- "여전히 부족"…비트코인 더 사는 마이크로스트레티지

- 비트코인 투자로 잘 알려진 글로벌 소프트웨어 기업 마이크로스트래티지가 전환사채 발행 규모를 늘려 비트코인 매입을 더 구매할 예정이라고 파이낸셜타임스가 20일(현지시간) 보도했다. 이날 마이크로스트래티지는 전환사채 발

.

These days, regardless of what anyone says, I think the best performing stocks since Donald Trump's election have been Bitcoin and related beneficiary stocks.

Looking at the price's daily chart, the most stable upward trend is Bitcoin itself, rather than related stocks, suggesting it is the most dominant stock.

Bitcoin Daily Chart

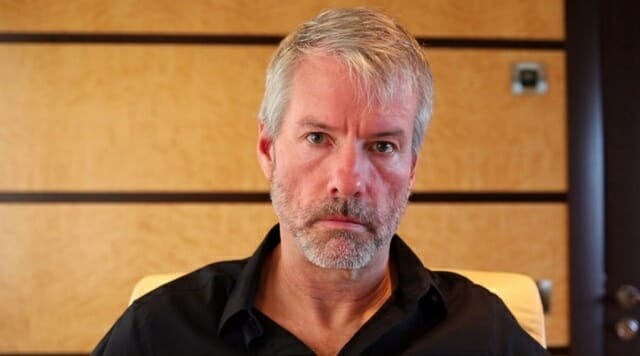

Among related stocks, the most volatile in the US is arguably MicroStrategy (MSTR), whose CEO is obsessed with Bitcoin.

Yesterday, various reports caused a significant drop of over 30% from the intraday high, creating a large bearish candle. Considering the chart's rise since September, the drop doesn't seem that significant despite the large bearish candle.

MSTR Daily Chart

News today shows that MicroStrategy's CEO is issuing more convertible bonds, claiming a Bitcoin shortage and the need for more. Haha.

This audacious CEO is accumulating Bitcoin as company assets, even taking on massive debt. The company seems to be completely reliant on Bitcoin's price movements, rather than its core business. All or nothing...?

MicroStrategy's performance shows its operating losses are increasing.

The company's stock price follows Bitcoin's price movements more than its business performance. Even if there are analysts for this company, it seems they should focus more on Bitcoin's prospects than the company's operating performance;

MSTR Earnings Trend

Recently, Bitcoin is surging again, benefiting from the Trump trade, and news of SEC Chair Gary Gensler's resignation announcement is further fueling the rally.

MicroStrategy's stock price has recently surpassed its all-time high since its initial public offering. Of course, thanks to Bitcoin...

MSTR Monthly Chart

Riding the surge, how high can Bitcoin go in this rally? This company's stock price seems highly sensitive to it.

Simply looking at the monthly chart, Bitcoin's price trend is as shown below. Will it reach the trendline above, not the $100,000 mentioned in recent news, but rather the $200,000-$300,000 range?

I often wonder if it's questionable over a period of 6 months or more, but it might be possible within 3 months or less (?)

This is because I think the US financial market is heading towards a climax. In the past, during such a spectacular final blaze, there have been occasional instances of explosive ‘animal spirits’ that would otherwise be unimaginable.

While the possibility of human manic behavior manifesting as speculation in the short term is quite high, the current situation seems unlikely to remain stagnant for a long time.

Bitcoin Monthly Chart

Comments0