- 'MSTR레버리지 ETF'에 2200억…서학개미의 위험한 베팅

- 국내 투자자들이 공매도 세력의 표적이 된 후 주가가 지지부진한 마이크로스트래티지(MSTR) 레버리지 상장지수펀드(ETF)를 대거 매집하고 있는 것으로 나타났다. 비트코인 수혜주로 분류되며 올 들어 460% 넘게 상승

.

Recently, I saw news that South Korean individual investors poured over 200 billion won into the "MSTR (MicroStrategy) Leverage ETF".

As most of you investing in the US market know, MSTR is a US company famously known for its CEO's aggressive investment in Bitcoin, using all the company's available funds.

While its main business is software development, it's become better known as a "Bitcoin investment company".

Therefore, since before the US presidential election, MSTR has experienced a tremendous surge as the possibility of Trump's victory increased, fully benefiting from the Trump trade. Naturally, during the short-term surge from September to November, the return rate of the 2x leverage ETF was incredibly high.

However, recently, it seems to be showing less strength than Bitcoin itself. This seems to be further influenced by news reports of increasing short-selling activities against the company.

MSTR Daily Chart

MSTX (MSTR 2x ETF) Daily Chart

However, as mentioned in the previous post, it's time to exercise caution regarding assets moving similarly to global stocks, taking a long-term perspective.

Even if there's a strong expectation that Bitcoin will benefit from the Trump administration, there's some doubt about whether it will show a completely different trend from the Nasdaq.

Following Chair Powell's statement in the latest FOMC meeting that he had never considered Bitcoin as a reserve asset, both the stock market and Bitcoin fluctuated. Looking at the daily chart below, the trend doesn't seem to have completely collapsed yet.

Bitcoin/USD Daily Chart

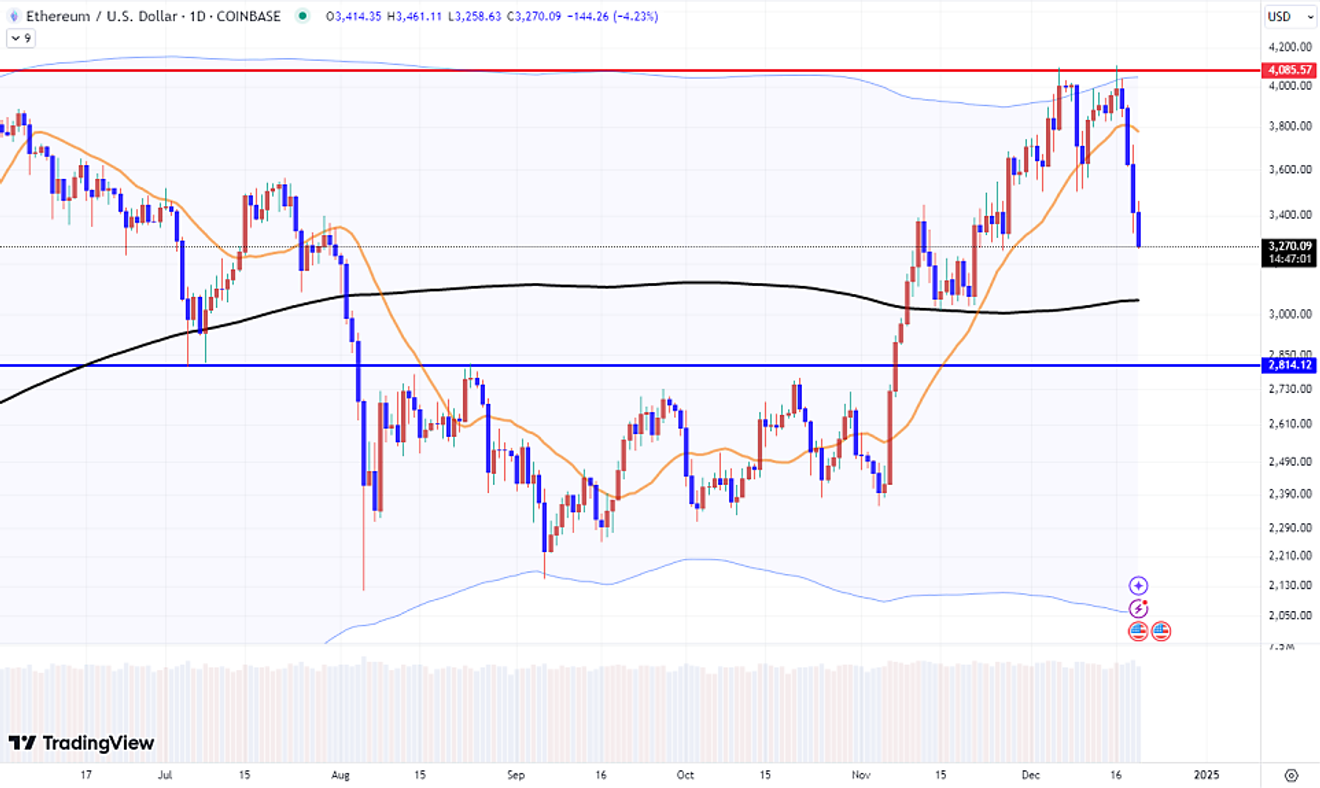

However, Ethereum, considered the leading altcoin with the second-largest market capitalization after Bitcoin, started showing signs of a collapsing chart yesterday.

While it's true that Bitcoin is stronger than other altcoins, including Ethereum, I'm somewhat skeptical about whether Bitcoin will move independently. It's a strong asset, so it's likely to follow suit, albeit slightly later.

Therefore, those who invested in MSTR or the MSTR leverage ETF based on Bitcoin's performance should prepare for the risk. Especially for those with MSTR leverage, I think considering a run is necessary.

Ethereum/USD Daily Chart