Subject

- #Samsung Electronics

- #Stock Price Forecast

- #Investment Strategy

- #Economic Recession

- #SK hynix

Created: 2024-10-30

Updated: 2024-10-30

Created: 2024-10-30 21:24

Updated: 2024-10-30 22:37

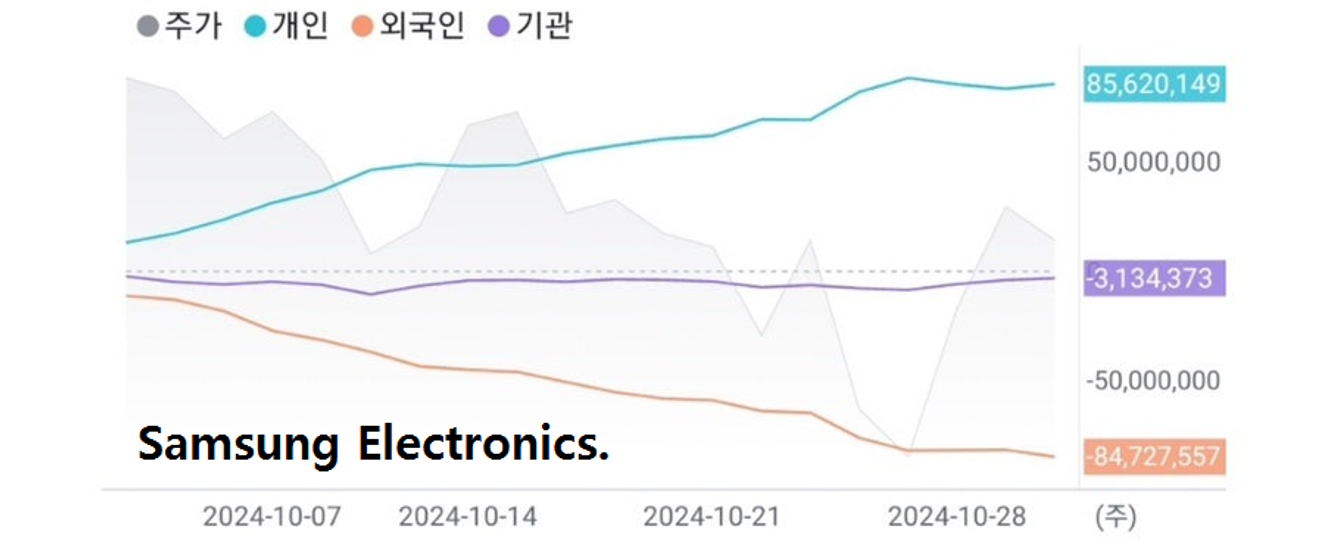

This week, starting Monday and Tuesday, signs of change began to appear in the supply and price of Samsung Electronics, the leading stock with the largest market capitalization in the domestic market.

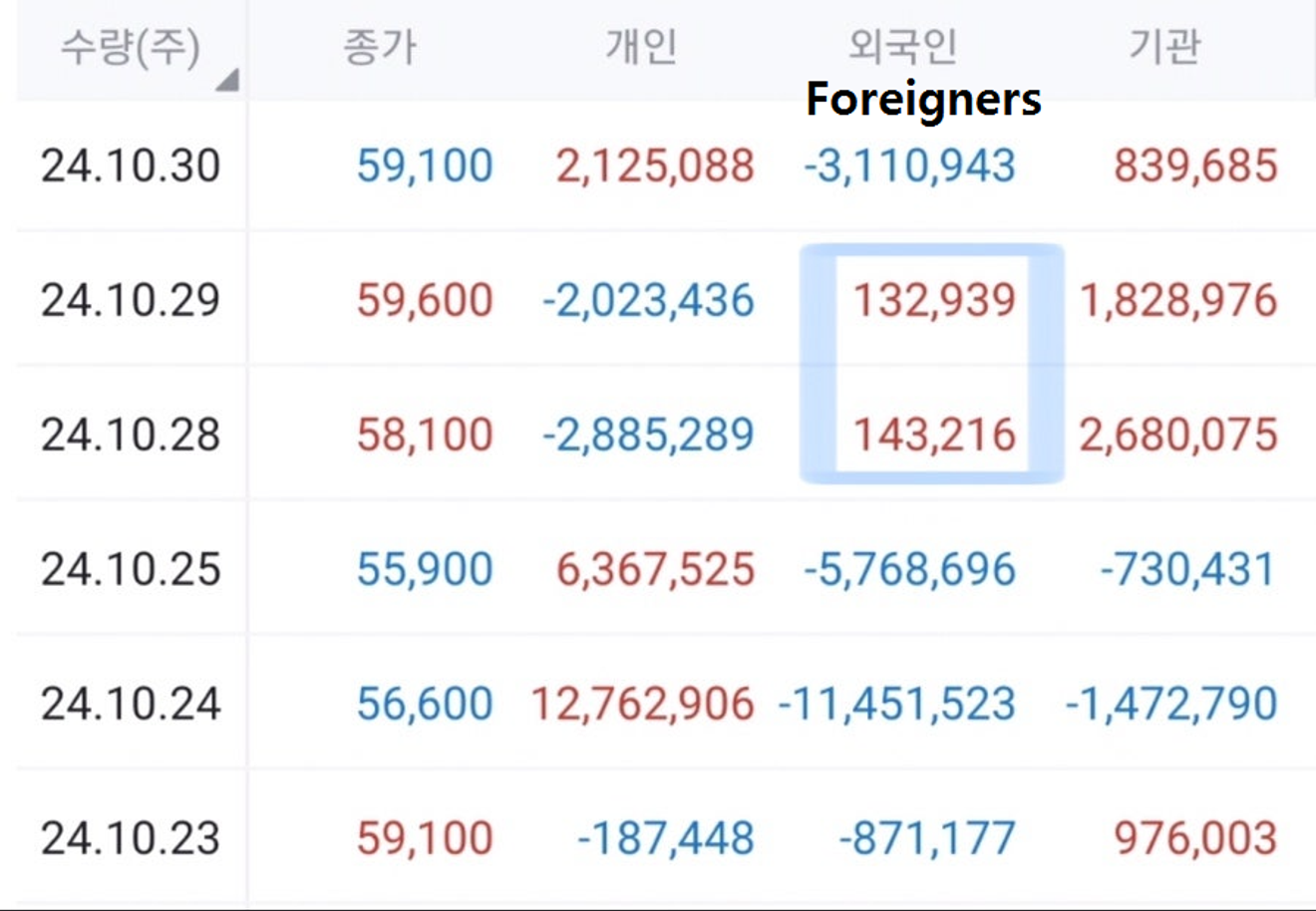

For two consecutive days, Monday and Tuesday, foreign investors started to net buy again, albeit not significantly, and domestic institutions followed suit with large-scale net purchases.

While the foreign net buying wasn't substantial compared to the prolonged period of net selling, it's noteworthy that this marked the first time since August 23rd that foreign investors showed two consecutive days of net buying.

This change in trend is even more significant considering that Thursday, October 31st, is the announcement date for Samsung Electronics' confirmed third-quarter earnings.

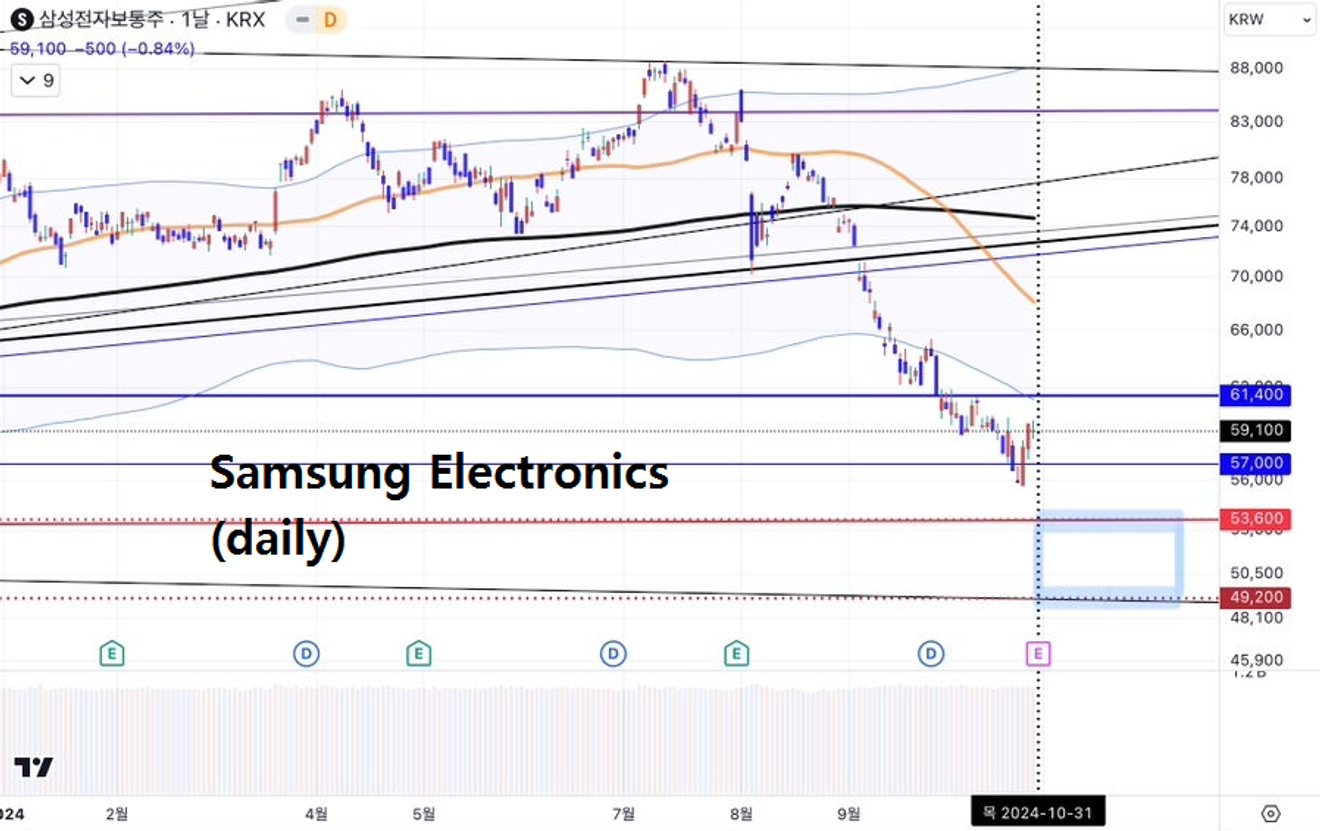

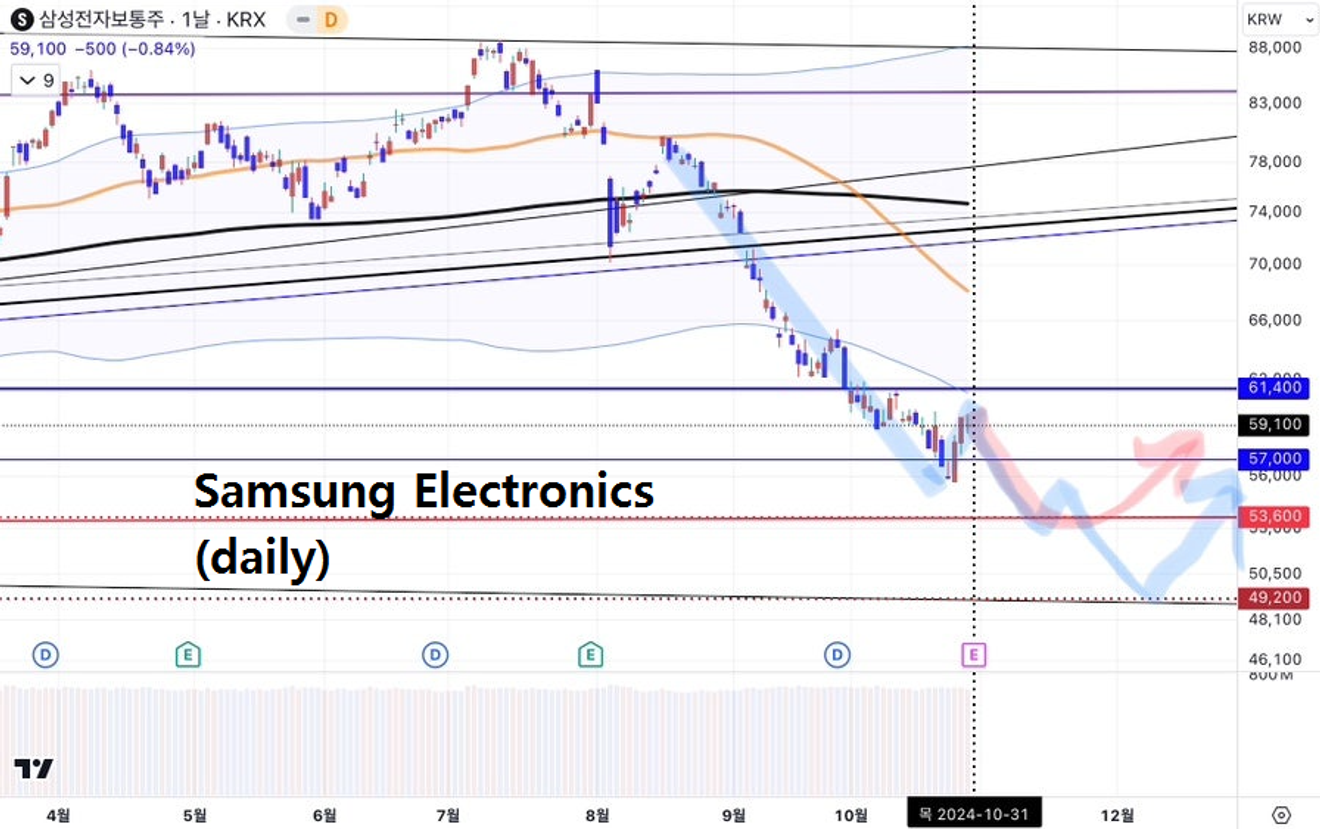

However, personally, I believe that the continuous decline in Samsung Electronics' stock price since early to mid-July has now begun to slow down, unlike other large-cap stocks (such as SK Hynix) that have held up better than Samsung. I've previously stated that strong price support is likely to appear only below 53,000 won.

Since Samsung Electronics' stock price has already fallen below 50,000 won, this expected support level is relatively close. Therefore, I expect the remaining decline to be relatively gradual.

If you're considering buying or adding to your Samsung Electronics holdings, it might be time to consider entry. However, instead of investing all at once, I recommend a gradual, phased approach over the next few weeks, observing the price trend.

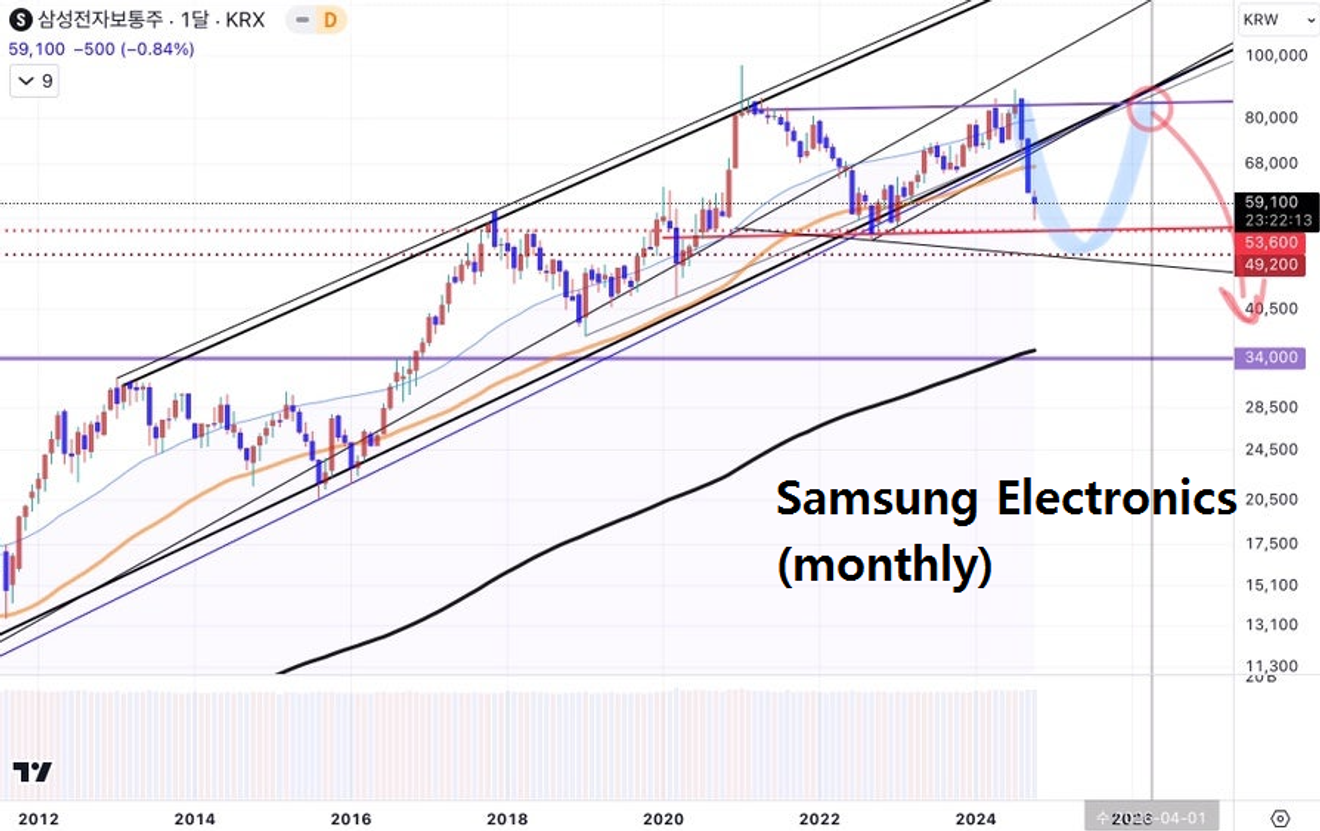

If the domestic stock market declines further, my outlook would depend on whether Samsung Electronics' stock price finds support around 53,000 won or falls to 49,000 won. However, I anticipate the stock price trend for Samsung Electronics over the next few months to a year to follow the pattern shown in the chart below.

If it finds support around the low 50,000 won range and starts to rebound, I expect it to rise back to around 80,000 won.

However, importantly, if it reaches that level, I believe it's time to sell off your Samsung Electronics shares in the medium to long term. If it climbs back to around 80,000 won in the long term, I'd suggest taking profits and exiting, rather than holding on hoping for a return to "100,000 won per share" and potentially facing "20,000 won or even 10,000 won per share" instead. That's my personal opinion...

In the short term, SK Hynix shows more weakness compared to Samsung Electronics; however, from a medium-term perspective, it still appears relatively stronger than Samsung.

Even if the KOSPI index declines due to market downturn, if SK Hynix's stock price holds around 140,000 won, it would indicate a stronger trend than Samsung Electronics.

Looking at the SK Hynix monthly chart, we see a shift in trend since 2021. It broke through the blue channel, slightly increased its upward angle, and transitioned to the red channel.

As shown in the daily chart above, even with further declines, if the price holds around 140,000 won, it will maintain a position to continue its strength.

As you can probably gather from the comments above on the Samsung Electronics stock price trend, this is naturally related to the outlook on the KOSPI index, given Samsung's significant weight in the index.

As shown in the KOSPI index monthly chart below, I observe that it will likely remain within the two upper and lower channel trendlines for a considerable period, including the present and future. One of the reasons I believe the KOSPI index will briefly fall below 2,000 points is this observation.

This trend is naturally linked to the US stock market. I view this prolonged period of movement within a large channel range (or "time lag") as the "preparation period for the Great Depression." (This perspective is not limited to Korea, but considers Korea's position within global developments.)

I have previously emphasized the need for caution regarding this "time lag" between the preparation period within this channel and the entry into the full-fledged Great Depression.

However, what's confusing is that these trends in global stock markets since mid-2021 are showing variations depending on each country's economic situation and outlook. Some are moving in an "upward or sideways box" (US, Europe), while relatively weaker economies like Korea are moving in a "downward box" as shown in the chart below.

From a real estate perspective, before this very long box (=time lag) created by the global financial market ends and the main game begins, real estate investors with excessive leverage should consider exiting early, considering the economic risks. Unlike the stock market, the real estate market doesn't allow for easy exit when things get bad.

Comments0