- 워런 버핏의 버크셔, 현금 보유 449조원…애플 지분 더 줄여

- 임미나 특파원 = 투자의 대가 워런 버핏(94)이 이끄는 버크셔 해서웨이(이하 버크셔)의 현금 보유액이 약 3천252억달러(약 448조9천386억원)에 달해 사상 최대를 기록했다고 블룸버그 통신과 미 경제매체 CNB

While there wasn't much noteworthy news over the weekend, there was a lot of talk about Warren Buffett's actions, as reported by US financial newspapers.

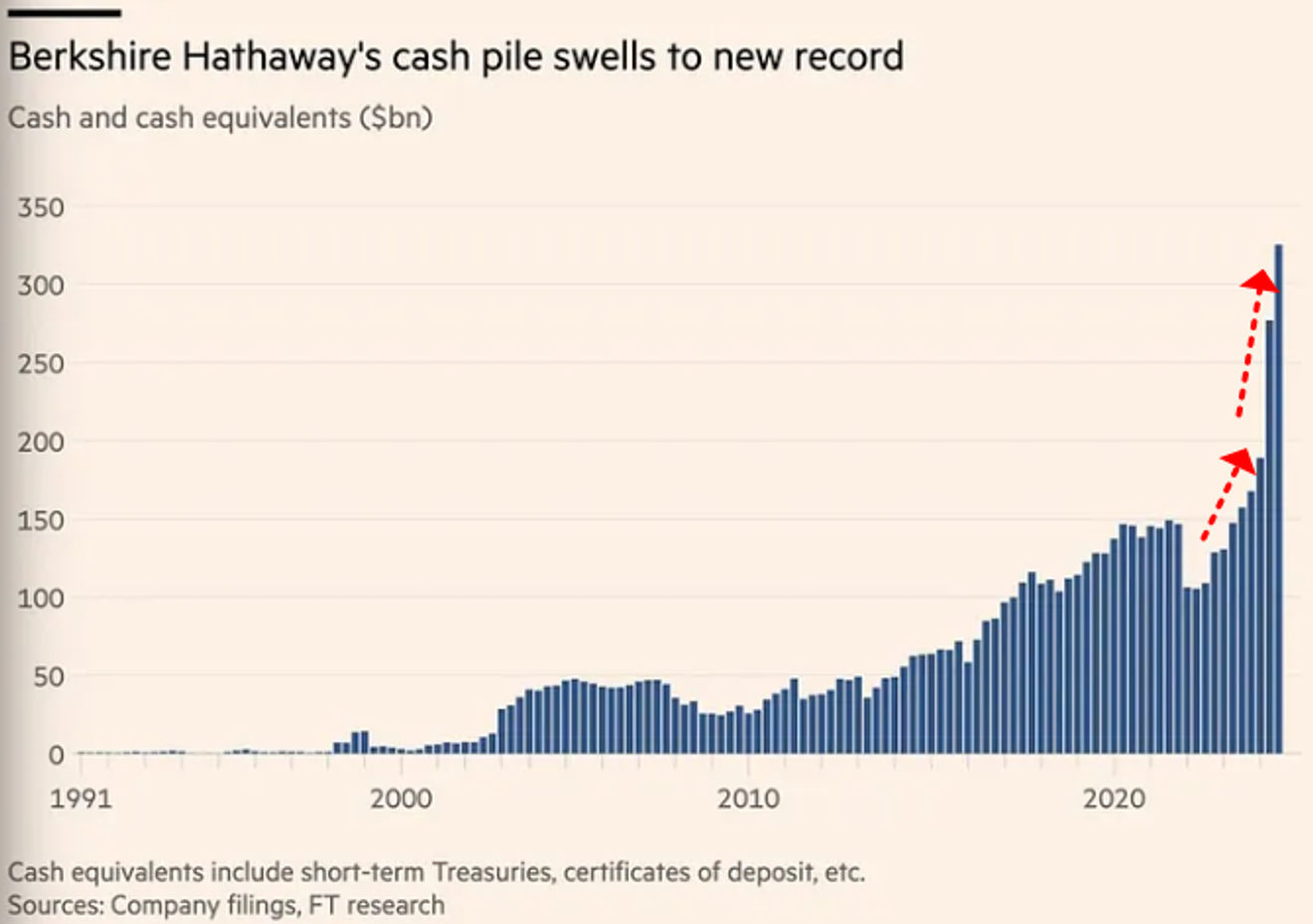

The news was that Berkshire Hathaway, led by Buffett, had its cash and cash equivalents reach a record high of \$325.2 billion (approximately 449 trillion KRW) as of the end of the third quarter of 2024. In addition, Berkshire Hathaway reportedly stopped buying back its own shares, a first since 2018.

However, more noteworthy than Berkshire Hathaway's record cash holdings or its unusual halt in share buybacks is the \"rate\" at which its cash assets are increasing.

The increase in the absolute amount is natural, considering Berkshire's growth as an insurance company and investment returns from asset investments. The increase in cash assets is a natural consequence of the overall asset growth.

But since around 2022, the \"rate\" at which cash and cash equivalents are increasing has significantly accelerated, especially in the latter half of last year (2023), causing some unease among observers. Is this a problem?

Some argue that this is simply Buffett building up cash in anticipation of tax issues, as he mentioned recently, and nothing unusual. Others suggest that Buffett is anticipating a poor outlook for the US stock market due to its overvaluation, and thus continuing to sell off assets.

As the news below shows, many prominent Wall Street investors lean towards the latter interpretation.

Those familiar with my previous posts will likely anticipate my perspective...

As mentioned in several previous posts, I've been arguing that the long game of the upcoming Great Depression began in 2022. Therefore, Berkshire's actions under Warren Buffett (increasing its long-term cash reserves) make perfect sense.

I've also repeatedly stated that we're approaching a time when blindly believing in the long-term upward trend of the US market will lead to danger, especially in light of the long-term peak theory regarding the US stock market.

Furthermore, I've suggested that a significant time lag might exist between the current pre-game phase and the full-blown onset of typical Great Depression phenomena (a long-term collapse in asset markets).

In the linked article above, I illustrated this time lag with a diagram.

If Buffett is also considering this possibility, then it makes perfect sense that during this period of time lag, as illustrated by the black highlighter in the diagram, he would continue to gradually sell off assets to build up massive cash reserves before the main game begins.

Naturally, this is because Berkshire Hathaway is a massive corporation with enormous assets; it can spread its share reduction over a long period, unlike individual investors who can adjust their positions quickly.

I predict that around early 2026, many individual investors will be saying something like this about Berkshire: \"Everything seems fine now. What's with Berkshire's continued focus on accumulating cash?\"

Comments0