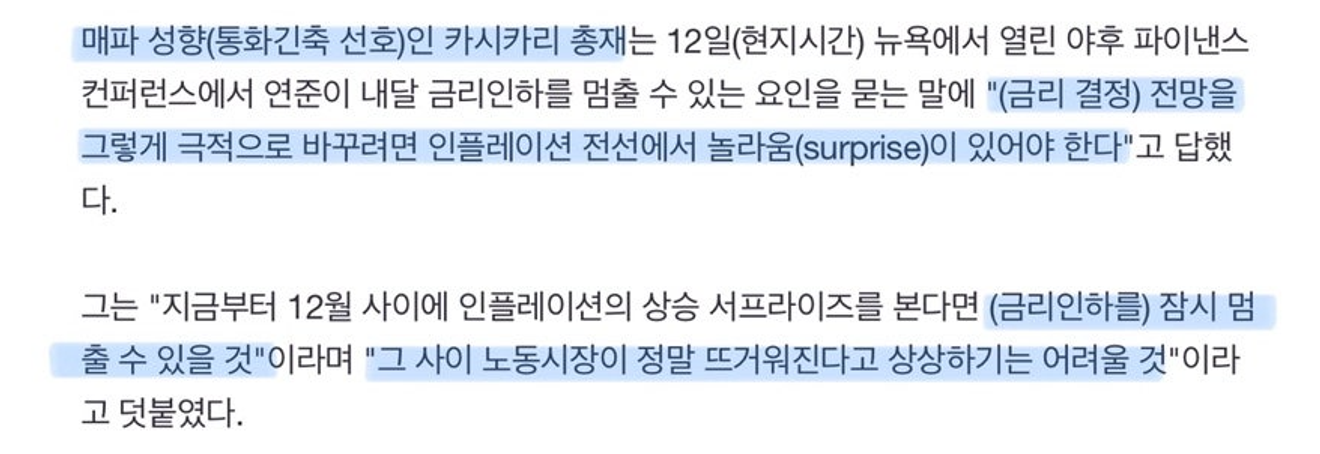

- 미국 금리 내달 추가인하? 연준 매파 위원 "동결요인은 인플레뿐"

- 카시카리 총재 "현재 통화정책은 약간 제한적" 닐 카시카리 미국 미니애폴리스 연방준비은행(연은) 총재는 다음달 연방준비제도(Fed·연준)가 금리를 내리지 않을 요인은 급격한 인플레이션뿐이라고 말했다. 매파 성향(통화

.

The prevailing view regarding the Fed's monetary policy until recently has been ‘soft landing + price stability’.

The US economy shows no signs of recession and is projected to be heading for a soft landing. This is combined with the expectation that inflation will gradually decline and stabilize.

Based on the expectation that inflation is entering a stabilization trend, even the traditionally hawkish members within the Fed are now showing a shift toward more dovish comments. The unanimous 25bp rate cut decision at the November FOMC meeting further supports this observation.

Following Trump's election victory, the probability of a rate cut at the December FOMC meeting has slightly decreased according to Fedwatch. Regarding this recent trend, Fed Governor Randal Quarles (a hawkish member) stated, as reported in the article below, that ‘for a December rate cut to be halted, there would need to be a surprise, such as a sudden jump in inflation.’

Unless surprisingly strong data emerges, this suggests a continued intention to pursue rate cuts. It's a rather unexpected comment from a hawkish member.

.

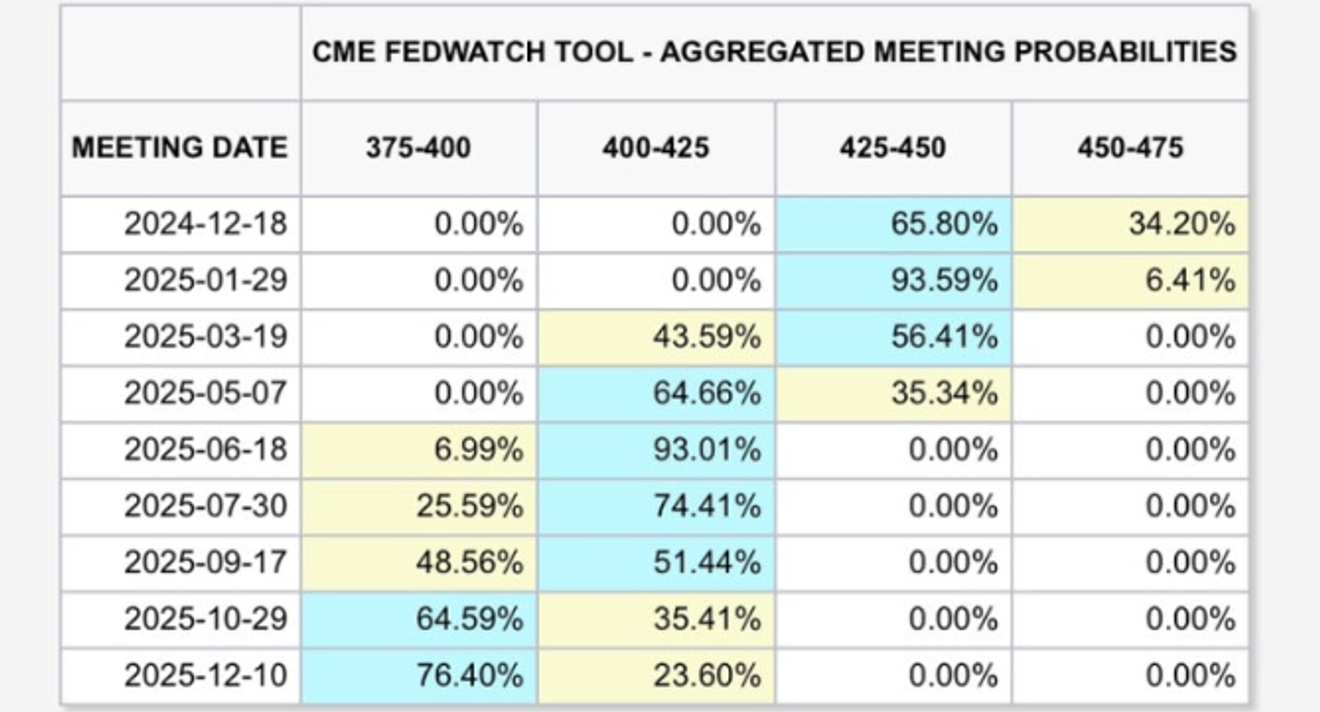

Currently, Fedwatch reflects three 25bp rate cuts by the end of next year, down from four recently.

Compared to the past, around the year-end, we usually see about 56 anticipated rate cuts for the following year. The current situation, which shows significantly fewer projected cuts, indicates a markedly different atmosphere from the past two years (2022-2023).

Of course, the news we typically see focuses on the narrative of ‘no apparent recession concerns, with stable inflation projections.’

Fedwatch

Since Trump's election win, 10-year Treasury yields and other long-term bond yields, which had previously surged, have started to hesitate. This raises questions about whether the previously touted narrative of concerns over expanding fiscal deficits still holds.

US10Y, daily

Meanwhile, as long-term bond yields hesitate, short-term 2-year yields are slowly rising. This might reflect some expectations, as seen in the Fedwatch table, that the Fed might pause after the December rate cut.

US02Y, daily

Looking at the recent price trend of gold, it raises doubts about whether the market is truly concerned about a resurgence of inflation due to fiscal deficits under the Trump administration.

As shown in the monthly long-term chart of gold below, gold has recently approached a significant long-term trend resistance line over the past few months. As the monthly chart shows, it remains near that level.

Gold, monthly

However, when zooming in to the daily chart, it seems a bit strange considering that the "Trump trade" should be strengthening.

While the recent sharp increases in Bitcoin and Tesla prices suggest the "Trump trade" is underway, the narrative of inflationary pressures from the expected fiscal deficits under the Trump administration, which was heavily discussed until recently, seems less evident.

Even now, immediately after Trump's election victory, the "Trump trade" is manifesting in other areas (Bitcoin, Tesla, etc.), yet inflationary concerns are not apparent in related market indicators.

We should consider whether the market is simply focusing on the expectation of inflation stabilization within a soft landing, or if it's anticipating a potential deflationary impact from a recession next year, contrary to the current trend.

Starting next year, the market will need to consider whether the concern should be inflation or, conversely, deflation.

Gold, daily

Comments0