- MS·메타, 3분기 호실적에도 시간외 주가 하락…왜?

- 마이크로소프트(MS)와 메타가 시장의 기대를 웃도는 3분기 실적을 내놓으면서 인공지능(AI)에 대한 대규모 투자가 수익화 성과를 내고 있는 것으로 확인됐다. 다만 양사 모두 AI에 대한 자본 지출이 늘어날 것임을 시

The US market, currently in its final regular trading session of October 2024, is experiencing a significant drop, continuing the downward trend seen in futures trading before the market opened. The US stock market, led by big tech companies, is under downward pressure, with the Nasdaq experiencing a sharp decline, currently showing a drop of over -2% mid-session.

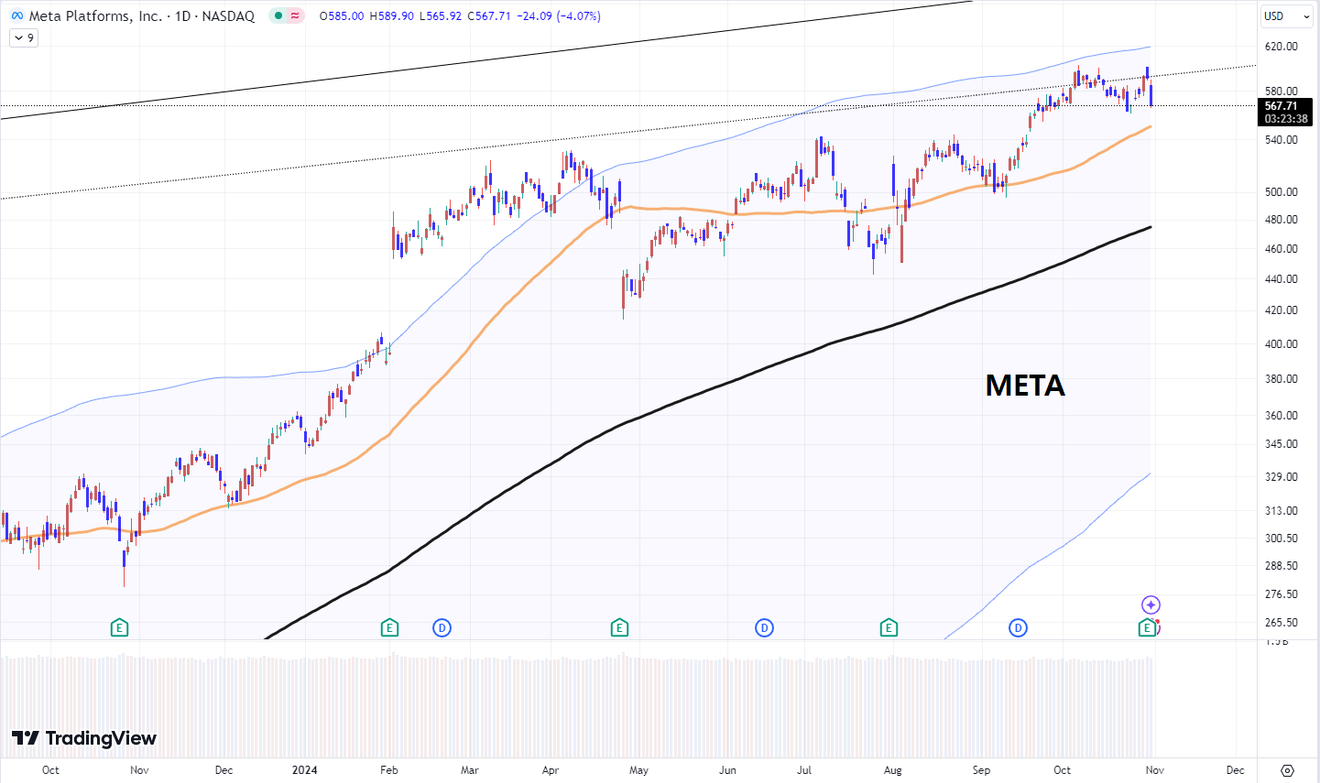

Among the M7 big tech companies, Microsoft and Meta, which released their earnings after the market closed yesterday, are experiencing the largest drops in response to the announcements. Microsoft is down -5%, and Meta is down over -4%.

While the intraday drop for these two stocks isn't drastically different, Microsoft's typically low volatility means the decline appears more significant on the chart.

Among the M7 big tech companies, Microsoft and Meta, which released their earnings after the market closed yesterday, are experiencing the largest drops in response to the announcements. Microsoft is down -5%, and Meta is down over -4%.

While the intraday drop for these two stocks isn't drastically different, Microsoft's typically low volatility means the decline appears more significant on the chart.

Despite the seemingly positive earnings reports, the reason for this decline can be understood by looking at related articles. In short, while AI-related sales are increasing, the "further capital expenditure (investment) needed for AI still seems a long way off."

Below is a daily chart of the S&P 500 index. I've marked points A and B.

Briefly, these two points are where I've personally been watching, thinking that "one of these short-term highs could become a long-term high." However, today's significant drop due to the Microsoft and Meta earnings announcements has me focusing on point A, wondering if it will be the peak.

I'm starting to think that the US stock market has used up all its "technical" cards to pull the index upwards. While sideways movement and consolidation at this level are possible, further significant upside seems unlikely.

This isn't a short-term (months or 1-2 years) perspective on the high point; it's a long-term perspective (at least a decade or more). It will take a few years to see if my assessment is accurate, but recognizing the possibility at this point is essential.

At least, recognizing this possibility allows us to consider what to avoid. For example, now may not be the time to invest in high-risk leveraged products like ETFs that double a specific stock or triple indices like TQQQ and SOXL, instead of regular stocks or 1x ETFs...?

The chart below shows the monthly chart of the Nasdaq 100 index. The current situation aligns with this trend.

It will either stop here or become a strong bubble.

However, even if some capital wants to push towards a bubble, the recent surge in US market interest rates is preventing that.

For now, with the big remaining earnings announcements from Apple and Amazon after today's session, we'll need to wait and see the post-market sentiment.

Comments0