Deep State rumors aren't unfounded...

Meanwhile, many people likely believe that productivity improvements due to artificial intelligence (AI) will offset these possibilities and lead to a positive path.

While I naturally believe that AI will be beneficial to economic growth in the long term, I also believe that in its early stages of development (now and the next few years), it could first have negative repercussions by permanently eliminating some jobs during a time when we are not yet prepared for the changes of the AI era.

Recently, President Trump also threatened to use "a law from 95 years ago" to impose tariffs of over 50%, wielding tariffs as weapons.

That law from 95 years ago... the infamous 'Smoot-Hawley Tariff Act,' which invoked the specter of the Great Depression once more.

Will Trump once again unleash this specter that drastically reduced international trade in a short period?

Currently, it seems that the mainstream view in news reports is that this is merely a negotiating tactic, a "bluff" to secure concessions from other countries.

Recently, President Trump and Secretary of Commerce Raimondo have also suggested that "if a lot of money comes in through tariffs, it would be possible to abolish the US income tax and the IRS."

To make such a claim to the American public, a 20% universal tariff (as has been mentioned as a possibility, even a pledge in the past) and a 60% tariff on China probably wouldn't be enough.

It seems that current events are resurrecting the ghosts of the Great Depression one by one. Though, it seems to be used as a threat for now.

Meanwhile, I find it interesting that recent domestic economic news related to Seoul apartments is sharply divided between Gangnam (prices are rising, buy now!) and non-Gangnam areas (continued stagnation). Which one is the fishing bait...?