- 트럼프 승리에 베팅하는 ‘트럼프 트레이드’가 살아났다

- 트럼프 트레이드 최대 수혜주 트럼프 미디어, 보름도 안돼 90% 가까이 치솟아 비트코인·달러화·은행주도 강세...“베팅 사이드 믿고 트럼프 승리 확신은 금물” 미국 대선을 10여일 앞둔 가운데 공화당 대선 후보인 도

Despite the US stock market closing with mixed results yesterday, the domestic stock market plunged again today. The KOSPI fell by 1.31%, while the KOSDAQ experienced an even larger drop of nearly 3%, closing down 2.84%.

Major stocks such as Samsung Electronics and Ecopro, which are significantly correlated with both the KOSPI and KOSDAQ indices, also showed a considerable decline.

Today's domestic market trend resulted in the KOSPI index slightly deviating from its short-term trendline, and the KOSDAQ index also closed with a large negative candle, seemingly unable to overcome the 60-day moving average resistance. This appears to be a rather negative trend.

KOSPI Daily Chart

KOSDAQ Daily Chart

Below is the weekly chart for the KOSDAQ. While the KOSPI's trend isn't significantly different, looking at the KOSDAQ's weekly chart, it's currently hovering around the midpoint of its trajectory toward the approximate endpoint I previously anticipated, starting from the first half of this year.

It seems that the latter half of this trend is starting today. Considering my prediction that it would approach the level near the low point of the COVID-19 crisis, there's still a considerable downside potential remaining. For such a movement to occur, it's important to remember that stocks at the top of the KOSDAQ market capitalization are highly likely to experience a concurrent weakening trend during this period.

KOSDAQ Weekly Chart

Today's market results show that not only secondary battery-related stocks like Ecopro and Ecopro BM, which are among the top market capitalization stocks on the KOSDAQ, but also bio-related stocks like Alteogen and HLB, are weakening.

Looking at the recent daily chart trend for Ecopro and Ecopro BM below, we see that the stock price, which had attempted to rise after the beginning of September, is now starting to slide, breaking down through its short-term support levels.

Ecopro Daily Chart

Ecopro BM Daily Chart

Samsung Electronics' stock price, which significantly impacts the KOSPI index, fell by over 2% today, showing a continued downward trend without any significant short-term technical rebound.

The lack of significant short-term rebounds suggests that we should consider the possibility that the foreign-led selling pressure will continue without interruption.

Although Samsung Electronics' stock price has become cheaper due to the significant decline from its peak, even those planning to make new purchases at these low prices should adopt a staggered approach over an extended period (perhaps several weeks), keeping in mind the possibility of further technical declines due to foreign-led selling. If the price falls below 53,000 won, as shown on the weekly chart below, it might be a good time to increase the investment ratio through faster paced staggered purchases.

Samsung Electronics Daily Chart

Samsung Electronics Weekly Chart

The dominant short-term narrative underlying the current trend in the US stock market, which significantly influences the domestic Korean market, appears to be concern over "rising market interest rates," rather than economic or inflation concerns. We don't anticipate immediate indicators suggesting an imminent recession or renewed inflation in the short term.

Instead, concerns about a mid-term resurgence of inflation are emerging, primarily fueled by the resurgence of the 'Trump trade' as the possibility of Donald Trump's re-election increases.

Recently, prominent political betting or gambling sites have shown a sudden increase in Trump's win probability (betting volume), diverging somewhat from public opinion polls. However, as the article below illustrates, this has also raised concerns about potential manipulation of public opinion due to a sudden influx of significant funds into these political betting sites.

Even if it's political betting, not an official opinion poll, it still significantly influences people's psychological views. If a large sum of money was intentionally injected just before the election to artificially boost sentiment toward a Trump victory, it should be viewed differently from political funding for things like TV ads – as a form of direct manipulation of public opinion using money.

In fact, the core issue seems quite similar to recent frequent news reports in Korea about the alleged manipulation of public opinion polls by Myung Tae-gyun and the possibility of psychological manipulation. The method differs, but the core problem appears much the same.

The charts below show the daily interest rate trends for major long-term US Treasury bonds, including 30-year and 10-year bonds. We can see that the longer the maturity, such as the 30-year bond, the more rapidly market interest rates have recently risen.

News reports indicate that long-term bond yields are surging due to the Trump trade, along with a rapid strengthening of the US dollar. As a result, while Big Tech stocks have shown a quiet trend since July, we're seeing some signs of pressure on other sectors and stocks whose prices have risen significantly on expectations of Fed rate cuts, which now see their further price increases suppressed.

US 30-Year Treasury Yield

US 30-Year Treasury Yield

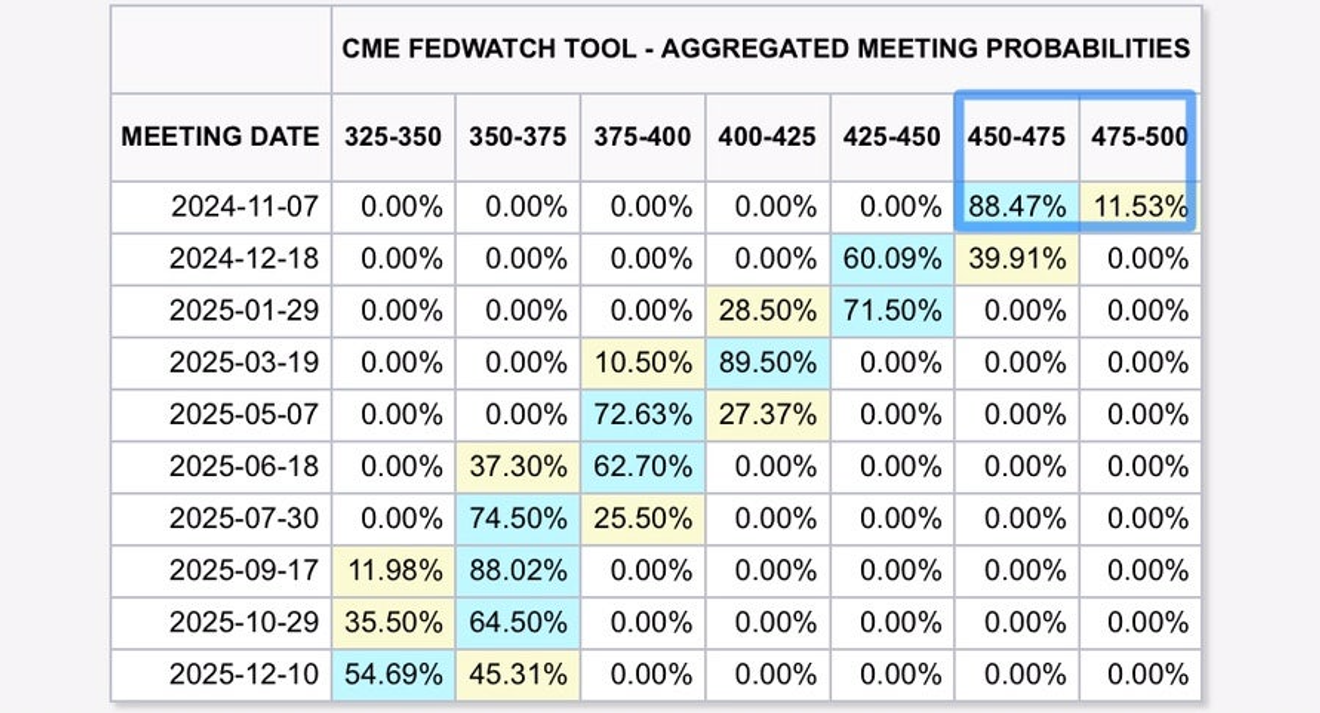

Looking at the Fedwatch and the trend in the interest rate futures market, the probability of a 25bp rate cut at the November FOMC meeting fluctuates between 80% and 90%.

Although still low, the resurgence of the Trump trade is currently preventing the probability of a rate freeze from falling further. If this probability were to increase, the US stock market could become more sensitive to interest rate changes.

Fedwatch Interest Rate Expectation Probability Table

Currently, for both the US and domestic stock markets, the most significant potential negative factor seems to be the increased possibility of an interest rate shock, rather than US economic concerns or short-term inflation rebound.

We're only seeing minor reactions to the Trump trade issue. However, if another issue were to arise concurrently, it could further stimulate market interest rates, especially long-term bonds, particularly given the potential for conflict in the Middle East.

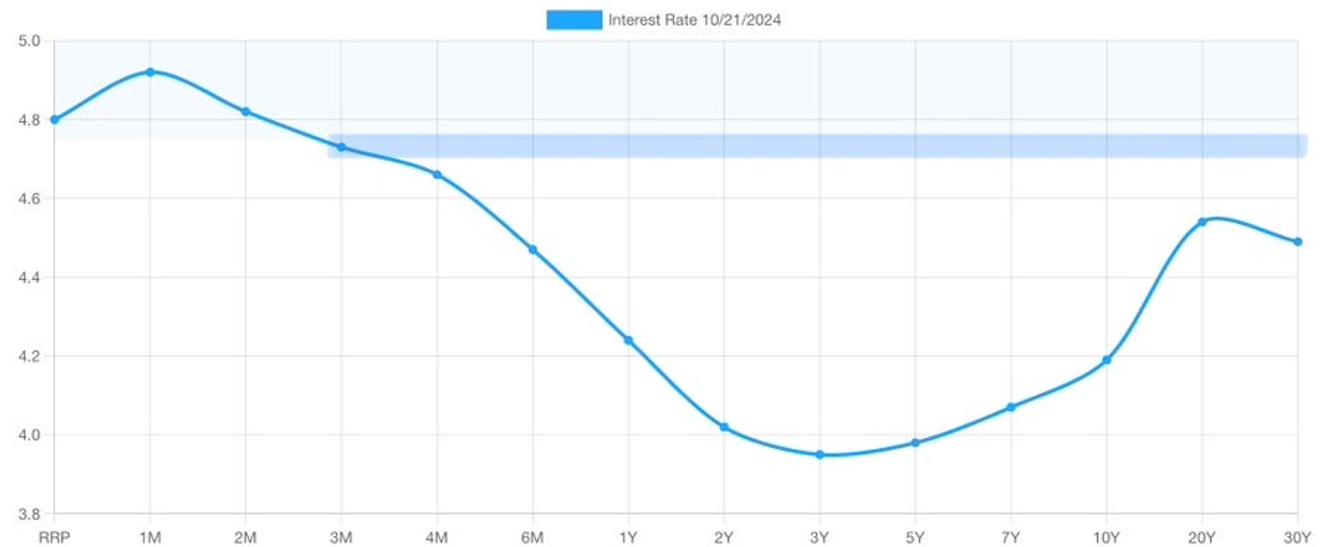

The 30-year Treasury yield is already approaching 4.5%, and the benchmark 10-year yield hovers around 4.2%. At what point will the market become more sensitive to the 10-year yield?

I personally suspect that the market will become more sensitive when the issue of "normalization of the long-short-term yield spread," a major market concern, begins to resurface. Just as the normalization of the 10-year to 2-year yield spread was an issue recently, the 10-year to 3-month yield spread remains. This is also linked to issues related to the bear steepening phenomenon in the bond market.

US Yield Curve

Yesterday, Goldman Sachs issued a pessimistic long-term outlook, predicting that the US stock market's returns over the next 10 years will not surpass those of the bond market.

Although there is some time lag, similar views were expressed by Wall Street legends like Ray Dalio and Stanley Druckenmiller in the past, and recently, Goldman Sachs and JP Morgan have echoed these sentiments.

I suspect that, similar to my frequent statements, they are offering this as a sort of preemptive "hint" about a long-term peak in the US stock market. As shown in the video thumbnail below, the assertion that "upward trend is over" doesn't mean a long-term bear market is inevitable. The possibility of sideways movement for a while still remains.

Comments0