- 파월 “미국 경제 강해…노동시장 하방 위험 적어”

- “미국 경제 유지되지 않을 이유 없어”“중립금리 찾기 위해 신중할 여유 생겨”▲제롬 파월 미국 연방준비제도(Fed·연준) 의장이 4일(현지시간) 딜북 서

.

For several weeks now, including at the recent FOMC press conference, Fed Chair Powell has repeatedly stated that 'the US economy remains strong. There is no need to rush further interest rate cuts...'.

This statement, coupled with the 'hawkish cut' at this FOMC meeting, resulted in a sharp decline in the US stock market on Wednesday, the day the FOMC statement was released.

Personally, I had thought that the sharp decline, marked by a long red candle on the US stock market the day before yesterday, would occur around the beginning of January, coinciding with the release of the non-farm payroll figures, but it seems that this large downward move happened sooner than expected.

I've been pondering Powell's repeated statement, "The US economy remains very strong." Is this sincere, or is it a kind of 'bluff' intended to further confuse investors? Whether it's sincere or not will retrospectively determine whether the beginning of a long-term bear market for global assets (stocks, real estate), including the US stock market, has begun.

My personal assessment, with a 65% probability, is that Chair Powell's recent statement is a 'bluff,' and that this FOMC meeting marks the beginning of this downturn.

A loophole? The remaining 34% probability suggests that Powell's assertion that the US economy remains strong is, from the current perspective, sincere; however, it is likely to last only a few months (the stock market as well).

If Powell's recent statement was a bluff disguised as a mistake, I think it's highly symmetrical to the statement "Current inflation is transitory," made in the latter half of 2021, which led to a missed opportunity for timely interest rate hikes and fueled inflation further.

Those of you who have been following my blog for a while will know that I've frequently argued for a long-term peak in the US stock market since the first half of this year. The idea was that once this peak appeared, it would take at least a decade or more to surpass it again.

However, I've wavered on whether a long-term bear market would begin immediately after the peak or with a longer time lag (about a year). Shortly after Trump's election victory in early November, I added the thought that 'it would likely begin without much of a lag.' The title of this post reflects that point.

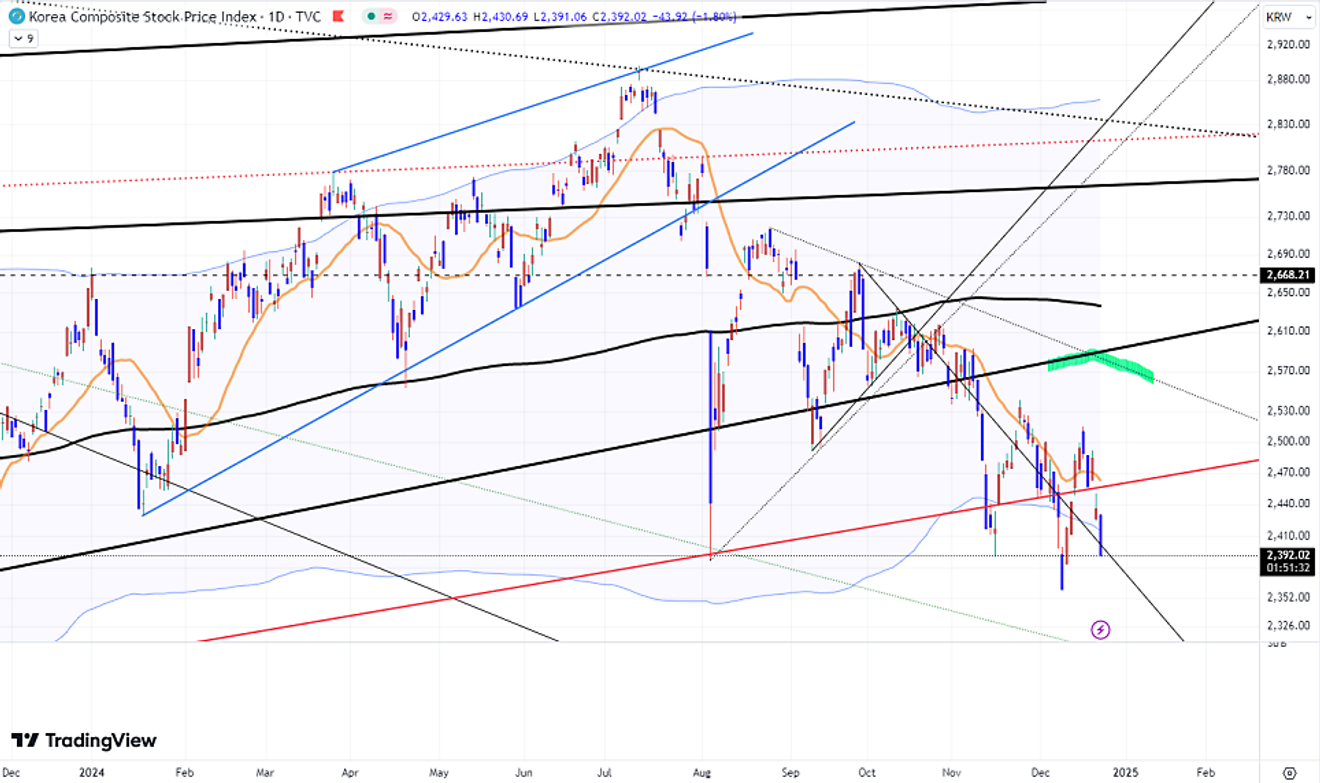

Below is a daily chart of the S&P 500 index for this year.

From a daily chart perspective, I've been observing market trends, estimating Point A as the 1st top and Point B as the 2nd top. Section C, I viewed as an 'extended wave driven by the Trump trade'.

The long red candle caused by the FOMC result the day before yesterday seems to have begun a trend in which Powell is forcibly ending? the Trump trade that continued after Trump's election victory.

S&P 500 Daily Chart

If the Trump trade were to continue in an extended wave form immediately after his election victory, not after his inauguration...it seems the US stock market has little intention of prolonging this. It appeared they would only drag it out until the end of the year before letting it fall.

That's why, even with the South Korean stock market, including KOSPI, halting Samsung Electronics' prolonged decline, leading to a year-end rally, I questioned whether this was entirely positive.

Looking at the US market from this perspective, shown in the S&P 500 chart above, it's understandable why Nvidia, the previous leader of the entire US stock market, has been showing a weak performance since July.

Looking at the S&P 500 and the three major indices alongside Nvidia's performance, we can infer that the period from July to the present has been a slow process of forming a peak over several months.

NVIDIA Daily Stock Chart

In terms of the KOSPI index, I mentioned that if a rally continues until the end of the year after Trump's election victory, it could reach the area marked in green below, but it would be difficult to go beyond that.

However, the recent declaration of martial law in South Korea broke this rally. I thought it might still have reached that point had this event not occurred, but now it seems more difficult...

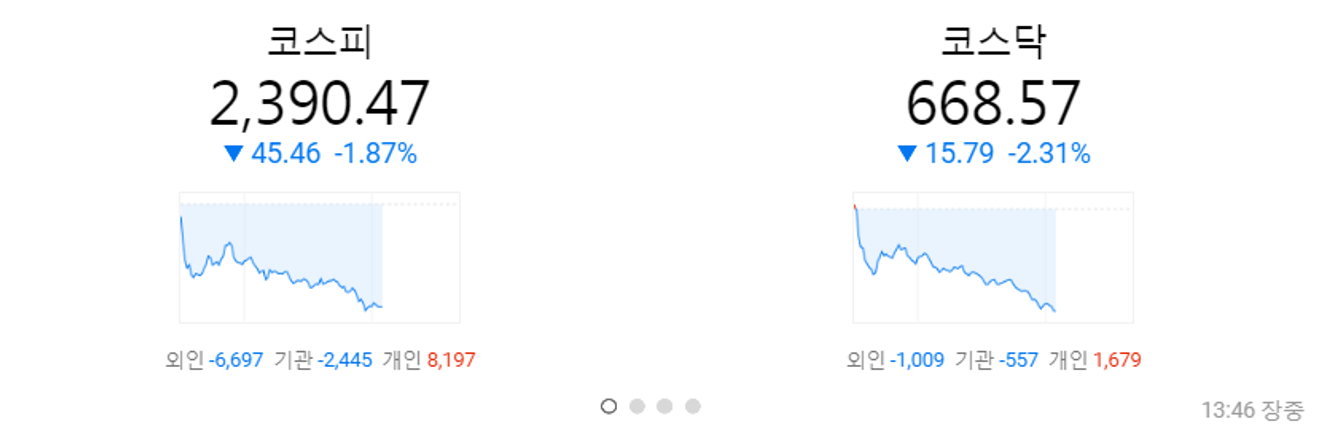

KOSPI Index Daily Chart

Foreigners continue their selling spree today, and individuals are absorbing almost all of it, leading to a continued downtrend.

Seeing this, I wonder if this isn't the right time for individuals to be buying.

Korean Stock Market (Intraday Trend)

Anyway, based on my 65% probability assessment, I suspect that a long-term bear market (or the main event of a Great Depression) for the global stock market, including the US stock market, has begun. The remaining 34% probability suggests this might happen a few months later.

Therefore, I believe we've entered a period where short-term trading focusing on "buy low, sell high" strategies during significant market drops is necessary for both the US and South Korean stock markets. It's no longer a 'Buy and Hold' market, but a 'Buy the dip, Sell the Rip' market.

I'm looking at the stock market in terms of 'several years.' The real estate market has more inertia than the stock market, so it would be 'several years + alpha.' I think we may need to look at the real estate (apartment) market until the early 2030s.

Even if the market fluctuates until the end of the year, we should be aware of whether stronger headwinds will begin to blow from the beginning of the new year.

The market's reaction after the FOMC meeting made it almost certain that there would be no rate cut at the next FOMC meeting in January. However, if the possibility of a January rate cut, which had been considered dead, unexpectedly resurfaces, we should view it with a suspicious eye.

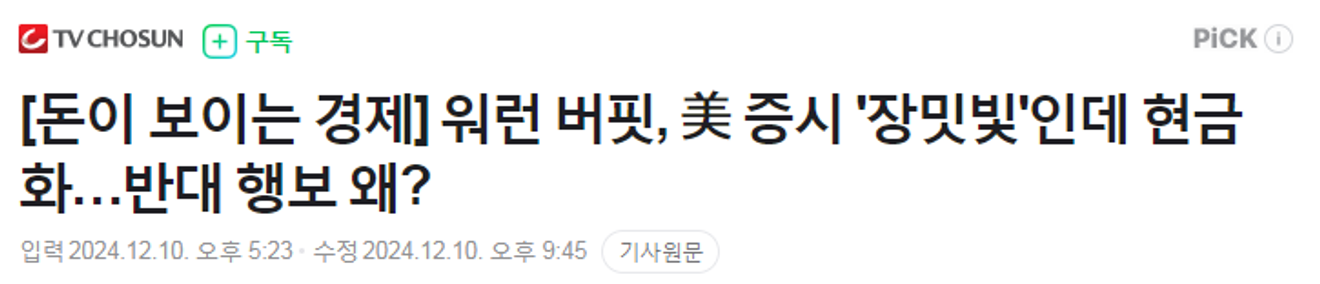

In relation to these issues, we should continue to monitor the quiet but unusual actions of Berkshire Hathaway, led by Warren Buffett, and ask ourselves why they are acting this way. We should pay close attention to 'asset protection' over a considerable period.

![[돈이 보이는 경제] 워런 버핏, 美 증시 '장밋빛'인데 현금화…반대 행보 왜?](https://imgnews.pstatic.net/image/448/2024/12/10/2024121090242_0_20241210214532771.jpg?type=w800?width=140&height=140)