- AI 회의론…500대 갑부 자산 하루새 182兆 증발했다

- ‘검은 금요일’로 불리며 미국 증시가 흔들렸던 지난 2일(현지시간) 세계 최고 갑부들의 자산 평가 가치가 크게 줄어든 것으로 나타났다. 블룸버그에 따르면 블룸버그 억만장자 지수에 속한 세계 500대 부자들의 자산 가

Based on the Nasdaq index since July, the US stock market has seen its previous upward trend stall after reaching its peak in July, remaining in a state of stagnation. The daily chart of the Nasdaq Composite Index below illustrates this trend.

Nasdaq Composite

Looking at the Magnificent 7 index (MAGS) and the FAANG index (FAANG) below, which were led by big tech companies until July, the bull market driven by big tech has stagnated since reaching its peak in July and continues to hover around that point.

MAGS : Magnificent seven index

FAANG : FAANG Big Tech Index

The Nasdaq index has been stagnating since mid-July, failing to decisively break through its previous high. I believe this was influenced by the "AI skepticism" that emerged in late July.

This past AI skepticism wasn't about the uselessness of AI, but rather a question along the lines of, "For companies outside of those providing the infrastructure for current AI technology or creating application services, will it be difficult to earn a significant return on investment (ROI) from AI in the short term (within 1-2 years)?"

While this AI skepticism isn't being discussed much now, looking at the Nasdaq's performance since it emerged, it seems to still be subtly impacting large technology stocks, particularly the big tech companies.

Although the previous "skepticism about the short-term profitability of AI application services" emerged, companies like Google, leading players in the field, seem to be saying, "Looking to the future, over-investment seems better than under-investment in the current situation." Companies involved in "AI-related infrastructure" seem to be largely unaffected by this skepticism at present.

A prime example of AI infrastructure is Nvidia (nVidia), a company producing AI semiconductors (accelerators). Nvidia's revenue is expected to remain strong for at least another year. A minor concern is that its operating profit margin may start to slow slightly, but it will still maintain incredibly high profit margins for some time.

Nvidia's stock price shows a trend of slightly surpassing its peak from June-July, just before the emergence of AI skepticism.

nVidia, NVDA

"Power supply related stocks," another crucial infrastructure area, are also moving based on a similar narrative that fundamental infrastructure needs to be invested in first, regardless of AI skepticism.

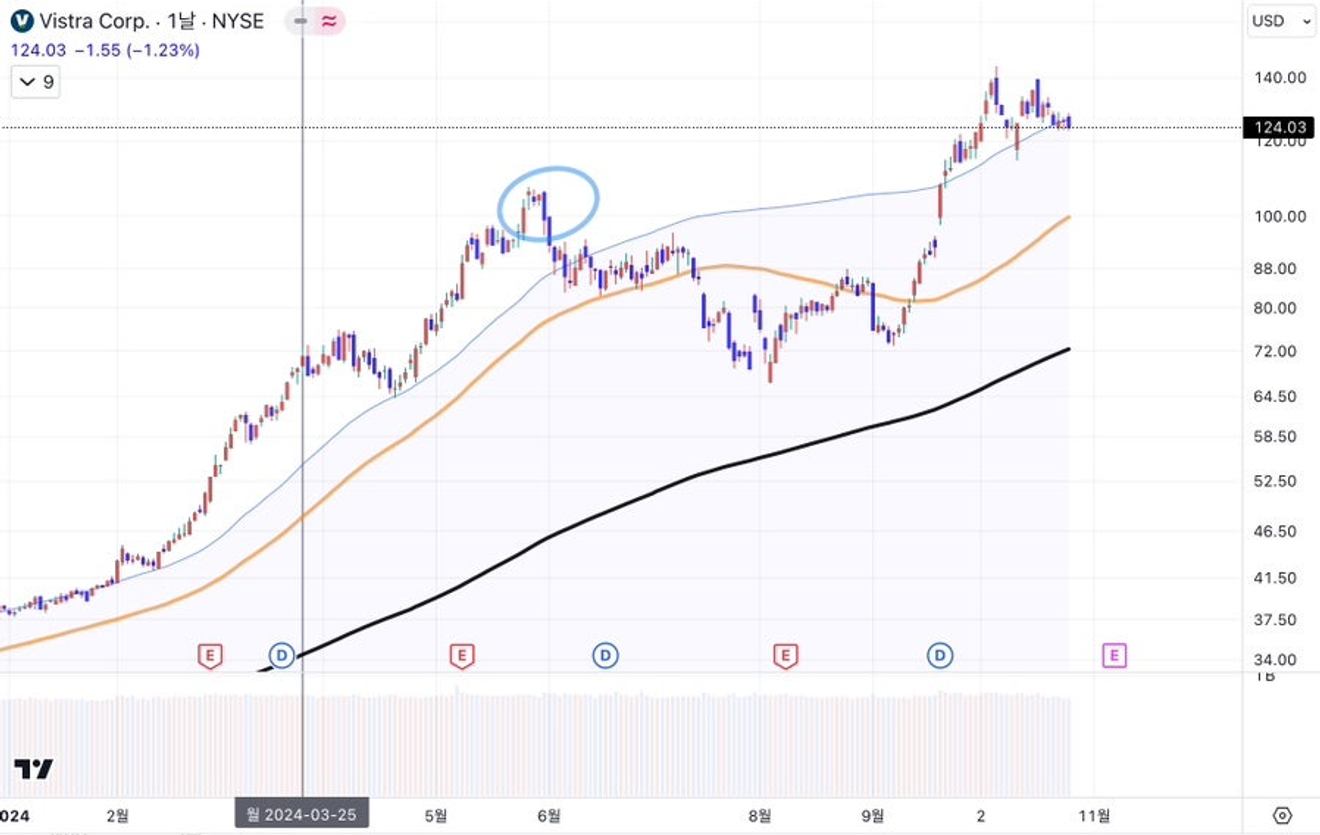

Prime examples include companies that generate and supply power using nuclear power or natural gas, such as Constellation Energy and Vistra Corp.

These companies have surpassed their July highs, driven by the anticipation of preemptive infrastructure investment, moving beyond the concerns of AI skepticism.

Constellation Energy, CEG

Vistra Corp, VST

Since the AI skepticism emerged, the stock performance of the M7 big tech companies has been particularly weak in software-centric companies, which are considered key players in future AI services, including Alphabet (Google) and Microsoft.

Among the M7, Google has seen the weakest stock performance since its July peak. This is likely due to AI skepticism coupled with concerns that future AI services might erode its core search business.

Microsoft, which surged with ChatGPT, hasn't fared much better than Google, with its stock price consistently trading below its July peak.

alphabet, GOOG

Microsoft, MSFT

Apple, despite receiving criticism for its on-device AI at the recent iPhone 16 launch event, has shown stronger stock performance than Google or Microsoft, which are more closely tied to prominent chatbots and AI search services. This is likely due to the "Apple" brand recognition.

Its recent stock price has rebounded to nearly its July peak and is currently hovering around that level.

Apple, AAPL

Amazon, while expected to integrate AI technology into its existing businesses, has seen less of a recovery than Apple, but still better than Google and Microsoft.

Amazon, AMZN

Among the big tech companies that have launched AI services, Meta (META) has received the most favorable market reaction. Its stock price has exceeded its July peak and remains at a higher level than Google or Microsoft.

Meta platforms, META

Based on related articles, Meta's open-source release of its language model, "Llama," appears to have received more positive feedback than Google and Microsoft's more closed strategies.

Meta's open-source strategy is seen as accelerating AI development and simultaneously expanding the ecosystem, reminiscent of the positive reception of Apple's App Store launched alongside the iPhone.

Tesla's self-driving program, "FSD," which recently unveiled its robotaxi service ("Cybercab"), is another example of a prominent AI application service, though still in the pilot stage.

Despite underperforming other big tech companies for the past 2-3 years, Tesla's stock price shows a growing market expectation, particularly related to the robotaxi service.

Although considered overvalued compared to other M7 stocks, the stock price trend suggests a strong expectation of the robotaxi service, which is slated for commercialization (though likely delayed, as in the past) in 2-3 years.

Tesla, TSLA

Looking at the stock performance of the M7 big tech companies involved in AI in the months following the AI skepticism, Nvidia is seen as a foundational infrastructure for AI services and is expected to continue performing well, while...

Among the remaining six companies, Tesla and Meta show growing market expectations regarding AI services. Apple maintains a steady position due to its mobile platform, while Google, Microsoft, and Amazon remain uncertain.

Even if the overall US stock market remains capped for a considerable time, the stagnation of some M7 stocks may open up further upward potential for selected companies, leading to market consolidation.

By next year, we might see new terms like F3 or F4 (Fantastic 3, 4?) replacing M7, as the leading players consolidate.

Following the AI skepticism, Google, Microsoft, and Amazon appear to have been negatively impacted in terms of short-term profitability of AI investment, while Tesla and Meta show growing market expectations of taking the lead in future services, even if immediate financial gains are limited.

Comments0