- 美연준 위원들 11월 회의서 "금리, 향후 점진적 인하 적절" 판단

- FOMC 의사록 "중립금리 추정 불확실성…긴축수준 평가 복잡하게 해" 이지헌 특파원 = 미국 중앙은행인 연방준비제도(Fed·연준)의 이번달 통화정책 회의에서 연준 위원들은 향후 금리인하를 신중히 할 필요가 있다는 데

.

The minutes of the Fed's November FOMC meeting were released last Tuesday. The revelation that a majority of committee members believed that gradually lowering the benchmark interest rate would be appropriate in the future led to a somewhat positive market reaction.

The bond market, which had shown some disappointment at Chair Powell's recent comments suggesting a possible pause in rate cuts, responded positively to the minutes, gradually lowering market interest rates.

Even though Chair Powell hinted at the possibility of holding off on a rate cut in December before the minutes were released, the futures market maintained its bet on a 25bp rate cut in December at around the mid-50% range.

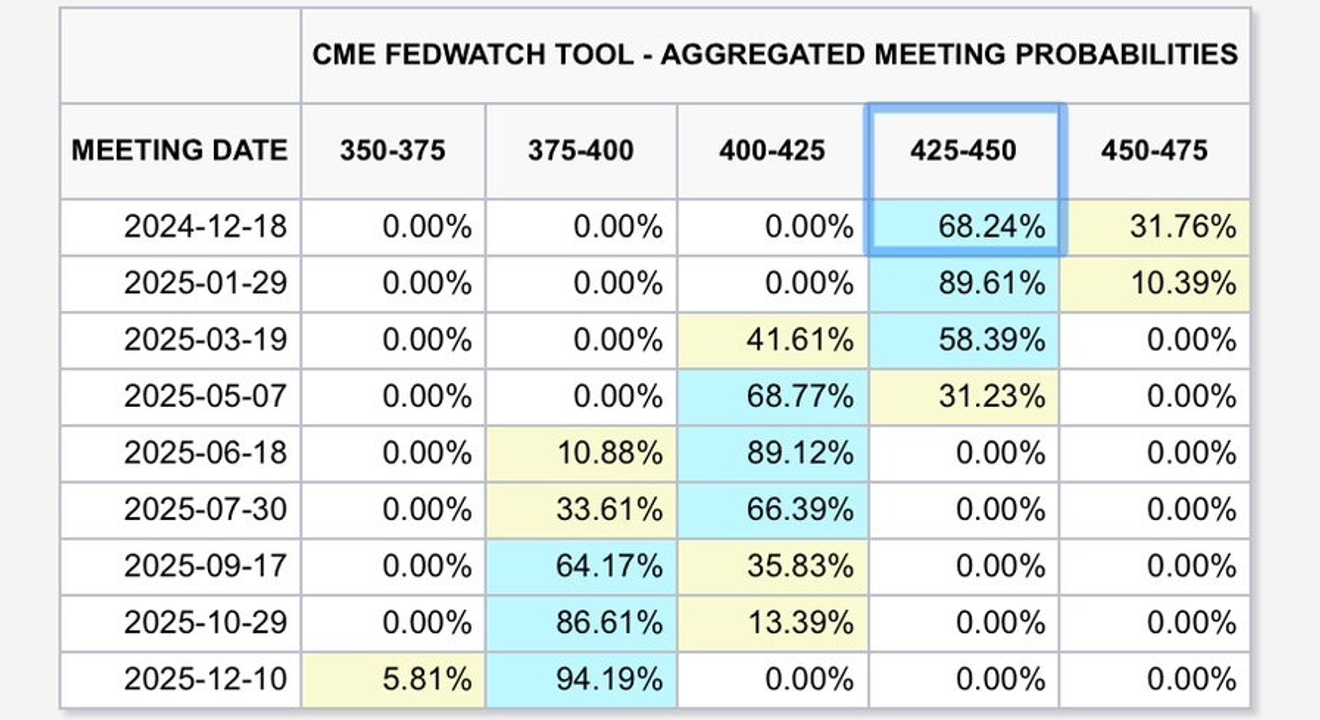

Due to the content of these minutes, even with the PCE price index showing a surprising lack of decline and signs of rebound yesterday, the Fedwatch's rate cut bets remain strong, reaching 68% today, a market holiday.

CME Fedwatch

Despite the recent easing of excitement surrounding the expectation of three 25bp rate cuts by the end of next year according to Fedwatch, it's somewhat unusual that the expectation of a rate cut in December hasn't decreased much since before the minutes' release.

The market had anticipated a lack of significant decline in the October PCE price index, so why...?

I believe the market is continuously weighing the possibilities of "inflation concerns or recession concerns."

While not prominently featured in the news lately, the market seems to be continuously pricing in the possibility of future recession concerns.

From this perspective, alongside the news from Wall Street media continuously highlighting concerns about inflation rebounding due to Trump, we are observing the 10-year Treasury yield and gold prices, which have struggled to break through key resistance levels.

US 10-Year Treasury Yield

International Gold Price Trend (Daily)

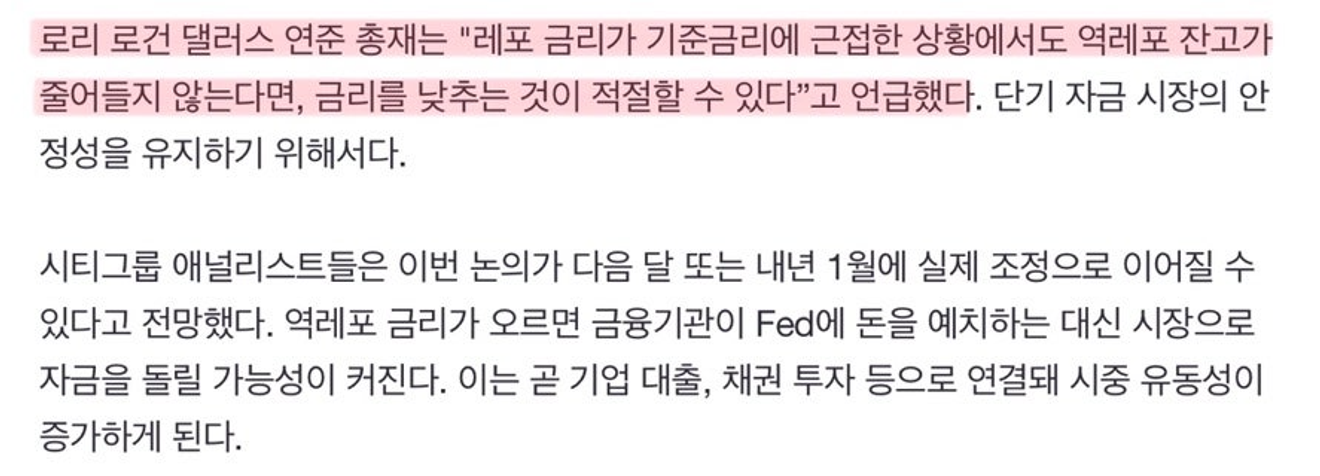

Along with the release of the November Fed minutes, it was reported that some Fed officials, including Lorie Logan, president of the Dallas Fed, spoke about lowering the reverse repo rate.

The proposal was to lower the reverse repo rate (RRP), currently set at +5bp below the benchmark rate, by 5bp to bring it flush with the lower bound of the benchmark rate. This would widen the spread between short-term Treasury bills (T-bills) and the RRP, incentivizing the release of the Fed's reverse repo balance towards external assets like T-bills, thereby benefiting short-term liquidity.

(Part of the article below)

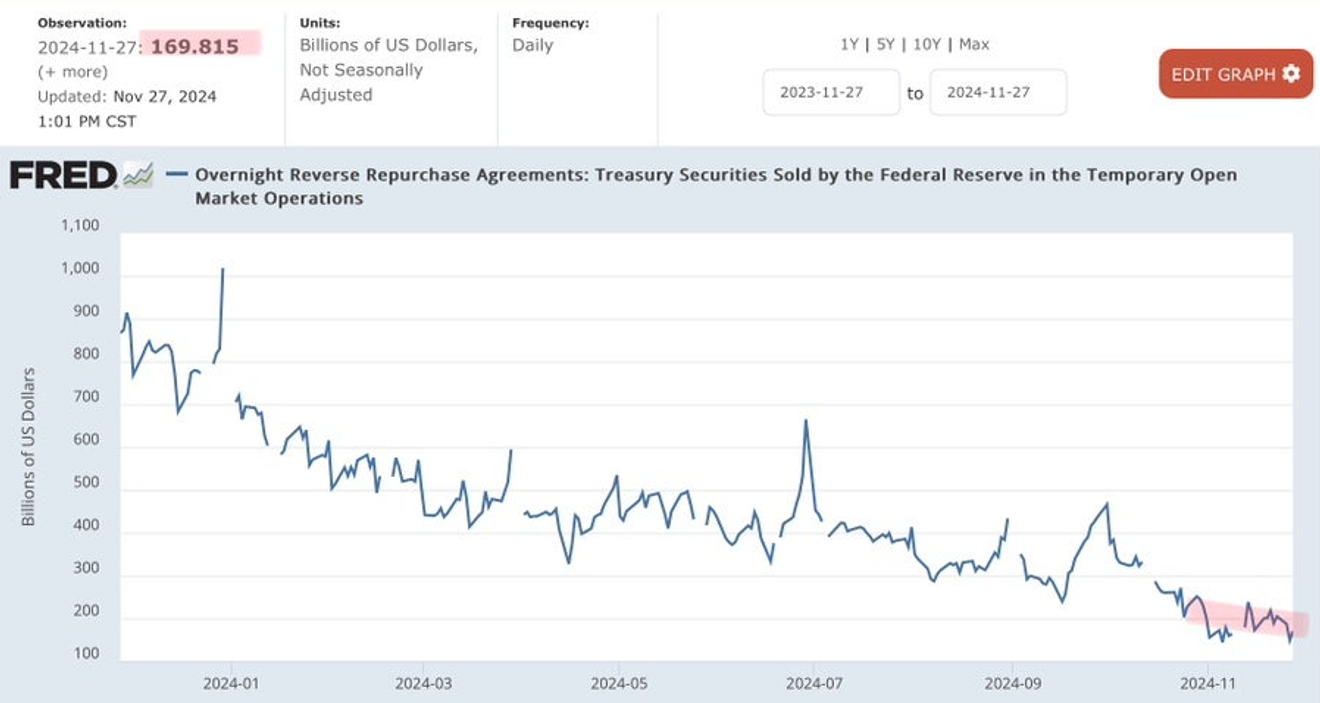

Compared to the second half of 2022 and the first half of 2023, when it reached a peak of over $2 trillion, the current reverse repo balance has significantly decreased to around $169.8 billion.

While the reverse repo balance decreased rapidly and flowed into the market from 2023 to early 2024, the rate of decrease has noticeably slowed since mid-year, coinciding with a reduction in the pace of quantitative tightening.

Trend of the Fed's Reverse Repo Balance

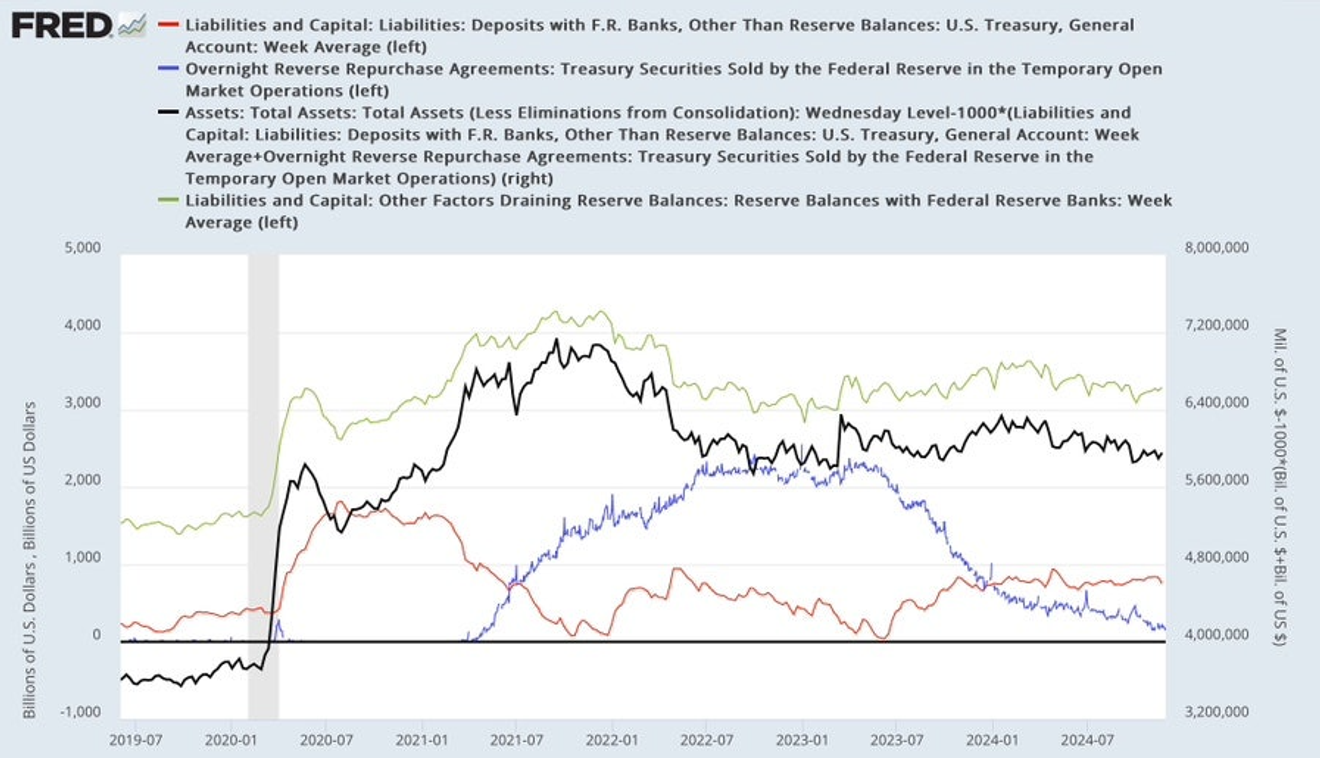

Trend of the Federal Reserve's Liability Account Balance

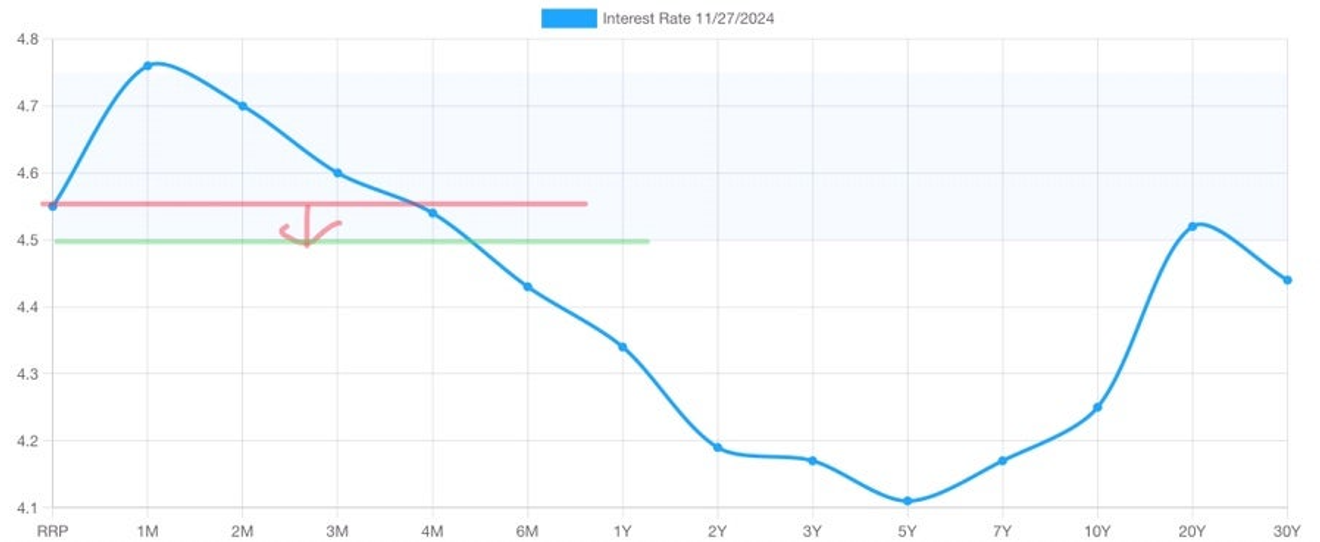

As shown in the yield curve below, President Logan's statement suggests lowering the reverse repo rate, currently +5bp below the lower bound of the benchmark rate, to be flush with the lower bound. This aims to widen the spread with very short-term Treasury securities (mostly 1-2 month bills?), incentivizing a shift of funds towards these assets.

It seems the intention is to push out the roughly $160 billion that has been fluctuating recently. This is likely to ensure that current quantitative tightening does not hinder the maintenance of short-term liquidity.

US Treasury Yield Curve (Yield Curve)

This seems to be related to the Fed's recent consecutive rate cuts and the minutes' statement indicating a continued gradual easing of rates in the future.

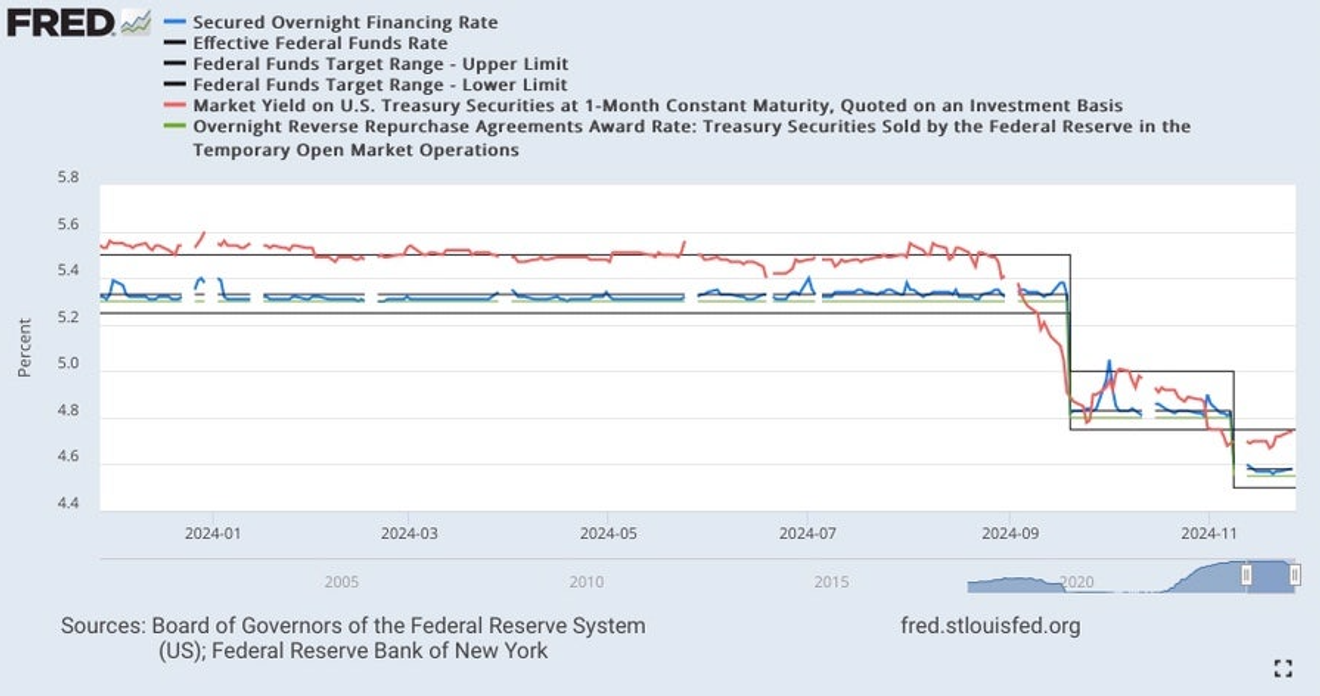

As shown in the short-term interest rate graph below, since the initiation of rate cuts, the 1-month Treasury bill rate (red line), which previously clung to the upper bound of the benchmark rate during the freeze period, has moved slightly below the upper bound, anticipating future rate cuts.

This narrowing of the spread between existing very short-term rates and the reverse repo rate appears to be hindering the reduction of the remaining reverse repo balance, prompting the move to lower the reverse repo rate to push the balance out.

Trend of Short-Term US Interest Rates

Meanwhile, this statement by a Fed official to drain the reverse repo balance leads to the expectation that the Fed will end quantitative tightening sometime in the first half of next year.

With the reverse repo balance depleted and total reserves not being very high, continuing quantitative tightening could potentially trigger a liquidity crisis in the banking sector, increasing the likelihood that quantitative tightening will have to be stopped.

However, the termination of quantitative tightening shouldn't be viewed as positive but rather neutral. Stopping quantitative tightening would mean there's no additional liquidity supply to the financial markets due to other factors.

Therefore, rather than focusing on whether quantitative tightening will stop, it's more important to focus on whether negative events will occur in the stock market. Especially given the continuing decline in long-term bond market interest rates, we should watch when the Fed might unexpectedly accelerate rate cuts.

That timing will likely coincide with the normalization of the remaining 10-year to 3-month yield curve spread. We should carefully observe when the Fed moves ahead of the rate cut pace currently anticipated by Fedwatch.

That point will likely mark when the Fed starts prioritizing recessionary concerns over inflation, and this shift could significantly impact the U.S. stock market.

Of course, the stock market will likely react before such a situation arises. And I also have a slight suspicion that the first half of the Trump 2.0 administration will unexpectedly take a hawkish stance.