- 신동아 법정관리에 건설사 ‘줄도산 공포’

- 시공능력평가 58위 신동아건설 미분양에 중견 건설사도 ‘휘청’ 건설업계 “사업여건 악화 지속” [신동아건설 제공] 건설 경기 침체와 고금리 지속, 공사비 급등, 정치적 불확실성 확대 등으로 한계 상황을 맞는 건설사들

.

(Continued from Part 1...)

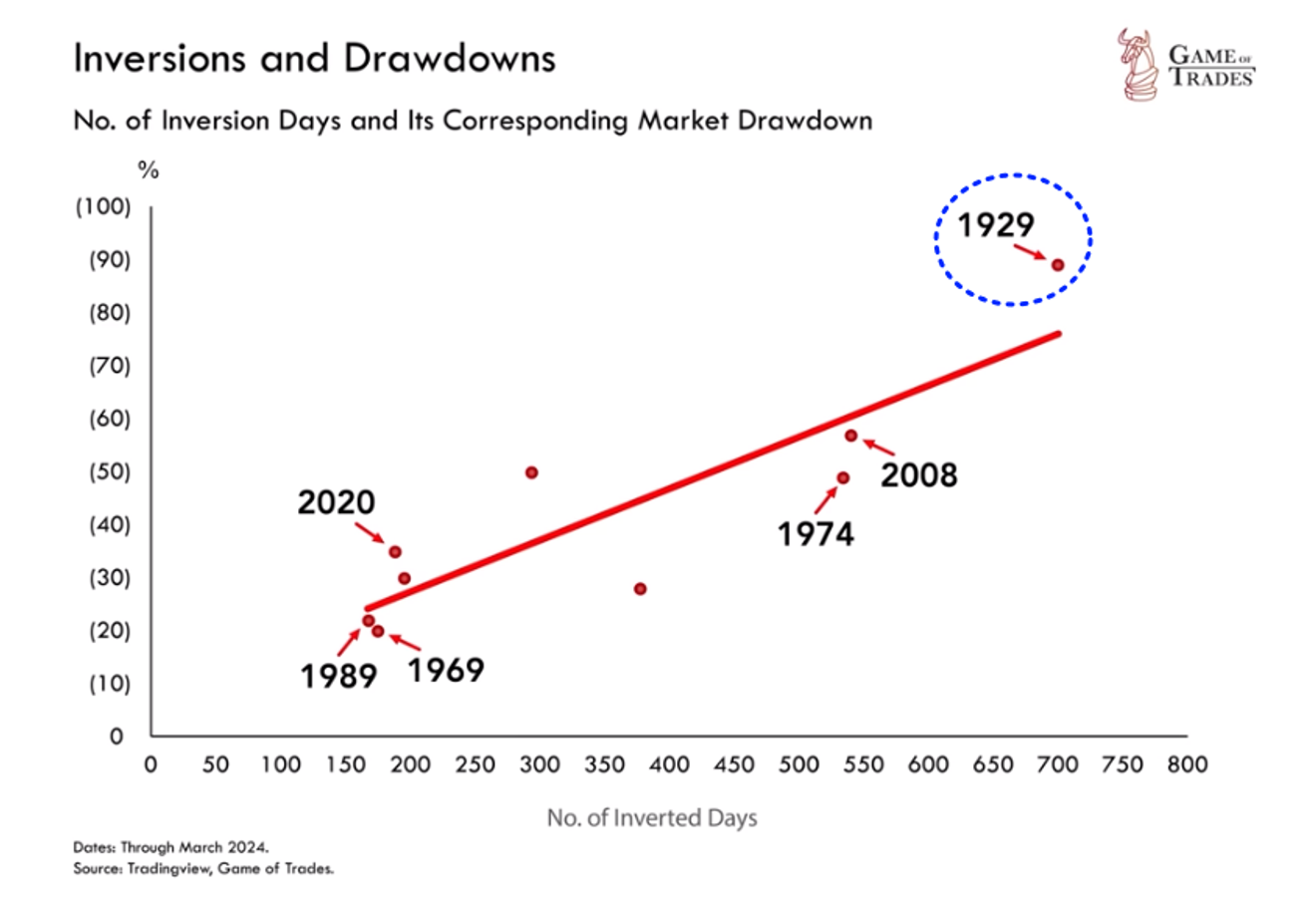

Previously, I showed you the chart below from a video on the same YouTube channel.

This chart shows a statistical implication: the longer the period of inverted long-short-term interest rates (over the past 10 years and 3 months), the greater the subsequent decline in the stock market during the recession.

In short, the longer the period of the inversion, the deeper the damage inflicted on the US economy. The longest inversion period in the past, during the Great Depression, lasted approximately 700 days, including holidays.

.

The inversion of the long-short-term interest rate, which began in late 2022 due to the Federal Reserve's sharp interest rate hikes, started to normalize in early to mid-December, before the December FOMC meeting.

As indicated in the chart below, this easily surpassed the inversion period of the 1929 Great Depression, setting a new record for the longest inversion period.

This doesn't necessarily mean the same outcome will occur. However, by observing these phenomena, I encourage you to consider the "probability" (the possibility that such an event may occur).

10-year - 3-month Interest Rate Differential

Next is a chart showing the daily trend of the won-dollar exchange rate.

In recent days, it has fallen somewhat from its previous high, partly due to the rapid rise and news about the possibility of tariff easing in the US yesterday, and is currently trading around 1454 won.

I previously mentioned the importance of paying attention to the long-term trend line (black line). The won has weakened significantly due to factors like the December emergency decree, surpassing this trend line. However, without the emergency decree, the won-dollar exchange rate would likely be around the blue line.

I also mentioned that crossing this trend line could mark a significant turning point not only for the Korean stock market but also for the US stock market.

Assuming the current trend follows the blue line, whether and when the December high is retested becomes a critical point. Personally, I expect the won-dollar exchange rate to surpass its previous high due to the strength of the global dollar, leading to a long-term upward trend.

Won-Dollar Exchange Rate

In connection with this trend, around the end of last year, I suggested that even if a year-end rally continues for the KOSPI and KOSDAQ indices, it would be best not to be too greedy beyond the approximate point indicated on the chart below.

Many stock market-related YouTube broadcasts claim that all the bad news has been priced in and the market has bottomed out. However, I believe the current rebound is likely to be short-lived, and even if it rises further, it will be difficult to break through the indicated index level.

KOSPI Index

KOSDAQ Index

I'll briefly mention one more interesting point:

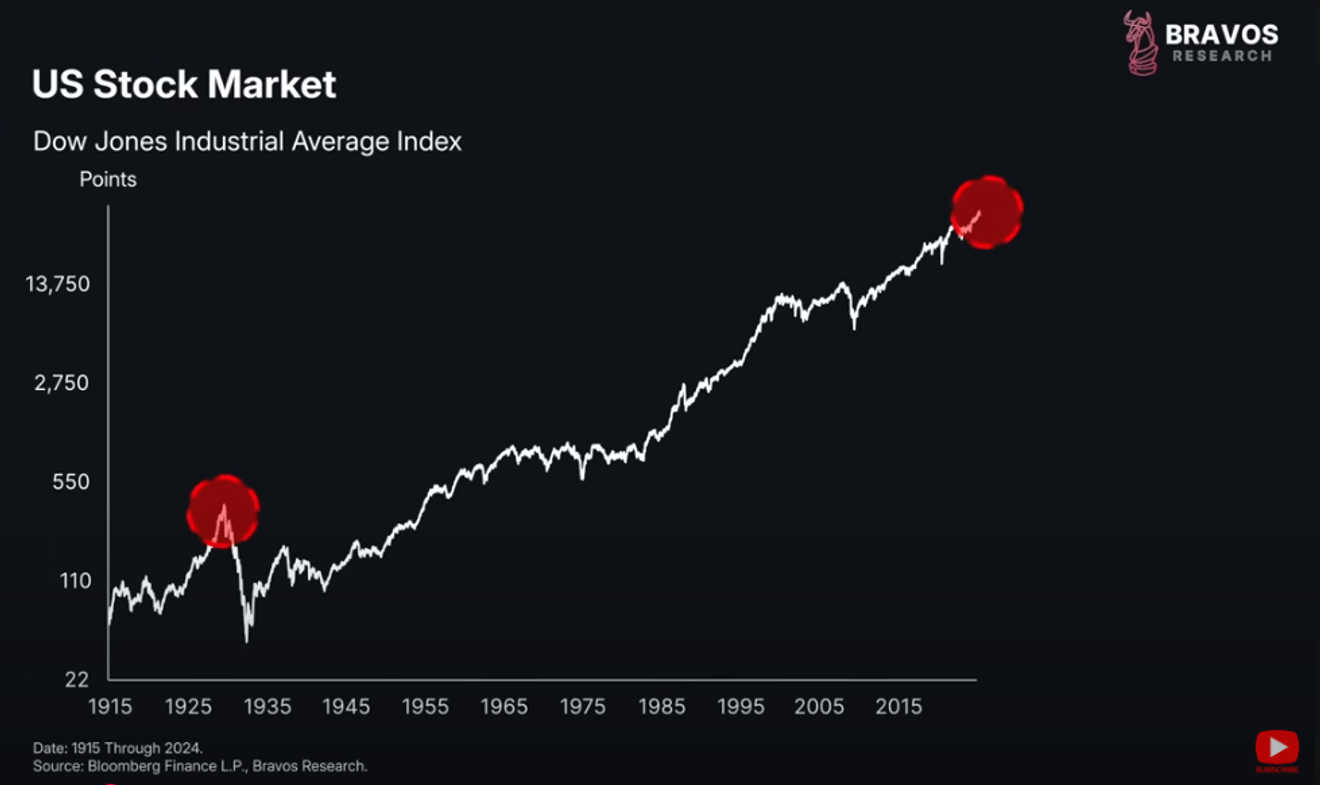

Based on a hypothesis and calculations using past cycles, the current position of the US stock market coincides with the peak in early September 1929, just before the Great Depression.

Disregarding the margin of error, the calculation suggests that this week marks the same point as the 1929 peak, a remarkable coincidence.

.

In short, my theory is that the ultra-long-term upward cycle, starting from 1933, ends this week, based purely on this calculation.

My remaining personal concern is whether the significant downturn will begin now or around summer, from a time perspective.

Therefore, I've been frequently suggesting that long-term investors should consider "exiting the market for a while." Unless short-term traders.

"With strong technological innovations like AI underway, how could the stock market experience a bubble burst?" Many might think this. If there's a lack of factors that would trigger such concerns, then many will be cautious, and a market crash may not occur. Perhaps people in the 1920s viewed new technologies like radio with a similar perspective to how we view AI today.

Domestically, real estate industry players are actively promoting the "theory of rising apartment prices due to a supply shortage" this year. However, news like the following about construction companies has been frequently reported recently.

With the construction industry in this state, can they actively increase supply? It's natural for new supply to shrink under these circumstances. Do you believe this kind of supply shortage will increase apartment prices?

While this blog focuses on protecting assets, my personal thoughts (including Nepcon) lean towards, 'If we can weather the storm and navigate the curve adequately...?' Like adjusting the allocation of stocks or QID/SQQQ...

In any case, it seems that it's time to stay away from things like SOXL or TQQQ. These could easily melt away without a chance of recovery.