Subject

- #Ecopro

- #Samsung Electronics

- #Stock Price Outlook

- #Supply-Demand Reversal

- #Stock Market

Created: 2024-10-28

Created: 2024-10-28 18:55

Today, U.S. index futures and Asian stock markets are generally showing signs of rebound.

Amidst the smooth flow of U.S. futures, including Nasdaq and S&P mini futures, our KOSPI and KOSDAQ indices are also continuing to rise significantly.

Following the mixed close of the U.S. stock market last Friday, the fact that the mini futures of all three major indices are currently rising on Monday is perhaps due to the news that came out around Saturday morning (Korean time). The news was less impactful than previously anticipated, leading to a short-term easing of geopolitical risks, which seems to be contributing to the rebound.

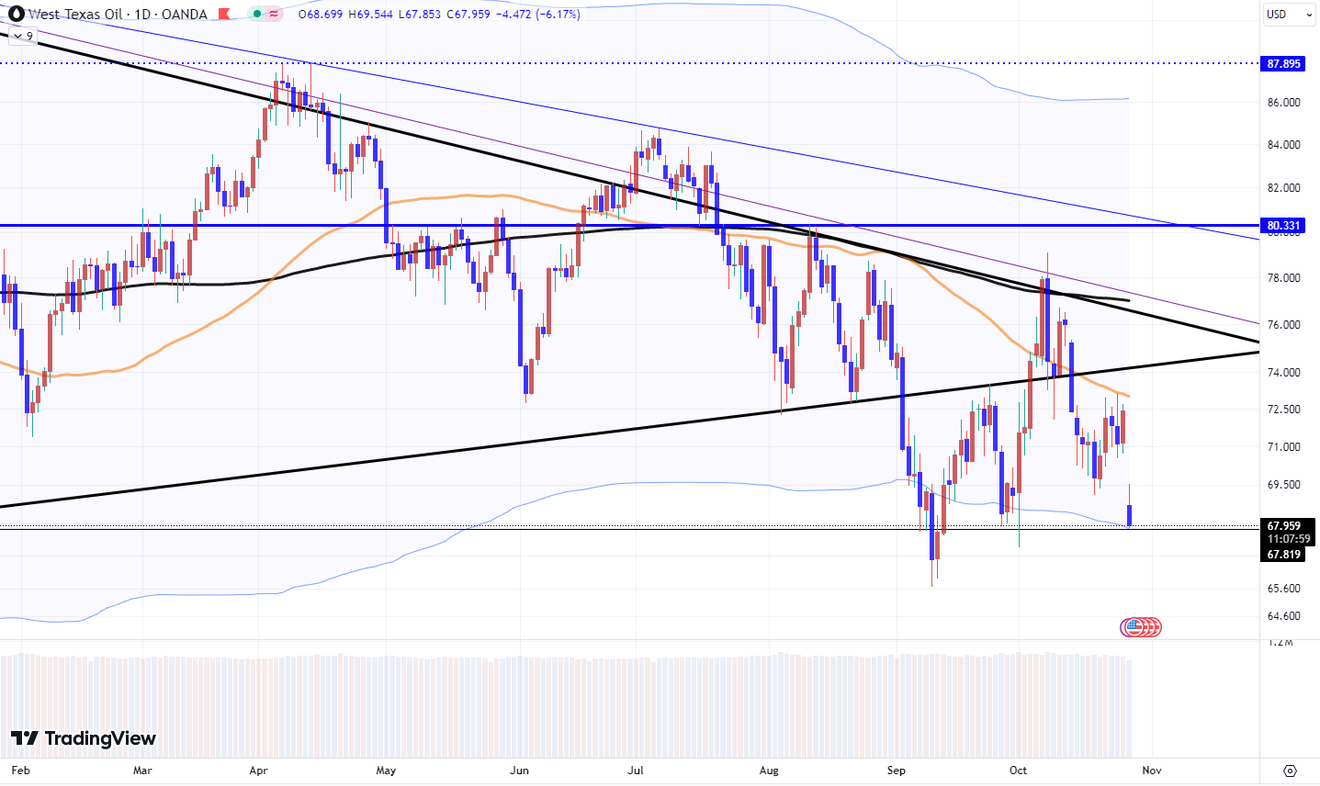

As a result of the news over the weekend and the subsequent reversal of hidden concerns, WTI oil prices are currently down more than -6% compared to the latter half of last week, while Asian stock markets are showing a rebound in relief.

WTI

Amidst the rebounding atmosphere in Asian markets, a distinctive feature is emerging in the domestic stock market. Stocks that have been tediously declining, causing people to lose hope, are showing a relatively stronger rebound than other stocks, creating a sense of reversal.

SK Hynix, which received positive reviews in its earnings announcement last week, is showing an unexpected decline today. On the other hand, Samsung Electronics, which had been consistently falling, is showing a sharp rebound of over 4%. The Ecopro brothers, who have not shown a continuous strong rebound since the middle of last year despite the significant drop, are also exhibiting a strong rebounding trend.

Looking at the stock price movements of these four stocks today, it seems that Samsung Electronics, Ecopro BM, and Ecopro, which have underperformed the KOSPI and KOSDAQ indices, are now shifting to outperform the indices. Of course, this is from a "relative to the index" perspective, not an absolute stock price increase perspective.

Below is the weekly chart of the KOSDAQ index. I still believe that the KOSDAQ index is on a path to fall below 500 points in the near future. If the KOSDAQ falls to that level, even if the KOSPI is relatively strong, it is likely to temporarily fall below 2000, potentially exceeding 2150 at some point.

The reason for this view is that I believe that around the time the Japanese and Korean stock markets, which fell first, appear to be bottoming out, the "Empire's (U.S. stock market) Strikes Back (?)" will begin in the U.S., further pushing down Asian stock markets.

KOSDAQ Composite Index Weekly Chart

The chart below shows the daily chart of Samsung Electronics. I've often mentioned that if Samsung Electronics reaches between 53,000 and 49,000 won, it should find a medium-term bottom around that level.

While the domestic composite indices still appear to be hanging in mid-air, Samsung Electronics' daily chart shows that if the past trend continues, it's already quite close. Seeing today's large rebound, I wonder if it's now time for Samsung Electronics to outperform the index relatively.

Of course, this doesn't mean that Samsung Electronics has bottomed out. Rather, it's the perspective that while Samsung Electronics has been declining on its own compared to the KOSPI and other stocks, the market is now changing to one where even if the KOSPI falls significantly, Samsung Electronics will perform relatively well with a moderate decline.

Samsung Electronics Stock Price Daily Chart

The weekly trend of Ecopro, which has been declining for a long time, is similar to the daily trend of Samsung Electronics.

It seems that the stock price is approaching a level where strong support is likely to emerge, but the KOSDAQ index, to which this stock belongs, still seems to have a lot of room to fall.

If Ecopro doesn't completely break down through the clustered support lines, I think it will now outperform the index and then, when the index bottoms out and rises again, it will be a good time to aim for a considerable rebound over a long period.

Ecopro Stock Price Weekly Chart

Lastly, here is the weekly chart of Ecopro BM. As it's related to Ecopro, it will likely follow a similar trend.

The next major support levels for Ecopro BM on the weekly chart are around 140,000 won and 90,000 won. Even if the KOSDAQ falls significantly, if it holds steady during the same period, it might be able to maintain support near the 140,000 won level.

Anyway... the domestic stock market still doesn't look good from the perspective of the composite index. However, signs of a reversal are starting to appear in stocks like Samsung Electronics and Ecopro, which until recently appeared to be the weakest in terms of supply and demand, at least from the perspective of relative stock price movements compared to other stocks. This is just a thought.

Ecopro BM Stock Price Weekly Chart

Comments0