- 가설 : Big Game

- (Topic) 왜 친구는 21년에 아파트 매수 계획을 철회했을까, 왜 22년 인플레이션 이슈의 홍수 속에서도 디플레 메커니즘에 계속 눈을 두고 있는가 : 중장기 대형 싸이클에 대한 가설 (Great reset)

.

A while ago, I slightly revised a part of the introduction to this Naver blog as shown below.

This is the part highlighted with a yellow highlighter. The statement about global depression is something I have often included before, and the only change is the addition of the period '2025-2028'.

I have occasionally talked about 2028, especially the number 2025 in the introduction. I added this because I feel that aspects that seemed vague until recently have become clearer.

If there were several hypotheses about a certain part, A, B, C, etc., and previously only one or two were considered ('Is it so? Or not?'), recently most of these hypotheses seem to be converging towards 'Is it so?'...

Since about last year, Professor Hyun-hoon Lee (?) of Kangwon National University has been actively uploading videos to YouTube stating that a global depression-level economic crisis could occur within the next few years. Instead of dismissing these as 'frequent fear marketing,' I believe it's time to seriously consider his arguments.

Last night, while watching American market analysis channels I often watch, I came across a video that made me think, 'Oh... I finally see a claim that is most similar to the basic clue of my 2020s Great Depression hypothesis.' I found it very interesting.

The channel is called Bravos Research (formerly Game of Trades). While many of their contents seem somewhat forced, some are worth watching.

The main points discussed in the video below are quite similar to the clues that form the most important part of what I call the 'Big Game' Great Depression hypothesis. I haven't seen anything like this on other domestic and international channels.

The images below are screenshots from the video above.

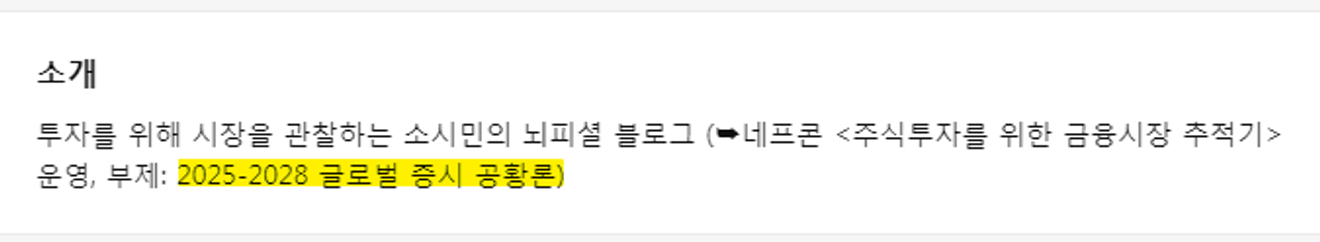

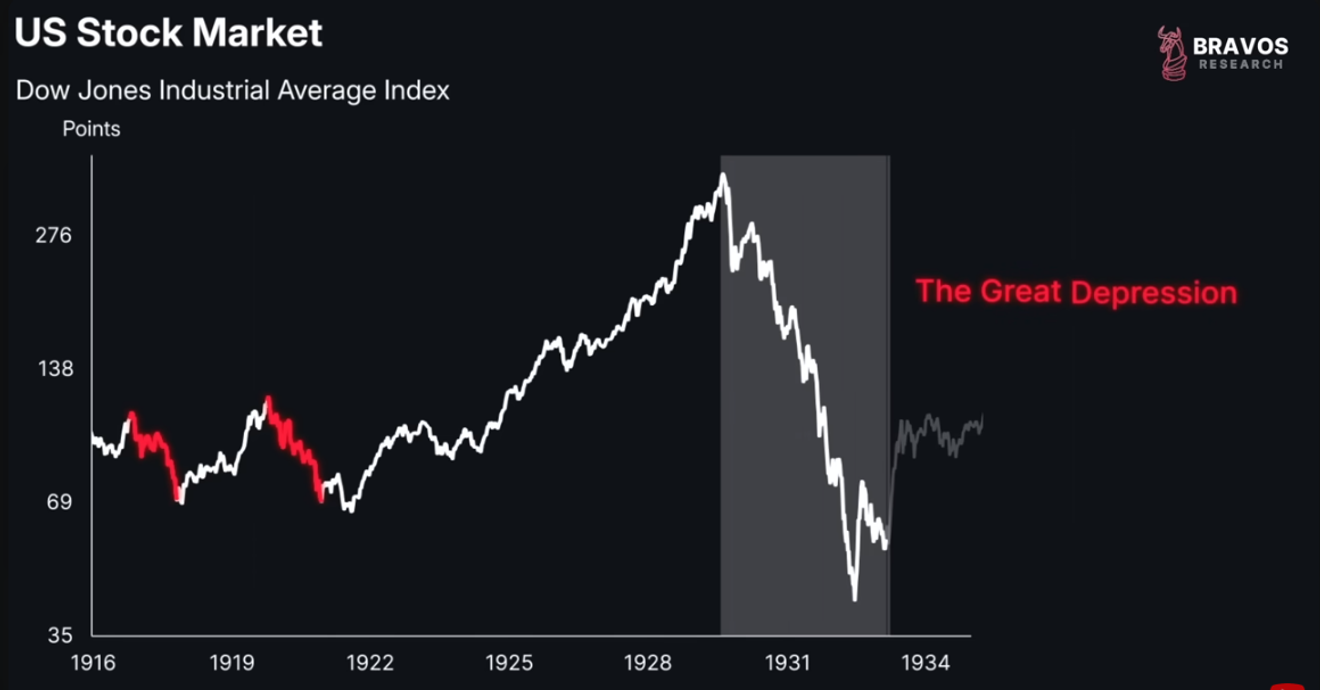

First, the two screens below show the Dow Jones Industrial Average during the first Great Depression (1st Great Depression) from 1929 to 1933.

Before the period of a sharp drop during the Great Depression, there was a period of great prosperity coupled with long-term technological innovation. This indicates that there were two relatively large downward markets of approximately -50% in a row before that period.

Dow Jones Industrial Average - Before and After the 1929 Depression

Dow Jones Industrial Average - Before and After the 1929 Depression

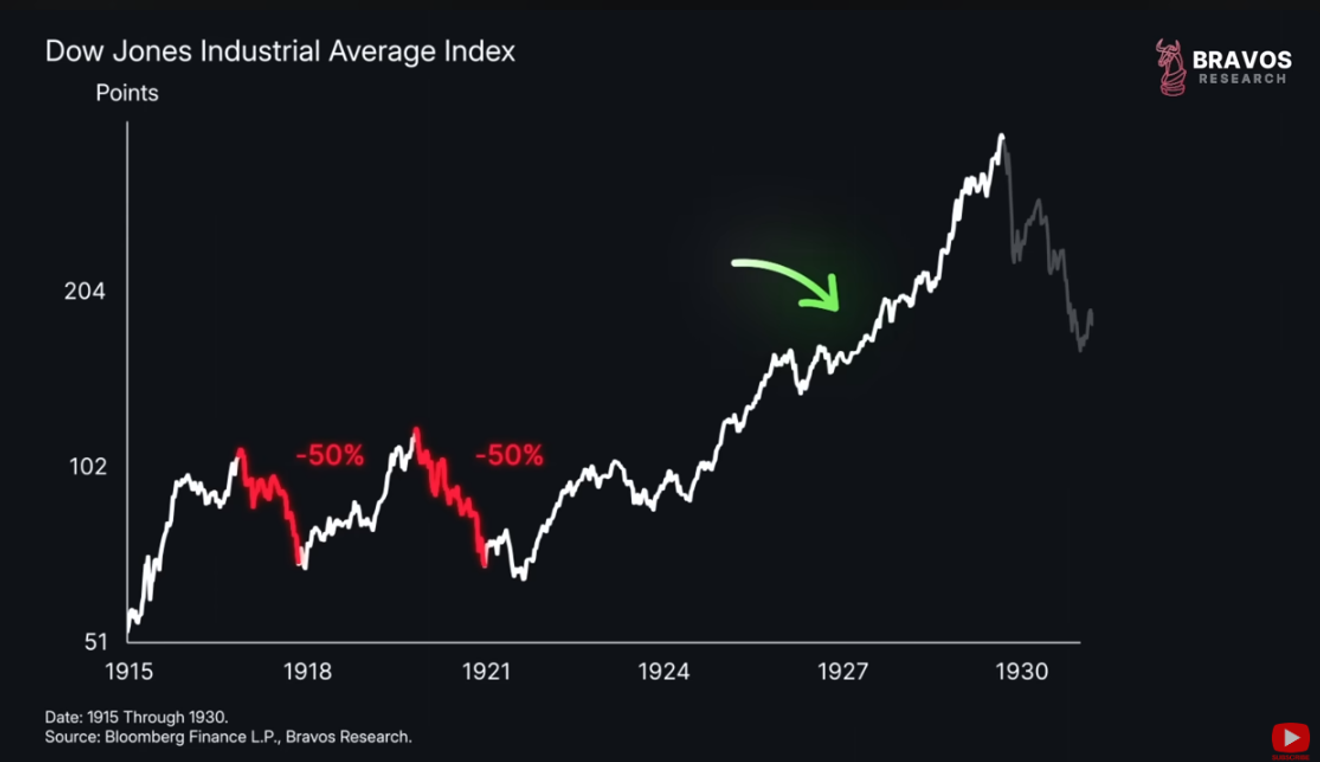

The screen below shows the Dow Jones Industrial Average from the late 1990s to the present.

As clearly shown in the image, this screen also shows that there were two major downward markets in the 2000s, similar to the 1910s. And the long bull market that followed the 2008 global financial crisis...

Dow Jones Index - From the late 1990s to the present

The following image directly overlays and compares the Dow Jones index trends of the early 1900s and the present.

Naturally, this image poses a question mark (?) about whether it will follow a similar trend to the past, and presents this as a question.

.

The most important commonality in the two images above is that there were 'two major shocks' before the long bull market unfolded.

To roughly extrapolate the situation, we can construct a narrative like this: 'The two consecutive shocks led to a situation where the US Federal Reserve and the Treasury Department were forced to pursue very accommodative monetary policies and expansionary fiscal policies, which led to a subsequent large and long bull market, and then a collapse of the asset bubble, resulting in a crash (Great Depression).'

And this is quite similar to the most crucial part of several hypotheses I presented in the post below,

From my vague recollection, the conclusion was that the US stock market would rise at least once more before the peak, but that the period after that would be unpredictable, and that those who wanted to liquidate their real estate due to high debt burdens should prepare in advance.

Because I had a personal basic hypothesis about the remaining period of the 2020s from a medium- to long-term perspective, all that remained was 'to check the likelihood that other market indicators and US economic indicators would follow this trend.' Perhaps whether the Federal Reserve and the government are driving the economic policies in that direction...

And now... For the past 2-3 years, the Fed has been shaking globally debt-vulnerable links with a long-term high-interest rate (higher for longer) policy, and the Biden administration, under Treasury Secretary Janet Yellen, has been pouring enormous amounts of money. High-interest rate policy with fiscal spending... A strange ensemble of policies has been pursued.

And now Trump is coming. It seems that he will start by issuing executive orders, similar to the circumstances behind the Smoot-Hawley Tariff Act, which symbolized the global trade war of the past.

While the 1929 Great Depression was a time when the gold standard was in effect, unlike the current credit-based monetary system, I think if the government debt ceiling negotiations go wrong and become restricted for a while, it could produce an effect similar (?) to the gold standard's restriction. Therefore, I plan to watch this year's debt ceiling negotiations not as a recurring political theater, but as a truly important event.

Those who support the 'no-landing scenario,' which continues to be cited by Wall Street and domestic securities firms, compare the current situation to the 1990s, when the IT bubble was rapidly inflating. They compare the present to a point slightly past the mid-1990s, before the end of the bubble.

However, from a perspective similar to the charts in the video above, I think that the present should be compared not to the long bull market of the 1990s, but to the long bull market of the 1920s.

Nasdaq Composite Index Monthly Chart

Therefore, I also mentioned that it is necessary to pay attention to the unusual trends appearing frequently since the latter half of 2024 in medium- to long-term charts like the one below.

I mean that we are seeing things that are different from the last 10 years, with some areas stagnating or accelerating.

(To be continued in Part 2...)