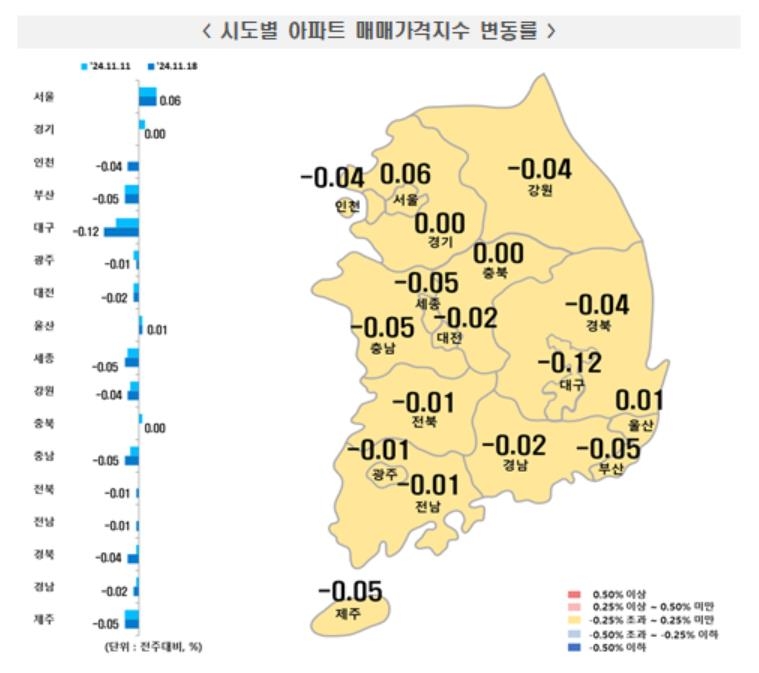

- 대출 조이자 전국 아파트값 반년 만에 하락…서울은 상승 지속

- 경기 매맷값도 제자리걸음…인천은 하락 전환 전셋값은 상승세 지속…서울 등 상승 폭은 둔화 전국 아파트값이 반년 만에 하락 전환했다. 서울의 매맷값은 상승세를 지속했으나 경기도가 25주 만에 보합을 기록하며 제자리걸음

![Global Markets Outside the US Still Trapped in the Aftershocks of the 2008 Global Financial Crisis [feat. European Markets]](https://cdn.durumis.com/image/qsplddh8-1id7eosmb?width=660)

.

The chart below is a daily chart comparing the S&P 500, a representative index of the US, with the composite stock price indices of major countries such as Europe, Japan, and Korea, as well as Vanguard's VT (World Stock ETF), a well-known global fund, from late 2019 to the present.

With the global stock market crash caused by the COVID-19 pandemic, there was a brief period of convergence, but since then, there have been large deviations depending on the economic conditions of each country.

Still, it can be seen that Japan's Nikkei index followed the US S&P 500 index almost identically until the middle of this year, and Europe's blue-chip index, the Eu500, only had similar fluctuations, and its current performance is only slightly better than the KOSPI.

![Global Markets Outside the US Still Trapped in the Aftershocks of the 2008 Global Financial Crisis [feat. European Markets]](https://cdn.durumis.com/image/oshcrqii-1id7ept64?width=660)

S&P 500 and Major Country Stock Indices

Looking at the stock market indices of these major countries together, I suddenly wonder how the medium- to long-term trend of the entire global stock market has progressed.

So I briefly looked at VEA along with VT, one of Vanguard's representative ETFs.

As shown below, VT benchmarks the 'FTSE Global All Cap Index' and aims to track the global stock market, including the US. Naturally, it can be assumed that the stock markets of developed countries such as the US, Europe, and Japan have the most influence.

![Global Markets Outside the US Still Trapped in the Aftershocks of the 2008 Global Financial Crisis [feat. European Markets]](https://cdn.durumis.com/image/ud79hsv-1id7eqktv?width=660)

VT ETF - Benchmark

On the other hand, VEA's benchmark is the 'FTSE Developed All Cap ex US Index'. It is an ETF that tracks the global developed market index, but the biggest difference from VT is that it tracks the stock markets of developed countries 'excluding the US (ex US)'.

![Global Markets Outside the US Still Trapped in the Aftershocks of the 2008 Global Financial Crisis [feat. European Markets]](https://cdn.durumis.com/image/nqjfl3ph-1id7erelk?width=660)

VEA ETF - Benchmark

Therefore, VT is heavily influenced by the US market. As shown below, since approximately 63.4% of its holdings are US stocks, this portion inevitably resembles the trend of the US S&P 500 index.

![Global Markets Outside the US Still Trapped in the Aftershocks of the 2008 Global Financial Crisis [feat. European Markets]](https://cdn.durumis.com/image/s1q68mnh-1id7eshrq?width=660)

VT - Country Weighting

On the other hand, VEA excludes the US stock market, the largest among developed countries.

Looking at the weightings, Japan has the largest weighting at 21.2%, followed by the UK, Canada, France, Switzerland, and Germany. Surprisingly, Germany's weighting isn't that high, perhaps because its stock market size is relatively small compared to its economic size.

While Japan has a very high weighting as a single country, if you group Europe at the EU level, this product appears to be most influenced by the European stock market index, the Eu500.

![Global Markets Outside the US Still Trapped in the Aftershocks of the 2008 Global Financial Crisis [feat. European Markets]](https://cdn.durumis.com/image/6t4d8qar-1id7es7it?width=660)

VEA - Country Weighting

Below is a monthly chart of VT.

Since this ETF is heavily influenced by the US stock market, it looks like a slightly suppressed S&P 500 index trend.

![Global Markets Outside the US Still Trapped in the Aftershocks of the 2008 Global Financial Crisis [feat. European Markets]](https://cdn.durumis.com/image/kv5pu1uh-1id7etvks?width=660)

VT Monthly Chart

On the other hand, since the US market is excluded from VEA, its monthly chart, as shown below, shows a smaller increase in the bull market following the low point after the global financial crisis than VT above.

However, excluding the US market, there is something interesting to see, as highlighted by the orange fluorescent pen line below.

We continue to see a trend where the high point of 2007, just before the global financial crisis, has not been surpassed and remains blocked. In particular, since VEA is heavily influenced by the European stock market, this suggests that the European stock market is still trapped and has not yet overcome the shock of the 2008 global financial crisis.

This makes us realize that the 2008 global financial crisis, which began with the collapse of the US subprime mortgage bubble, had a greater impact on Europe.

![Global Markets Outside the US Still Trapped in the Aftershocks of the 2008 Global Financial Crisis [feat. European Markets]](https://cdn.durumis.com/image/gd8n87a8-1id7euiom?width=660)

VEA Monthly Chart

Will the European stock market recover, follow the strong US stock market trend, and will VEA renew its previous medium- to long-term highs and head straight for a long uptrend?

Of course, I believe there's a high probability that it won't break through immediately in the 2020s. This is especially true if the US economy weakens later and turns into a recessionary trend.

Looking at these fragmented trends, it's time for everyone to consider why we should now be aware of the possibility of a global economic depression.

Regarding the domestic stock market, some securities firm employees say that it's a buying opportunity since the KOSPI and KOSDAQ have fallen significantly, and in the real estate market, many voices still say that the recent decline in apartment prices is temporary and represents an opportunity.

Should we look for medium- to long-term buying opportunities, expecting the domestic stock market and apartment market to recover soon next year?

I doubt that the current situation is unfolding smoothly enough to reflect the contrarian views of the past.

Comments0