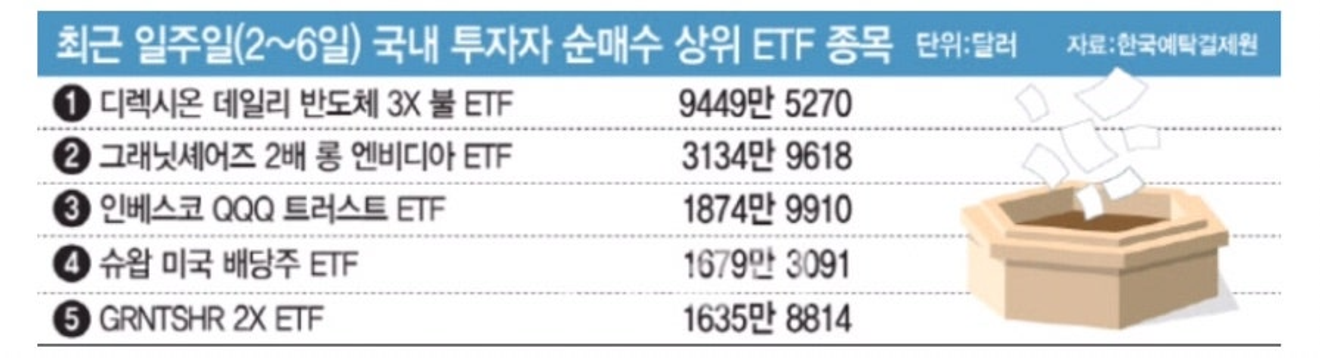

- 美 증시 급락에도…반도체 3배 베팅하는 개미들

- 미국의 경기침체 우려 속에 글로벌 증시가 급락한 가운데 서학개미들은 오히려 고배율 레버리지 상장지수펀드(ETF)에 몰려드는 것으로 나타났다. 손실을 만회하고 수익률을 극대화하기 위해 리스크를 감수하겠다는 전략으로 풀

If we assume that a long-term, sharp decline in the US stock market will proceed similarly to the 1929 Great Depression and make a similar comparison, we can also make the following predictions about its progress.

If a similar long-term decline of about 34 months before the end of 2028 occurs, the period from the end of 2021 to the beginning of 2026 will be left out. This is the "time lag" that I mentioned earlier, which those who advocate for another depression tend to overlook. This is the section marked with a black highlighter on the chart.

This intermediate "floating" period shown on the chart below is approximately four years. While it may not be a long period, it is generally a considerable length of time. Even holding a single stock for more than a year is considered "long-term investment rather than swing trading," and stock investors usually have an inherent sense of urgency. If the claim of an impending "Great Depression" is repeated for four years without any signs of it, people will inevitably ignore such claims.

Although this section is marked with a black highlighter on the chart below, those who are well-versed in the basic characteristics of the stock market will likely anticipate that this section is a neutral period where a major long-term bear market has not yet emerged, and the market will continue to fluctuate up and down.

In the case of such progress, I have described this predicted period in other articles as a "large-scale washing-out period" or a "high-priced play from a large-wave perspective (high-priced large box-range consolidation period)."

What we can vaguely predict about the US economy during this period is that "the US economy may continue to show a trend of seemingly deteriorating while somehow persevering for a considerable time." Reflect on and consider what you've seen in economic news and related videos about the US economy since 2022.

It's already September, so a few months will quickly pass, and it will soon be 2025. Time will surprisingly fly by.

Since the start of high interest rates in 2022, many individual investors are excitedly watching as the Federal Reserve is reportedly entering a period of rate cuts after a year-long period of rate freezes. Is that so...?

However, from my perspective of the technical and macro trends in the US stock market, I believe there is a slight possibility starting in 2025 and a very high possibility starting in 2026 of entering a negative long-term cycle.

I've occasionally mentioned the 'main stage of the Great Depression' in the past, referring to the period after this neutral black period. In other words, it refers to the point where the Fed's period of sustained high interest rates is definitively over, and interest rates begin to rapidly decline. (Although rate cuts are starting this September, I believe there is a high probability that there will only be a 50bp cut, followed by a considerable period of freezes, then later another cycle of continuous rate cuts.)

I pay close attention to the nuances of the words I use in my writing. For months, I've been discussing a long-term bearish outlook for the US stock market at this index level, but instead of using terms like "major bearish trend" or "long-term crash," I used "long-term high point theory." This was intentional, to convey the nuance that while further upward movement of the index seems unlikely, there's still some time before a major long-term decline sets in.

Due to the long-term bull market in Nasdaq and the recent excitement surrounding artificial intelligence, many believe this will lead to an even longer period of prosperity for Nasdaq, which is evident in many YouTube channels promoting long-term investment in leveraged ETFs such as TQQQ and SOXL, heavily weighted toward large-cap technology stocks.

You can probably guess what risks I foresee with this investment strategy, even though it has been successful up until now.

If, as expected, the global stock market is in dire straits around 2029, the real estate market, due to its inertia, will likely experience further downturn for several years.

Therefore, I find considerable merit in some of the speculation that the real estate market could experience its worst cycle from 2025 or 2026 to around 2032. This is a significant issue for those considering purchasing apartments.

This may seem like an unrealistic story to most, but I've offered it as a long-term topic to consider during the Chuseok holiday. :) An issue worth considering in the age of increasingly prevalent self-reliance economics...

Of course, the decision remains yours.

Comments0