- Thoughts on the Market After the US Presidential Election [ft. Is the US Stock Market Peak a Little Further Ahead?]

- This article analyzes the changes in market outlook after the US presidential election. It states that the US stock market rose more than expected after Trump's election, and concerns about inflation are low. The author suggests that the US stock market

I noticed that the previous post I uploaded over the weekend (link below) received an unexpectedly high number of "like" clicks compared to other posts; I found this rather unusual.

The title was, "Several Thoughts on the Market's Short-to-Medium-Term Outlook After the US Presidential Election"... Why is this?

I wondered if perhaps some long-time readers of my blog, seeing only part of the title, might have misconstrued it as, "Their views have changed? So, since they previously talked about the Great Depression, etc., does this mean they now have a positive outlook on the stock market after the US election?" They might have clicked "like" without actually reading the content.

Of course, those who actually read the content would know it contains rather gloomy information.

Donald Trump has been confirmed as the 47th President of the United States. His inauguration is scheduled for January 20th of next year, marking a handover from current President Biden.

I have repeatedly stated that the Federal Reserve's sharp interest rate hikes since 2022 have, in a broader sense, already started to bring us into the sphere of influence of a potential repeat of the Great Depression-level global economic crisis that was anticipated in the 2020s.

The Federal Reserve's prolonged high-interest rate policy ("Higher for longer") since 2022 has begun to create small cracks in the massive debt that the US and the rest of the world accumulated after the financial crisis. However, I also believed that there would likely be a significant "lag" before this manifested as a long-term decline in asset markets such as stocks and real estate, a so-called "main game".

I thought it would take more time for a figure perfectly suited to this historical environment to reappear, and I mentioned "Trump's return" in a lighthearted note I wrote at the Netcon in 2022. This is because no one is more suited to leave a mark in history like the Great Depression than Trump.

For one, the person needs to be someone capable of drastically disrupting the global trade order, someone who could potentially halve global trade volume during their term, mirroring the Great Depression. The person also needs to be a political outsider, not part of the Washington establishment. And no one fits this description better than Trump.

Therefore, a part of my Great Depression theory was that the "main game" of the Great Depression-level crisis would begin and largely unfold under the next administration (presumably a Trump administration), not under the Biden administration.

Until last week, I thought that even if a Trump administration came to power, the main game wouldn't begin until about a year after his inauguration. However, the main point of my recent post was that it could be brought forward to around the time of his inauguration.

However, instead of the US stock market immediately hitting a ceiling at the current level as I had previously suggested, I changed my prediction to say that there might be a further strong surge in the market until early next year.

If a period of short-term jubilation appears in the US stock market, the long-term collapse signal could be significantly brought forward to start as early as the beginning of next year. This is why I revisited Warren Buffett's recent move to rapidly increase his cash holdings.

This is based on the US stock market. Looking at the domestic real estate (apartment) market, it's possible that South Korea is already inside the starting gate of the collapse phase.

Furthermore, while we don't know what will happen, the existing "US government debt ceiling" extension, which is set to expire in early January, is about to see both the Democratic and Republican parties in Congress move towards negotiations. If, before the new Congress convenes, the Democrats and anti-Trump Republicans in the Republican party join forces to block an increase in the debt ceiling, under the pretext of preventing a Trump administration from acting unilaterally, this could potentially create a temporary environment similar to the gold standard during the Great Depression.

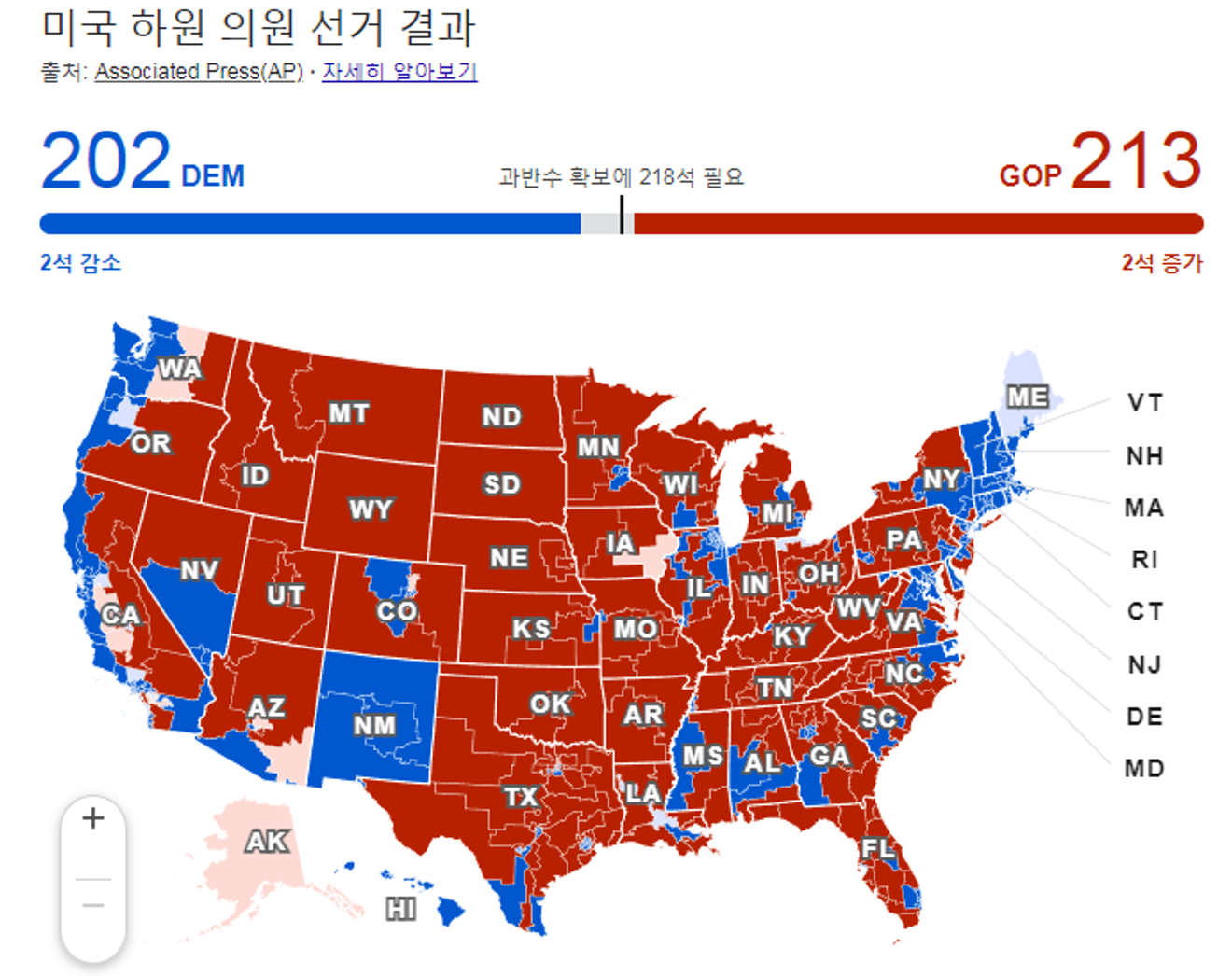

The House results haven't been finalized yet, so we'll have to wait and see. If the Republicans sweep the House, I suspect there may be unusual debt ceiling negotiations before Trump takes office.

US House Election Counting (still in progress)

The FOMC meeting last week was surprisingly quiet.

As expected, a 25bp rate cut was decided, but unlike the previous 50bp cut, which was followed by considerable noise regarding the reasons for the big cut, this time the decision was unanimous, and no one questioned whether the cuts were happening too quickly in succession.

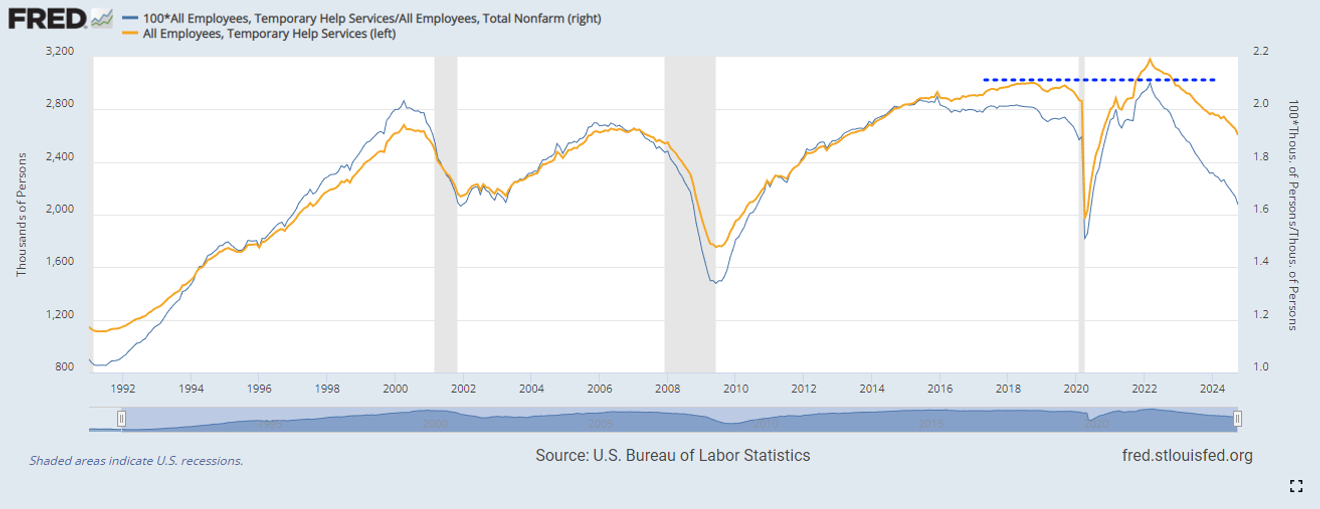

The graph below shows the trend of data for an item called "Temporary Help Services" in employment data.

At first, I didn't understand this service term, but after looking it up, I found out that it refers to "temporary staffing services of staffing agencies." In South Korea, this would show the trend of the number of "temporary workers" in the United States.

The yellow line shows the trend of the total number of temporary workers, and the black line shows the proportion [%] of temporary workers in the total number of employed persons.

It's not surprising that the number of temporary workers surged until mid-2022, because immediately after the pandemic, it became difficult for small and medium-sized enterprises to hire people directly, as more people stayed home until the pandemic subsided. They used temporary workers from staffing agencies instead.

And, as the pandemic subsided, it's not surprising that the number of temporary workers decreased from its peak as companies switched to hiring their own employees (regular, contract, etc.).

However, both the absolute number and the proportion of temporary workers in the total number of employed persons have recently declined sharply.

Temporary Help Services

But does this mean that since 2022 companies have strongly favored hiring regular employees instead of temporary workers? That doesn't seem to be the case. I haven't heard of any recent legislation in the United States promoting an increase in the proportion of regular employees in the US, which prioritizes a flexible employment environment.

Those who have worked in companies will know that, even in South Korea, temporary workers are the most vulnerable group of employees. Next come contract workers, then regular employees.

If a company's situation deteriorates slightly, it is likely to reduce its temporary workers first, as they are temporary and essentially external workers. This trend is becoming more pronounced recently, so the proportion of temporary workers in the total number of employees is falling sharply.

What I'm trying to say with this example data is that the recent deterioration of US employment data is being accepted by the market as being due to temporary factors such as hurricanes and strikes. However, in the data to be released over the next two or three months, we will check whether this is true or whether the hurricanes have masked the truth.

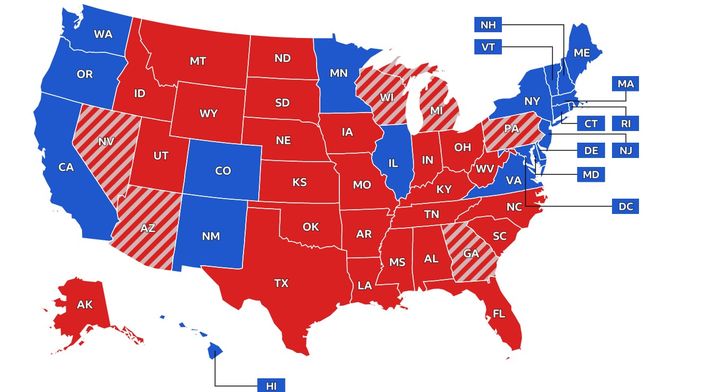

Fedwatch

As shown in the screenshot above, the Fedwatch shows that the market is expecting three 25bp rate cuts by the end of next year, including December this year.

This is quite different from the past, when the market usually made a lot of noise towards the end of the year, expecting "sharp cuts of around five times the next year." Now, it seems that the market has largely adopted the "soft landing" theory.

The market's excitement over the scale and speed of rate cuts has subsided.

However, why do I feel that the actual rate cuts next year will be much larger than the predictions shown in the Fedwatch futures market? I think this question is the essence of what Moon Hong-cheol, team leader at DB Financial Investment, argued in the video I attached at the end of my previous post.

Comments0