- 트럼프, 미 대선 승리 선언…"47대 대통령에 당선돼 영광"

- 미국 공화당 대통령 후보 도널드 트럼프 전 대통령이 11·5 미국 대통령 선거 승리를 선언했습니다. 트럼프 전 대통령은 미 동부시간으로 대선 다음날인 6일(현지시간) 오전 2시30분쯤 자택이 있는 플로리다 팜비치 컨

Surprisingly, faster than expected, news of Trump's victory in the US presidential election is coming in today, the day after the election. In swing states, Trump has been widening the gap from the beginning, unlike in the past, and Fox News, which is friendly to the Republican Party, is reporting the news of Trump's confirmed victory the fastest.

Since most people expected Trump to have a higher chance of winning than Harris, we are more curious about the results of the congressional elections, which will have a greater impact on policy implementation such as tax cuts and deregulation, than the news of Trump's victory itself.

According to the news so far, the Republicans are likely to become the majority party in the Senate, while the situation in the House of Representatives is still unclear. If the Republicans also take control of the House, the market's low-probability expectation of a "red wave" will be realized, which could be somewhat surprising.

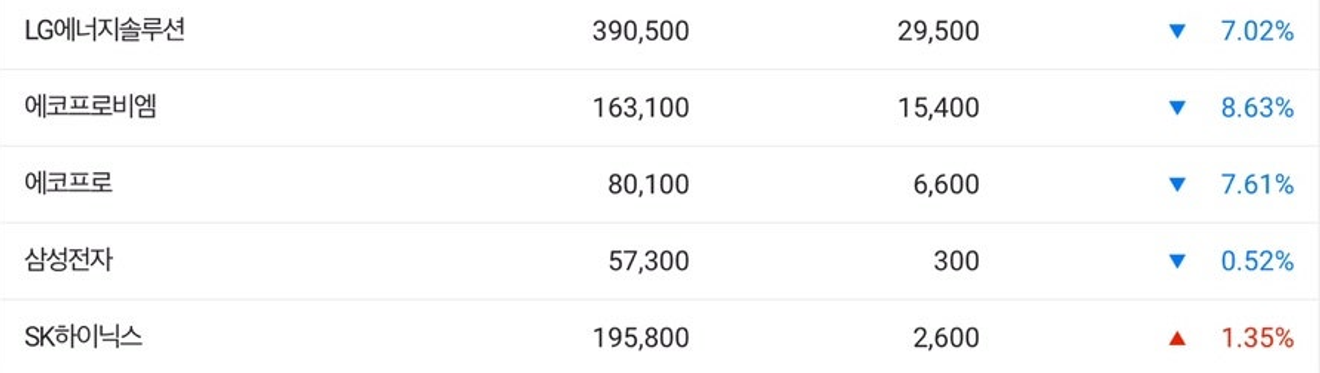

During the Asian trading session, when the vote counting atmosphere was being reported, a clear Trump trade seemed to erupt. In the domestic stock market, shares related to electric vehicles and secondary batteries, which are among the top market-cap companies and were considered to be uncooperative with Trump's policies on electric vehicle and renewable energy support, lost ground, pulling down the overall domestic stock market.

The market's color in the afternoon was clear. As reports indicated Trump's lead, the US 10-year Treasury bond yield strongly broke through the 4.3% line and is rapidly approaching the 4.5% line, showing a sharp rise.

The dollar index is also rising sharply along with interest rates.

Aside from the US presidential election, the big event of this week, the FOMC result announcement is scheduled for Friday, the 7th.

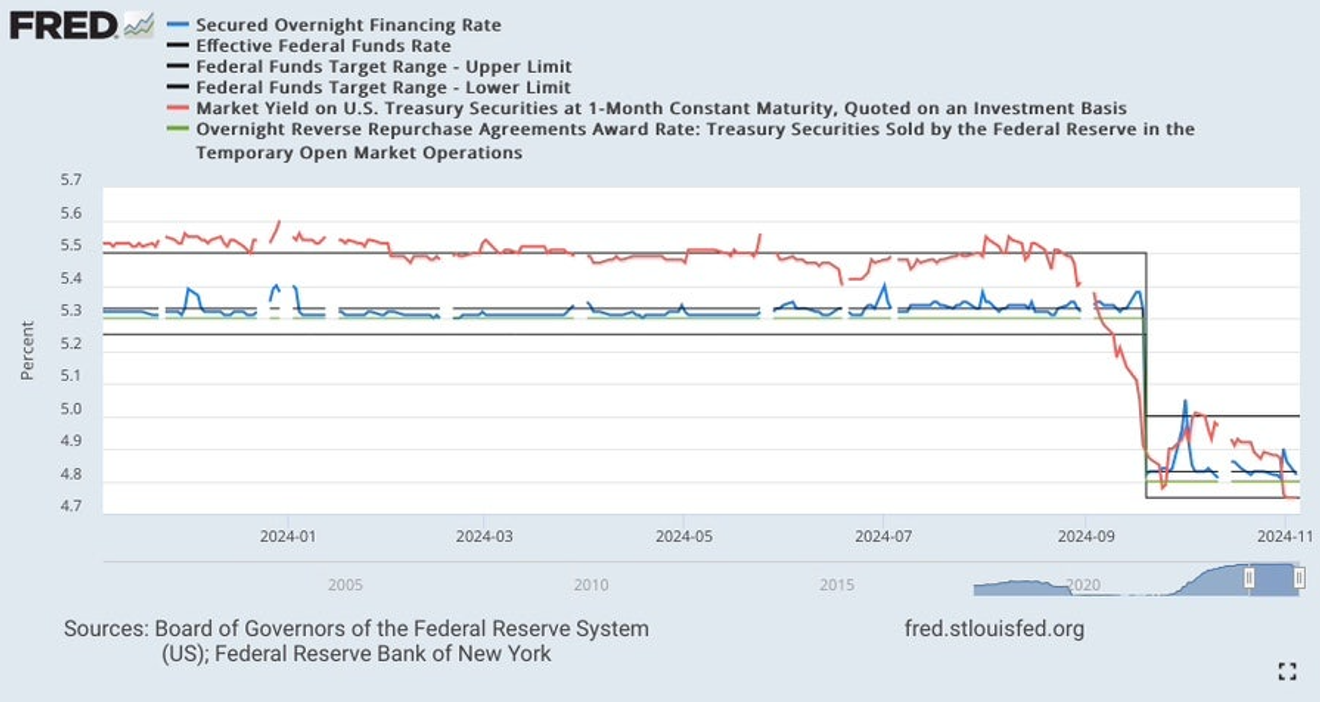

In the short-term interest rates, the possibility of a 25bp cut is being taken for granted before the FOMC, and the one-month interest rate is preemptively falling to the 4.75% line, which is the lower limit of the current policy rate.

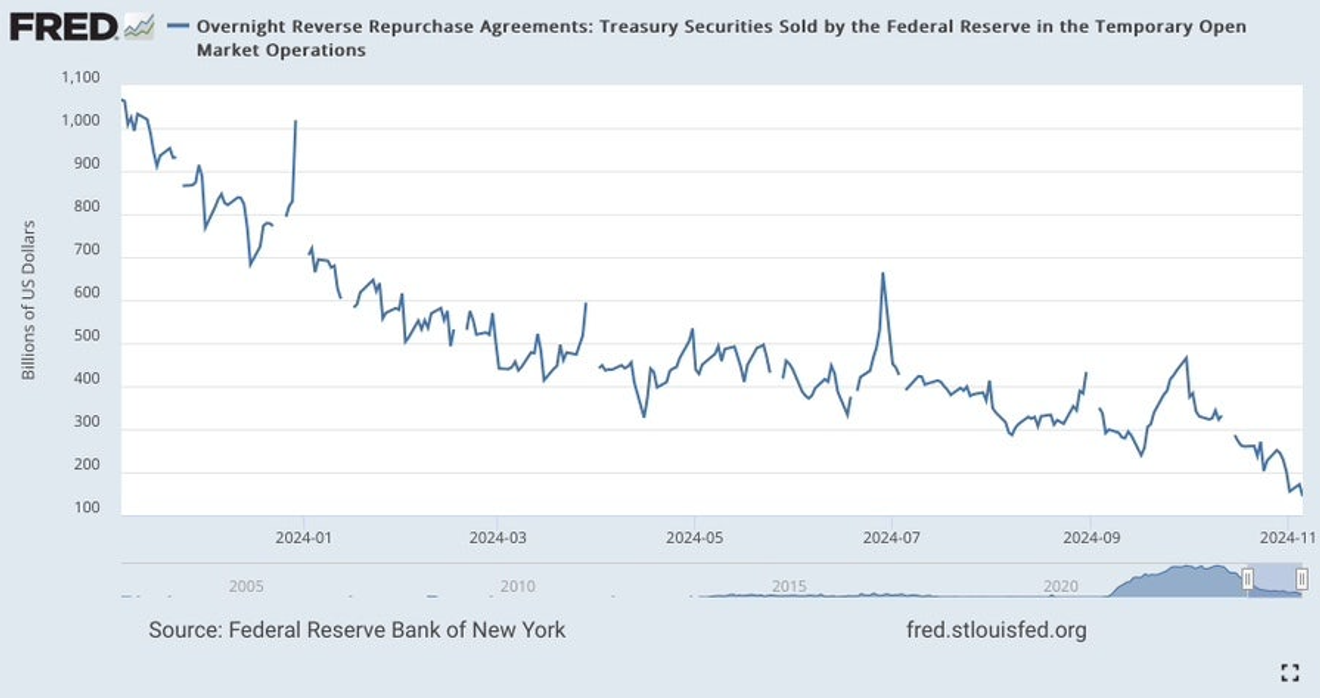

Even as the one-month interest rate is preemptively falling below the reverse repo rate, the reverse repo balance below shows a continuous downward trend recently, without the usual spike at the end of the month.

Looking back, the reverse repo balance, which once exceeded \"2 trillion dollars\". has decreased significantly. Currently, only about \"150 billion dollars\" remain.

Over the past few months, when the reverse repo balance had been hovering around \"300 billion dollars\", many articles on economic issues stated that it would be difficult for the balance to decrease further from there and that it would remain at that level for a considerable period. It was said that the point at which the reverse repo balance would run out was still far off, but now, it seems that the anticipated timing is unexpectedly approaching, perhaps even running out?

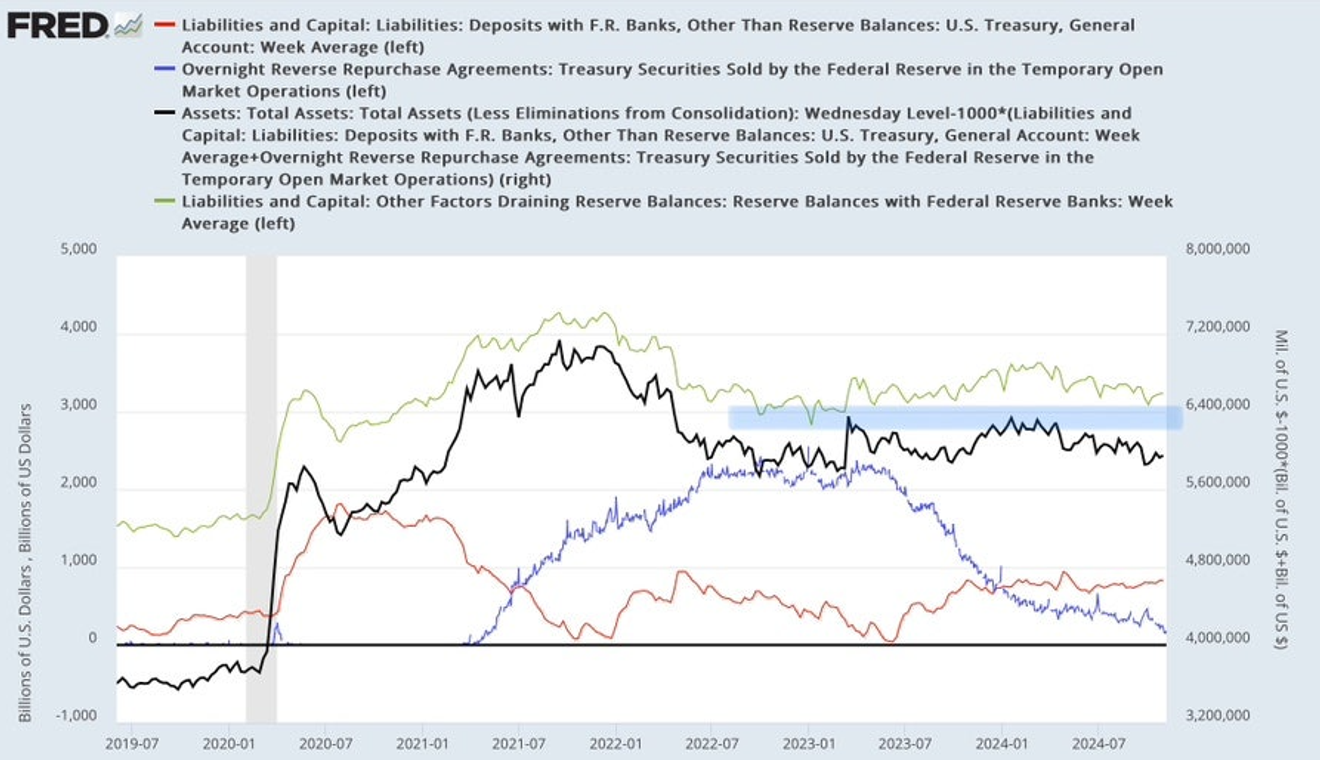

Looking at the chart below showing the Fed's liability accounts, even though the reverse repo balance has been continuously decreasing recently, total reserves (green line), which represent short-term liquidity, have been slowly decreasing for several months.

This is likely due to the Treasury's intention to maintain the TGA balance (red line) at the current level, and the fact that quantitative tightening (QT) by the Fed, although smaller than before, is still ongoing.

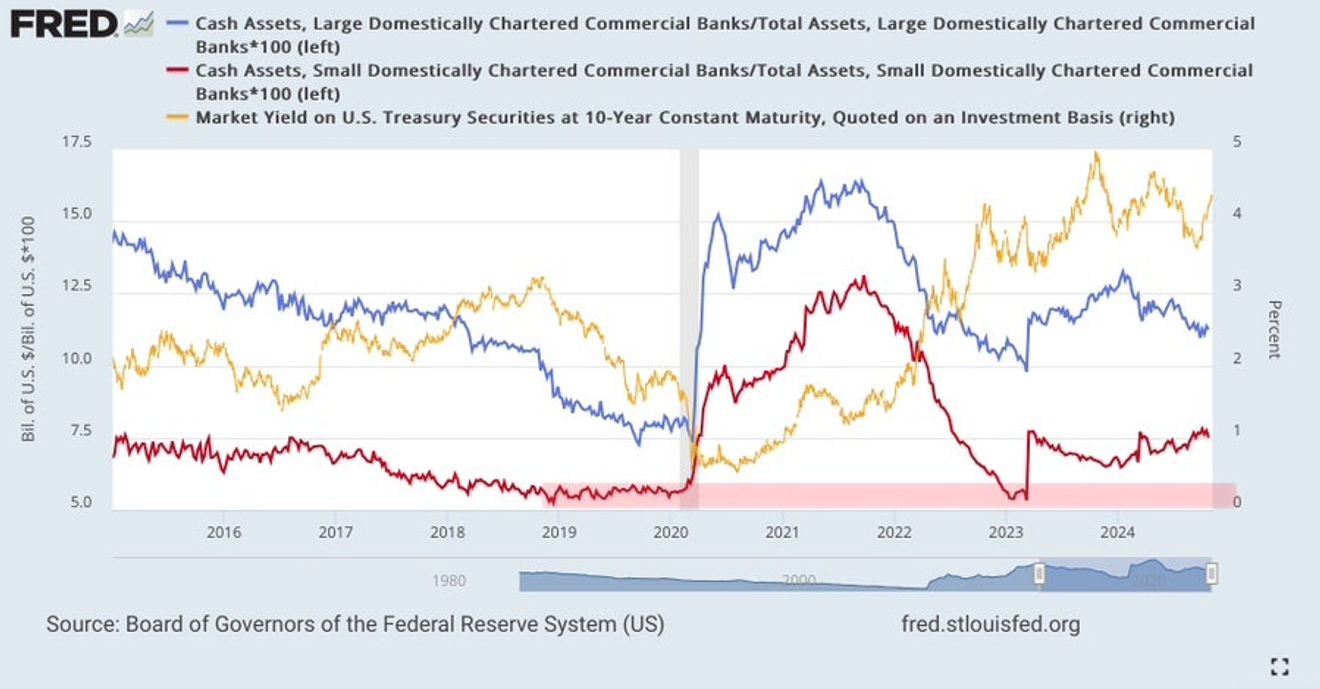

The chart shows that while reserves are approaching the levels seen at the beginning of 2023, which triggered the regional banking crisis, the ratio of cash (reserves) to total assets for major and smaller banks is still high compared to the levels that caused problems before, so there seems to be no problem in the short term.

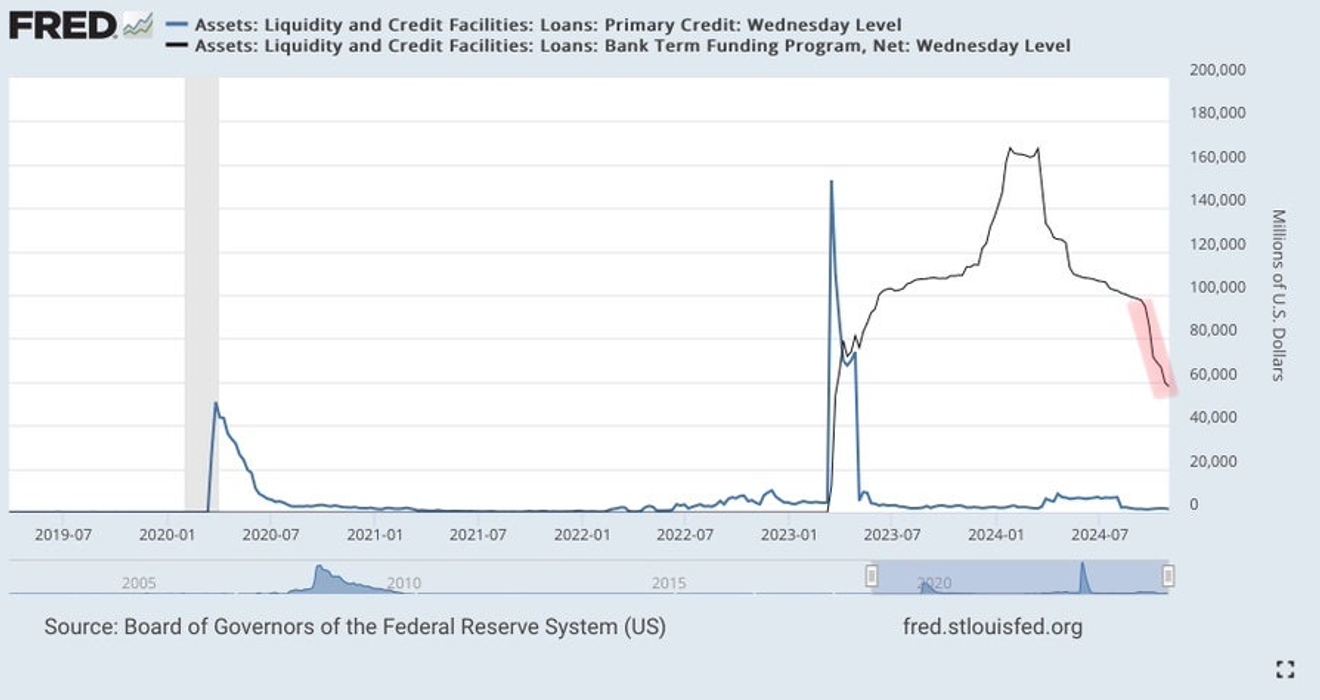

As the March maturity date approaches, the BTFP balance, as shown in the chart below, is decreasing as loans are repaid.

This loan repayment will have a considerable impact on the decrease in reserves, although not a huge amount.

If the reverse repo balance continues at the current pace, it is expected to approach the bottom level of less than \"1000 billion dollars\". Given the repayment of the BTFP loan, which has a set schedule, reserves will likely continue to decline until early next year, unless the Treasury lowers its planned TGA balance.

However, according to reports so far, the Treasury plans to maintain the TGA balance at around \"850 billion dollars\" until the end of the third quarter of next year. Therefore, around March next year, I wonder if there might be some problems due to the reserve level.

Considering this trend, if the reverse repo balance is approaching the bottom level around or shortly before March next year, the Fed might announce a halt to quantitative tightening.

However, just as quantitative tightening itself was not a major negative factor for the market in the past, its cessation is unlikely to act as a major positive factor. It would probably just be a short news item, passing quietly without much incident.

Comments0