- 주식투자를 위한 금융시장 추적기 : 네이버 프리미엄콘텐츠

- Top-down 형 투자자 대상의 경제 관련 시장지표와 통계지표 분석을 통한 미국 중심의 시장 이야기 (종목추천 등 유사투자자문 행위 아님) - 2025~2028 세계 경제 대공황론 현실화 가능성에 대응하는 시장 브리핑. 블로그 '시장은 항상 옳더라(/gupsin)' 필자가 운영하는 프리미엄콘텐츠 채널 // ※ 본 채널은 퀀트적 관점에서의 탐색을 위한 일부 포스팅 외에는 개별 종목들의 추천/분석과는 거리가 있는 경제/투자 채널이므로 착오 없으시기 바랍니다. (*착오 구독에 유의)

.

If a full-blown Great Depression cycle begins this year, I believe it will be a deliberately orchestrated flow "by US finance".

The US-China power struggle, or US hegemony, or "shearing the sheep"... everything is intertwined in this picture.

The long-term upward cycle of the US stock market index, which began in March 2009, immediately after the global financial crisis, likely reached its peak sometime between November and December last year.

Now, the question is whether the downward trend will begin in January and continue through the first half of the year, or whether it will continue in a narrow range before beginning in the second half of the year around this summer. That's the crossroads we seem to be at.

If it starts in January as it currently appears, and the US stock market (S&P 500) follows a trajectory similar to the one below, I personally believe that "the game has begun" with a very high probability.

S&P 500, daily

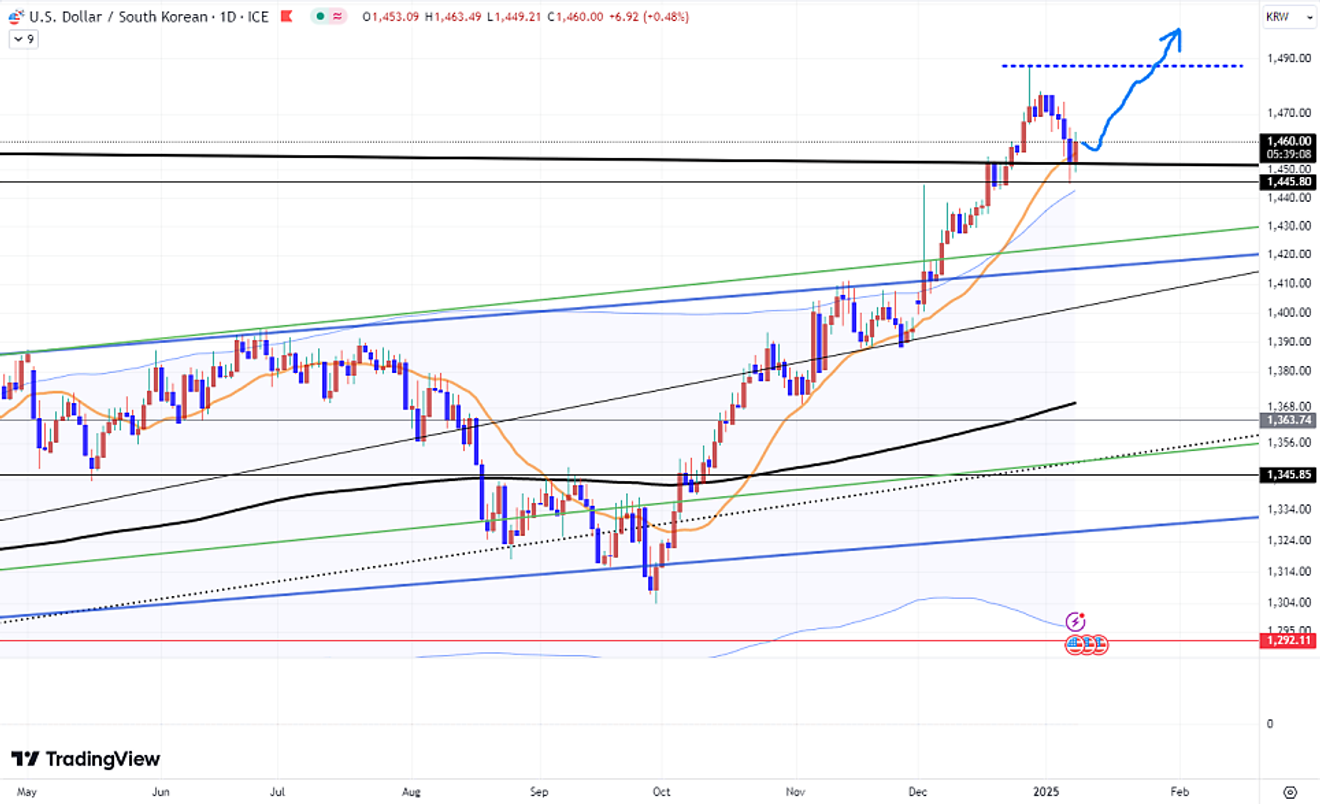

If the US stock market follows this trajectory in the first half of the year, I believe the won-dollar exchange rate will easily surpass the previous high of 1487 won, which many people recently thought "would surely not be exceeded." This could happen as early as January.

Won-Dollar Exchange Rate, daily

And perhaps around the time, or slightly before, the won-dollar exchange rate charts this upward trend, we will see a closing price drop below the index band (by Trump trade) built on top of the existing structure after the US presidential election in November of last year.

Furthermore, if the recent US market trend, which shifted from concerns about employment slowdown to inflation concerns due to Powell's statements, reverts back to employment slowdown concerns, it would further increase the likelihood of this scenario.

I have been continuously emphasizing that a long-term risk may begin. This is because most of the indicators I am closely watching are converging recently.

If the trends I have been discussing recently overlap, from the current point onwards, at least index-related ETF products (QQQ, SPY, TQQQ, SOXL, etc.) are entering a period where, even if you try to "buy the dip" after a significant drop, holding them long-term is extremely risky.

If the US stock market and financial market indicators soon show this trend, it means that it's already too late to respond to the already severely shrinking South Korean real estate market (apartments).

S&P 500 (Additional extended high band created by Trump Trade), daily