- “내년 대폭락…엔비디아 주식 98% 떨어진다”美 해리 덴트 전망

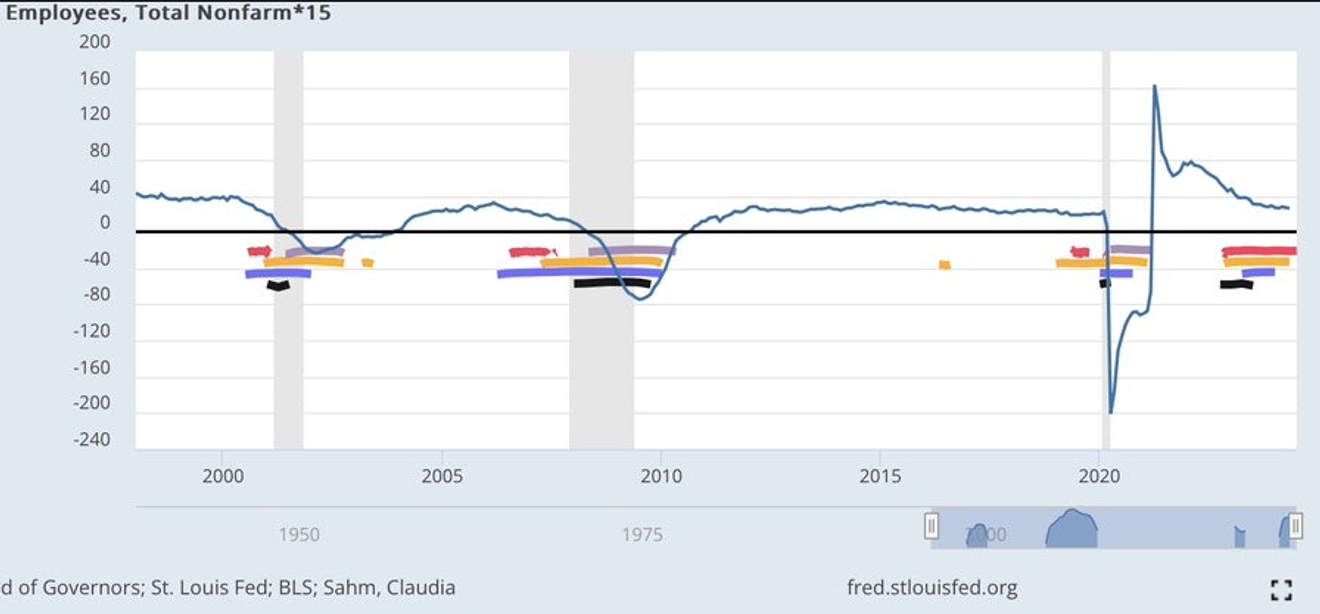

- 해리 덴트, 폭스비즈니스와의 인터뷰 “거품 14년간 지속”…대공황 넘는 대폭락 예고 “엔비디아 주가가 98% 떨어질 것이다. 나스닥은 92% 하락한다.” 미국 경제학자이자 ‘인구절벽’ 저자로 알려진 해리 덴트가 내년

(Continued from Part 1)

Lately, I've been intermittently issuing warnings about a long-term peak in the US stock market, a seemingly out-of-the-blue prediction that's garnered some strange looks.

Even considering the current US stock market, armed with the revolutionary technology of artificial intelligence, it's still risky to have an unwavering belief in the long-term upward trend of the US stock market index (market), at least from the perspective of the overall market index; this may not apply at the individual stock level.

I mentioned earlier that the most important point is 'why did that index stop right there at the beginning of 2022?'

I believe it will become a very significant resistance line, and if it is broken, but later proves to be temporary, it will be a very important point.

Below is the frequently viewed S&P 500 index.

The next chart is of the SPXEW, an equal-weighted index that represents the equal-weighted average of the S&P 500 constituents.

Unlike the regular S&P 500 index, which is market-cap weighted, the SPXEW appears to have been consistently encountering resistance near the peak of early 2022.

The next chart is an ETF that tracks the MSCI USA Equal Weighted Index, which broadens the scope from 500 large-cap stocks to include some mid-cap stocks, using an equal-weighted approach.

By broadening the range of included stocks, it's even clearer than the SPXEW above that the index is still being held back by the previous high.

This suggests that the outperformance of the market-cap weighted S&P 500 index is due to the influence of a few big tech companies.

From a perspective excluding these big tech companies, it shows that "other stocks have, on average, mostly stopped rising after hitting the peak in early 2022."

Those who believe the market will continue to rise will say that "big tech will soon take a breather, and the momentum will shift to other stocks, leading to a rotation."

However, I predict that if big tech takes a break, it won't lead to a rotation into other stocks; instead, everything will come to a standstill for a while.

The current situation, having broken through the significant early 2022 high, could very well become a long-term peak if the index were to fall back below this level later. This is because that would indicate that the previous surge was temporary.

However, even if this scenario unfolds, I don't believe we're at the beginning of this phase yet, and I don't expect an immediate sharp downturn. I simply anticipate that the market will soon push back strongly at this level, signaling it has reached its limit.

Monitoring US macroeconomic indicators serves to check if the scenario predicted by these market indicators is unfolding in a similar direction. A plausibility check, if you will.

So far, I believe US economic indicators are supporting my predictions.

It seems that real economic indicators are being controlled, postponed, and then unleashed all at once.

I previously shared an interview article about Harry Dent, an eccentric American economist.

He predicted that Nvidia would fall by 98% from its peak by next year, and that the Nasdaq would fall by 92%...

Most YouTube videos mentioning this claim dismissed it as "absurd and nonsensical," hardly worth discussing beyond a bit of amusement. Lol.

However, disregarding the timing and some degree of difference, it aligns surprisingly well with my prediction for the late 2020s, at least from a stock market perspective.

I've shared some of these thoughts on other blogs, but outside of the Nepcon channel subscribers, there seems to be some confusion as to why I'm making these seemingly out-of-the-blue statements. So, I thought I'd share a bit of my reasoning.

Some of this has been mentioned in previous blog posts... Anyway, that's it.

It sounds absolutely absurd, doesn't it? Lol.

Whether this proves to be completely unfounded or a chillingly accurate prediction, we should have a better idea in a few months. Currently, I'm closely observing the "concerns about the possibility of a bear steepening" issue.

Comments0