- 미국 연준, QT 언제 어떻게 되돌릴까···"섣부른 기대 금물"

- [오피니언뉴스=이상석 기자] 미국 연방준비제도(Fed·연준)가 양적 긴축(QT) 프로그램을 곧 축소하거나 심지어 종료할 것이란 전망이 시장에서 점차 당연하게 회자하는 가운데 좀 더 신중해야 한다는 전문가 경고가 나왔다.연준의 12월 연방공개시장위원회(FOMC) 이달초 의사록이 공개되고 로리 로건 댈러스 연방준비은행 총재가 대차대조표 축소 속도를 늦추는 것에 대해 언급한 이후 시장이 연준의 QT 임무 완수 선언에 대해 진지하게 받아들이기 시작했다고 마켓워치는 24일(현지시간) 전했다.의사록에서 연준의 여러 위원은 대차대조표 축소 속도

Recently, while browsing the internet, I came across some opinions regarding the possibility of a repeat of the early 2023 SVB (Silicon Valley Bank) crisis, or a similar regional banking crisis, in the near future, based on the flow of US reserves. I briefly examined these opinions and considered them.

To conclude, my personal opinion is that ‘it won't happen in the next few months, and even if it does, it will likely occur after some time has passed.’

To understand why this concern is arising, we need to examine the ‘Lowest comfortable Level Of Reserves,’ or LcLOR, which represents the minimum reserve level required for the stability of the banking sector.

As shown in the news article below, the Fed discusses the minimum total reserves (Reserves) that must be maintained to ensure the systemic stability of the US banking sector. This is not a fixed theoretical level, but rather a somewhat ‘conceptual level.’

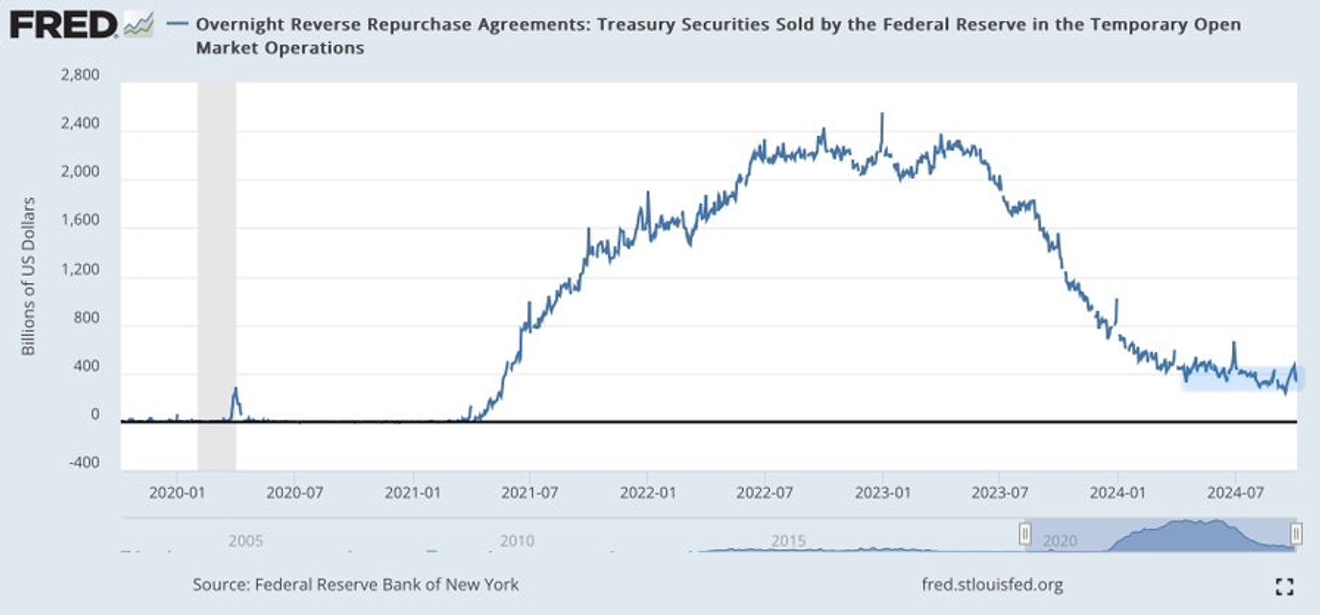

Below is the trend of the Fed’s overnight reverse repurchase agreements (ON RRP) balance over the past five years. The ON RRP balance, which reached a maximum of approximately $2.4 trillion during 2022-2023, has been steadily declining. It served as a short-term measure to bolster liquidity in the US financial market, but since mid-year, it has been fluctuating around $400 billion.

Similar to how individual checking account balances typically don't drop to zero unless in extreme circumstances, but maintain a minimum level, the Fed’s ON RRP balance, as long as the reverse repo account isn't closed, is likely to have a floor around this level, with only minor fluctuations.

In other words, while there are still substantial ON RRP balances, this balance has largely played its role in replenishing reserves, and its impact may be diminishing.

Nevertheless, despite the monthly decrease, the Fed's quantitative tightening (QT) continues. This means that the reduction in reserves due to quantitative tightening is ongoing and regular.

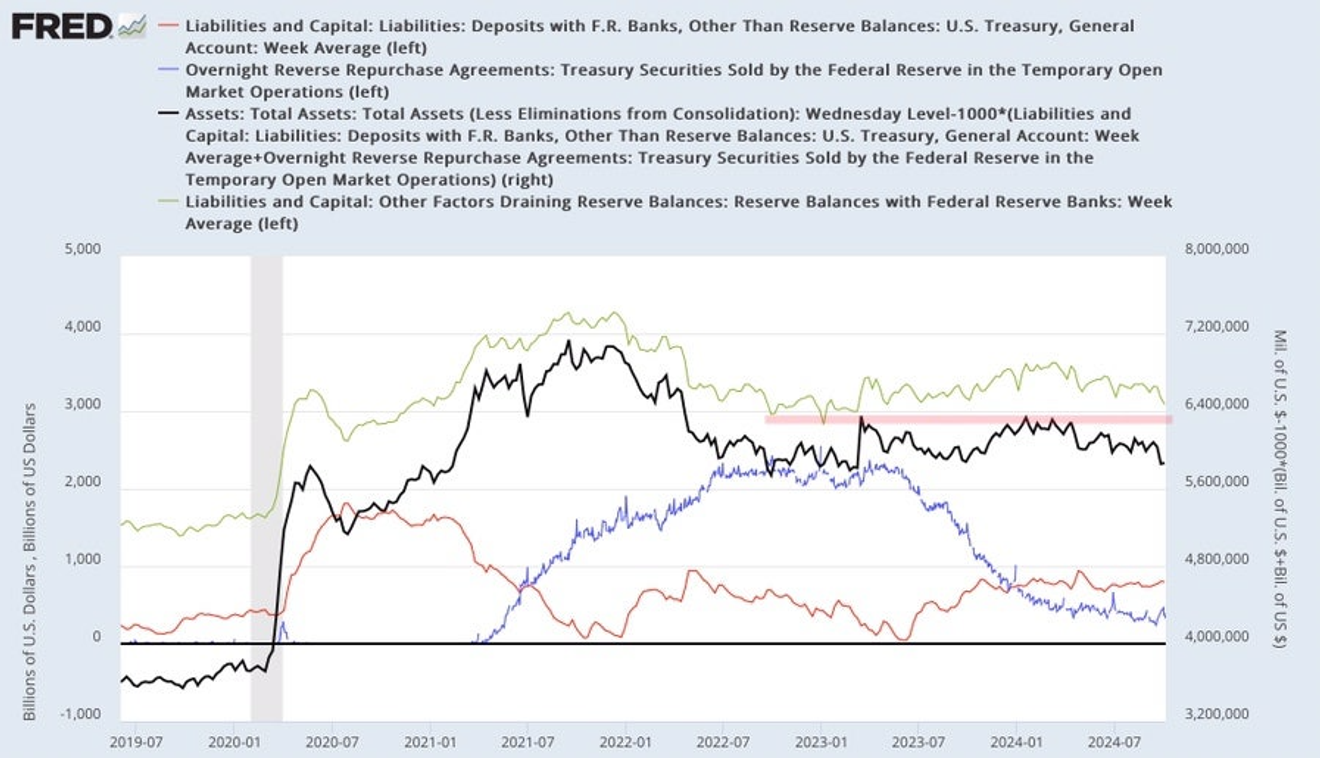

Looking at the chart below related to the trend of the Fed's liability accounts, the flow of total reserves in the banking sector (shown in green) indicates that the outflow of ON RRP balances has slowed down in recent months. This is further reduced after the corporate tax payment period in September.

If this situation continues without a significant increase in government spending through TGA (Treasury General Account) balances, reserves could gradually decrease to around $3 trillion or even temporarily fall below that level.

This is based on the current trend. The regional bank crisis of early last year suggests that the appropriate LcLOR is approximately $3 trillion. Conceptually, this is roughly 10% of the US GDP. Falling below this level could lead to a repeat of the regional bank crisis last year.

Therefore, observing the current reserve trend, one might think that a banking sector crisis could occur within a few months if this continues.

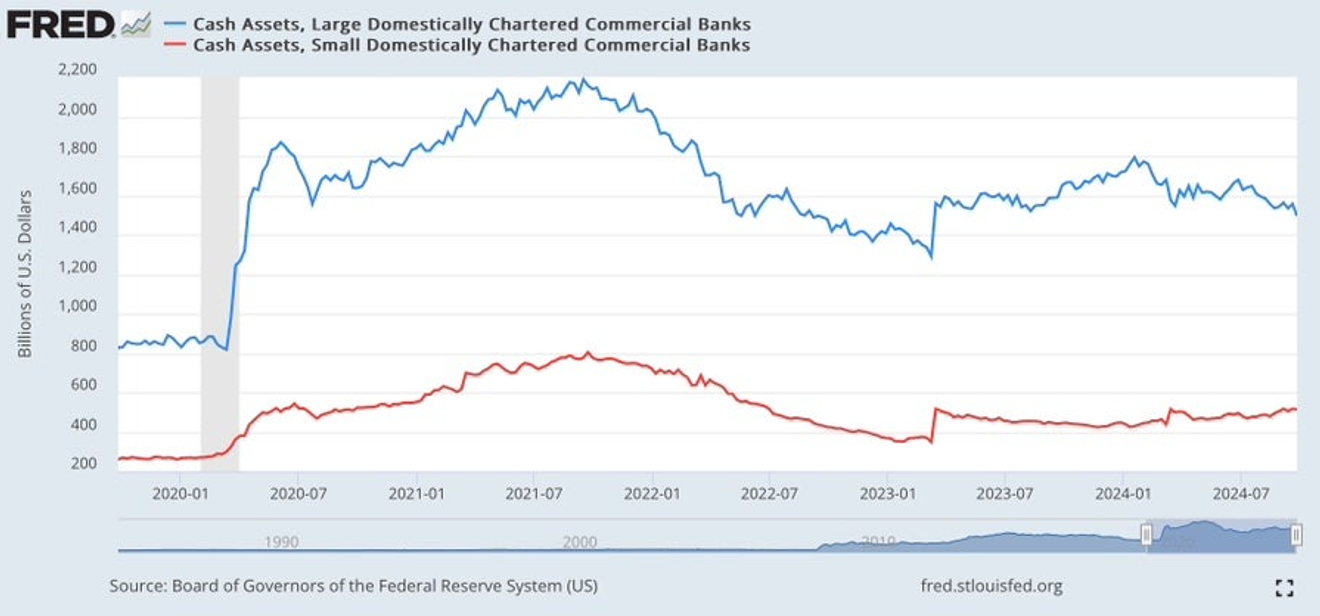

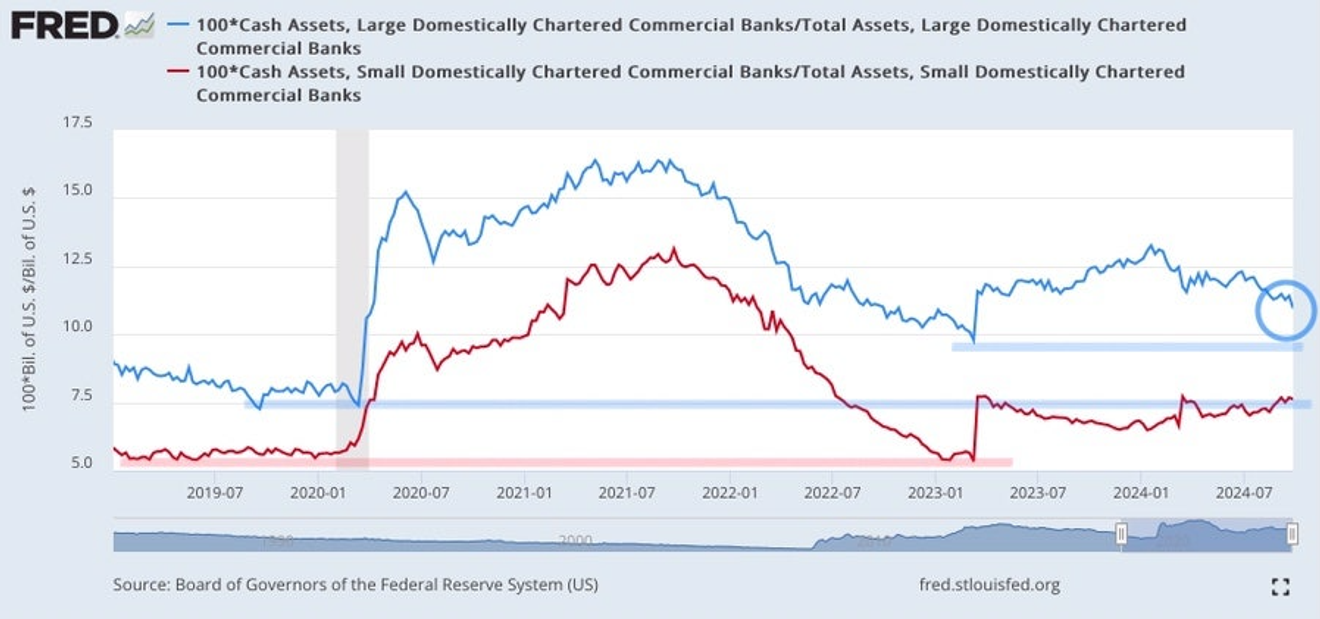

Below is a chart showing the trend of reserves (cash) for large and small banks in the US. This shows that the recent decrease in total reserves is due to large banks.

Looking at the trend of reserves for large banks (blue), the reserve level was higher in early 2023 during the regional bank crisis than in 2019 during the repo market crisis. Although it has decreased slightly recently, the current level is still higher than during the regional bank crisis.

The trend for small banks (red) is similar. However, unlike large banks, the reserves of small banks have been slightly increasing in recent months.

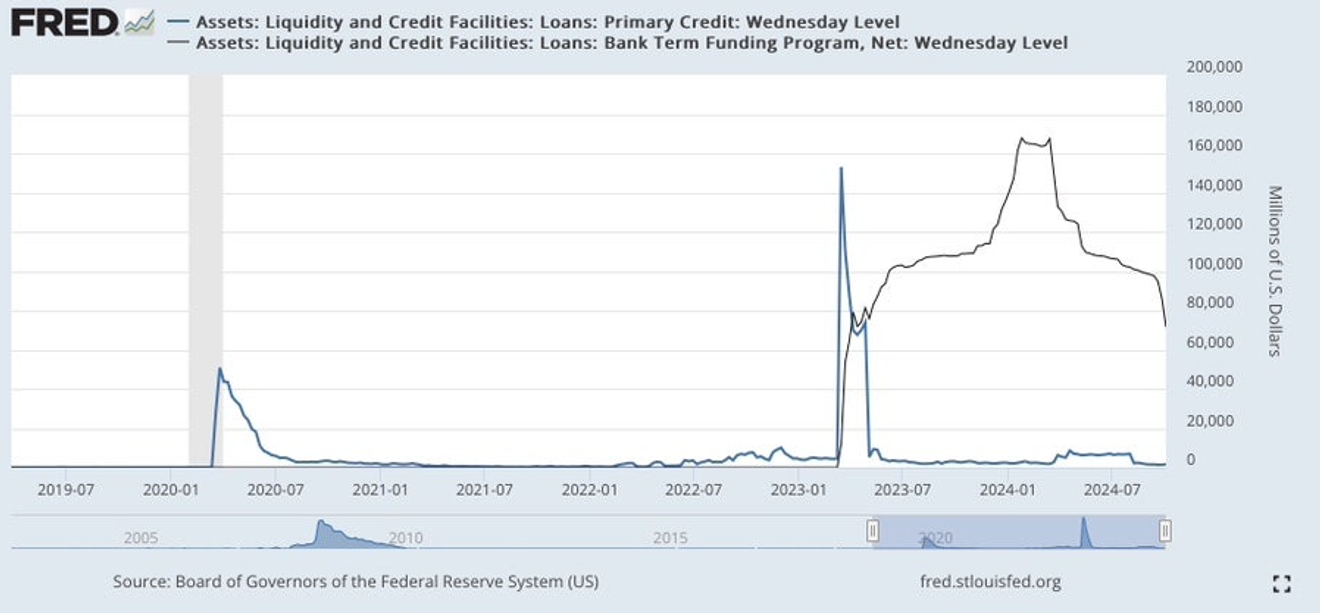

However, the recent decrease in reserves in the banking sector, primarily among large banks, seems less likely to be due to a slow bank run caused by problems within large banks. Instead, it appears to be largely due to the reduction in existing external borrowings, such as the decrease in BTFP (Bank Term Funding Program) borrowings.

Rather than indicating a problem, it seems that large banks are simply repaying the BTFP loans as they mature, or they are prepaying them because continuing to hold them offers no further benefit (unlike a few months ago, when there were discussions of risk-free arbitrage profits from BTFP loans).

Looking at the trend of total reserves by bank size, banking crises occurred in 2019 and 2023. However, the scale of reserves was also larger in each period, possibly due to the increase in GDP size.

Therefore, I think it might be more convenient to look at the ‘ratio of total assets’ rather than the total amount to determine if the reserve level is problematic for the banking sector.

Below is a chart showing the trend of the ratio of reserves (cash) to total assets for large and small banks.

For large banks, this ratio was higher in 2023 than in 2019 (hence, there were no major problems with large banks during the regional bank crisis), and it is currently higher than during the 2023 regional bank crisis.

Although the reserves of large banks have decreased somewhat in recent months, it's unlikely that a widespread problem among large banks will occur unless it drops to the levels seen during the 2019 repo market crisis. Individual bank issues might arise, but not a systemic crisis.

Small banks experienced a regional banking crisis shortly after their cash/total asset ratio dropped to 2019 levels in early 2023. This suggests that if this ratio falls to the 2019 and 2023 crisis levels again, there is a high probability of another crisis.

Currently, small banks’ cash/total asset ratio has remained relatively stable since the early 2023 regional bank crisis, thanks to the funds provided by the Fed through the BTFP and the discount window (mostly BTFP). Therefore, there seem to be no major problems currently.

However, considering that the BTFP loans are scheduled to mature around March 2025, a temporary banking crisis centered on small banks could reoccur around that time. However, if a crisis does occur, it will likely be addressed by the Fed, as the core issue is still unrealized losses on government bonds, not problems with loan assets.

In the short term, there appear to be no major problems in the US banking sector. Even if a problem occurs temporarily, it might cause some instability around March next year when the BTFP matures. However, for now, the focus should be on Israel’s actions rather than the risk of a financial crisis.

However, if problems arise beyond unrealized losses on securities like Treasury bonds and MBS (mortgage-backed securities) that the Fed considers safe assets—for example, problems with loan assets—the situation for those banks could change significantly.

Perhaps, as more time passes with persistently high interest rates, problems might materialize with commercial real estate (CRE) loans?

The commercial real estate price index (CPPI) below shows that prices have fallen significantly due to the Fed’s recent shift towards rate cuts, and are now rebounding slightly due to expectations of further rate cuts. For commercial real estate to recover, rapid and continuous rate cuts are necessary.

Conversely, if rate cuts are hindered or stopped, problems could arise, potentially leading to a renewed decline. If this problem becomes widespread, it could trigger a financial crisis similar to the 1990 savings and loan crisis, mainly affecting small and regional banks. However, for this to become a major issue, more time—perhaps until the latter half of next year—would be required.

Considering these trends, I believe that risks to the US banking sector will not materialize in the short term. For now, however, greater attention should be paid to Israel's volatile actions.

Rather than the risk of a financial crisis, we should be more concerned about the risk of prolonged high interest rates.

Comments0