Subject

- #US Stock Market

- #Stock Price Decline

- #Samsung Electronics Stock Price

- #KOSPI Outlook

- #KOSDAQ Outlook

Created: 2024-10-09

Created: 2024-10-09 00:41

I recently saw a YouTube video about the domestic stock market, and it presented a completely different perspective on the patterns than mine.

The video predicted a significant rise in the KOSPI index by the end of the year, within the next few months. I have a different view, as I've stated before, and believe a substantial further decline is still to come.

Below are the recent daily charts of the KOSPI and KOSDAQ indices. The KOSPI index seems to be showing equal strength in both upward and downward movements, making it difficult to predict its direction. Looking at it a bit more broadly, the trend of the KOSDAQ index seems clearer.

To put it simply, I expect the KOSDAQ index to continue its downward trend towards one of the two points shown in the chart below; either around 485 points or around 450 points (448~455 band).

Regardless of which point it reaches, it will represent a significant drop compared to the beginning of the year, nearly halving the KOSDAQ index.

Looking at the numbers alone, it might not be immediately clear just how significant that level of KOSDAQ index is. However, if we look at a wider time frame, it's quite close to the low point reached during the 2020 coronavirus pandemic crash.

While the KOSPI index reached its high point in July of this year, the KOSDAQ index peaked earlier in March and has been trending towards these lower levels. That's my conclusion, take it or leave it!

Of course, this is based on an observation of the KOSDAQ index alone, but it also incorporates my considerations of the US stock market.

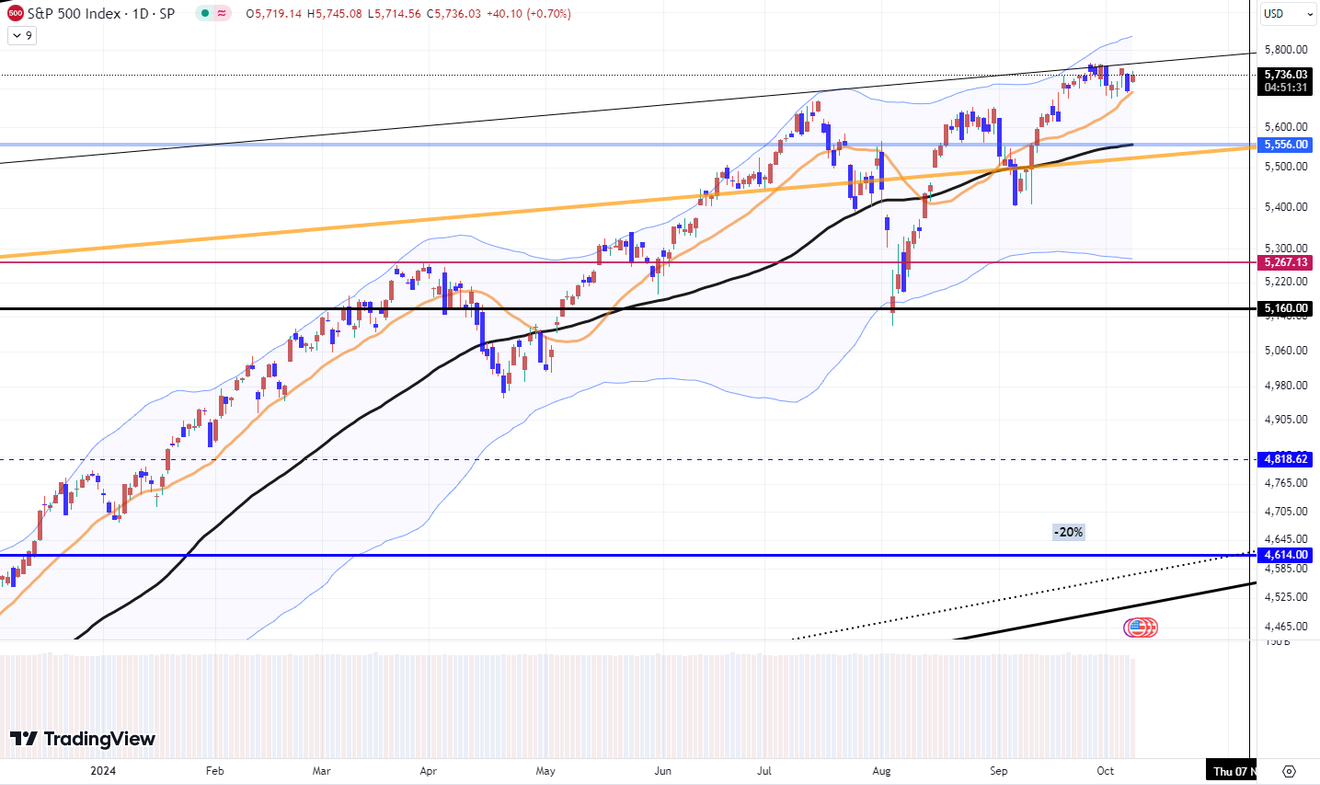

Based on the S&P 500 index, I personally believe there's about a 60% chance that the US stock market has reached a long-term peak and is currently in a "waiting for an event" state.

That event, as you might expect, involves Israel. More specifically, I believe there's a possibility of a short-term shock related to interest rates (bonds) or renewed inflationary concerns stemming from Israel.

Since the KOSDAQ has a longer way to fall in the short term compared to the US stock market, its decline feels like it's happening in two stages. The first decline has already occurred, with a recent rebound providing a temporary lift. The second stage seems likely to happen alongside the US market...?

My previous mention of a "minimum of 2150" for the KOSPI index should be understood as focusing on the "minimum" rather than the specific number 2150.

Similarly, when discussing the support levels for Samsung Electronics, whose stock price has already fallen significantly, I emphasized lower support levels rather than the current level. This is because I anticipate further declines for Samsung Electronics, possibly reaching the 49,000 to 53,000 range.

These factors combined explain my repeated advice to readers of my blog to maintain "at least 50% cash reserves." This is based on my short-term outlook.

If the KOSDAQ index does indeed plummet to that level within the next few months (or even before the end of the year), I would consider the probability of the asset market entering a gradual Great Depression-level cycle to be very high.

Please remember that these are just my personal opinions, take them with a grain of salt.

Comments0